CenterPoint Accounting

- Refund a Negative Invoice (Credit Memo)

| Document #: | 3250 | Product: | CenterPoint® Accounting |

|---|

If a refund is needed for a customers return that was saved as a negative invoice instead of a customer deposit, please choose one of the steps below.

This document provides step-by-step instructions on how to refund a negative invoice.

Step A - Create a Customer Refunds Sales Item (One Time Setup)

Step B- Enter a Negative Customer Invoice

Step C - Apply the Negative Invoice to the Original (Positive) Invoice

Option 2 - Refund with Handwritten or Computer Generated Check Refund

If a refund is needed for a negative invoice for a customer, you have two options:

Option 1 - Cash Refund

Step A: Create a Customer Refunds Sales Item (One Time Setup)

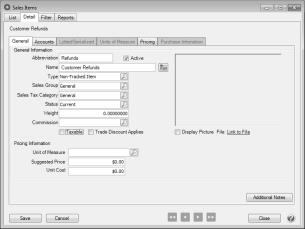

- Select Setup > Sales > Items. Click New.

- Enter an Abbreviation that can easily identify the Customer Refunds sales item.

- Enter Customer Refunds as the Name.

- Select Non-Tracked Item as the Type.

- Select a Sales Tax Category.

- Uncheck the Taxable box.

- On the Accounts tab, enter or select a Sales and a Returns & Allowances account. If you are also using the Sales Orders module, an Expense account is required.

- Click Save.

Step B: Enter a Customer Invoice (this will deduct the amount from the cash account and document the refund on the customers account)

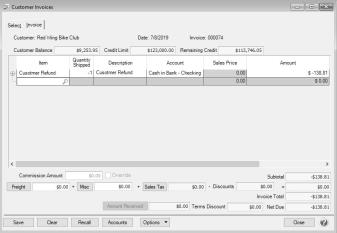

- Complete the Select tab with the customer's information.

- Select the Invoice tab.

- Select the Customer Refund sales item created in Step 1-A.

- Enter a negative Quantity.

- Change the Account to the Cash account used for refunding money to customers.

- Enter the amount to be refunded in the Amount column as a negative number.

- Save the invoice.

Step C: Apply the Negative Invoice to the Original (Positive) Invoice

This has no financial affect, but will remove both the customers negative and positive invoice from the A/R Aging Report.

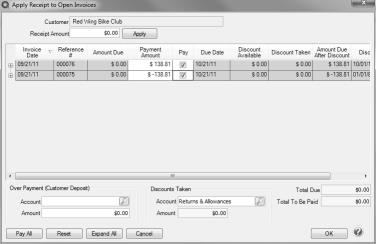

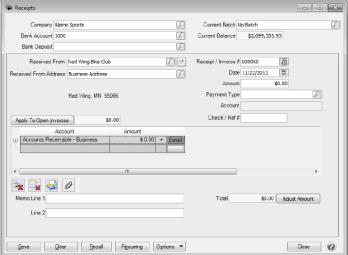

- Select Processes > Sales > Receipts.

- Fill in the Company/Fund, BankAccount and Customer fields.

- Click on the Apply to Open Invoices button.

- Select both the positive and negative invoices for the refund amount.

- Click OK.

- The total of the receipt will be $0.00.

- Click Save.

Option 2 - Refund with Handwritten or Computer Generated Check Refund:

- Complete all of the steps above for a Cash Refund (Note: in the Account field, be sure to select the checking account you will be writing the check out of).

- Select Setup > Names. Find this customer and click Edit. Put a check mark in the Vendor box. Click Save.

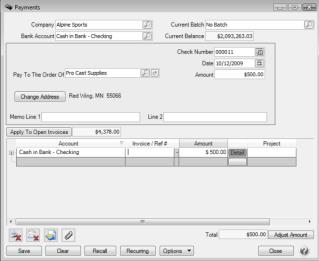

- Select Processes > Payments.

- Process a normal Payment transaction for this customer. Important: when entering the payment transaction, use the checking account in the Bank Account AND in the Account fields. If a computer generated check is needed, be sure to select the Print this Check field, otherwise leave it blank to record a handwritten check.

- Click Save to complete the refund and if selected, print the check.