CenterPoint Payroll

- Reporting Employer Paid Health Insurance on the W-2

W-2 Forms Prepare & Print - Duration: 53 min 36 sec_24.jpg)

| Document #: | 3225 | Product: |

|

|---|

The Affordable Healthcare Act requires most employers to report the cost of employer sponsored health insurance in Box 12 on the W-2.

Option A: Add Benefit to CenterPoint. This will automatically be added to W-2s

Option B: Manually add Health Insurance to W-2 grid in Aatrix

Option A: Edit the Health Insurance Deduction

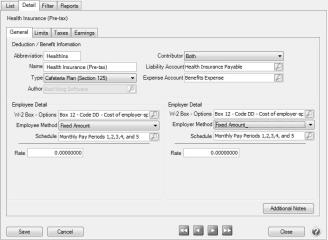

- Select Setup > Payroll Details > Deductions & Benefits. Click on the Health Insurance deduction and choose Edit.

- If the deduction/benefit is already calculating the employee and employer share of health insurance, make sure the W-2 Box - Options for both the Employee and Employer detail is filled in with Box 12 Code DD - Cost of employer-sponsored health coverage, then click Save. The health insurance amounts will print in Box 12 Code DD on the W-2.

- If the deduction is currently setup to calculate just the employee share, it will need to be updated to include the employer share as well.

- Change the Contributor to Both.

- Select an Expense Account

- Fill in the Employer Detail section. The W-2 Box - Option should be Box 12 Code DD.

- Click Save.

- If you do not currently have a deduction/benefit set up for Health Insurance, please see the document Deduction & Benefit Setup.

Add Employer Share of Health Insurance to Employee

Once the Deduction/Benefit is setup with the employer share, the amount the employer pays must be added to the employees record.

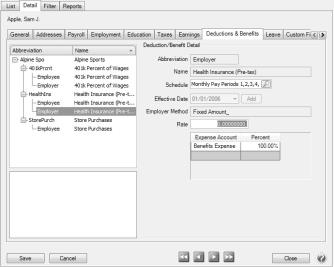

- Select Setup > Employees. Highlight the employee and click Edit.

- Click on the Deductions & Benefits tab. In the upper box, select the Employer line under the Health Insurance deduction/benefit.

- Enter the Rate. This is the amount of benefit that will be calculated with each pay run.

- Click Save.

- Repeat for each employee.

Option B: Manually Add to Aatrix Grid

- Follow W-2 steps like usual until you get to the W-2 Preparer (grid).

- Right-click on column header and choose Insert.

- Enter a name for the column.

- Enter a default value (optional).

- Click OK.

- This adds a Yellow - Unassigned column to the grid.

- Click on the Yellow - Unassigned header and choose Box 12 - Code DD.

- Enter the appropriate amount for each employee.

- Continue processing W-2s as usual.