CenterPoint® Accounting

- Depreciation Schedules

Related Help

A depreciation schedule allows you to define the type of tax schedule you will be using for depreciation. It works in conjunction with a capital asset type where you specify the start and end dates of a depreciation schedule, and the method, method years, and property class each schedule will use to calculate depreciation transactions,

Prerequisite

Follow Steps 1 and 2 of the Setting Up the Depreciation Module topic.

Create a Depreciation Schedule

- On the Setup menu, point to Fixed Assets, and then click Depreciation Schedules.

- Click New.

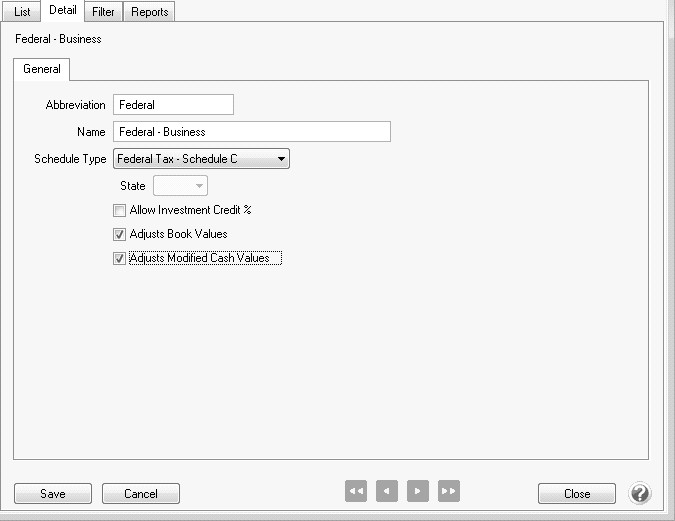

- In the Abbreviation box, enter up to ten characters of optional information that you can easily identify the depreciation schedule by.

- In the Name box, enter up to 30 characters of required information that describes the name location type.

- In the Schedule Type box, select any of the following types:

- Basic (the default)

- Federal Tax - Farm

- Federal Tax - Schedule C

- Federal Tax - Schedule E

- State Tax - If you have a Federal and a State Tax schedule the State Tax schedule values, except for the SDA percent and amount and the Section 179 amount, are copied from the Federal schedule.

- Alternative Minimum Tax If no Federal Schedule has been defined, no Alternate Minimum Tax values can be determined or changed. If you have a Federal and a Alternate Minimum Tax schedule the Alternate Minimum Tax schedule values (method, property class, recovery years, etc) in most cases can be determined by the values found on the Federal schedule and IRS Rules.

- Management Use

- If you selected State Tax as the Schedule Type, select the State associated with the schedule .

- If you took investment tax credit in a previous year, select the Allow Investment Credit % check box to indicate that this depreciation schedule uses an investment credit percentage.

- Select the Adjusts Book Values check box to indicate that the schedule adjusts book value through GL Transactions. This field can only be selected by one schedule. Selecting this field will unselect it for any other schedule that may have it selected.

- Select the Adjusts Modified Cash Values check box to indicate that the schedule adjusts Modified Cash values on the Balance Sheet. This field can only be selected by one schedule. Selecting this field will unselect it for any other schedule that may have it selected.

- Click Save to save the depreciation schedule and return to the List tab, or click Close to save the depreciation schedule and close the Depreciation Schedules screen.

Edit a Depreciation Schedule

- On the Setup menu, point to Fixed Assets, and then click Depreciation Schedules.

- Select the depreciation schedule you want to change, and then click Edit.

- The Depreciation Schedule Information is displayed. Edit or view the depreciation schedule detail.

- Click Save to save the depreciation schedule and return to the List tab, or click Close to save the depreciation schedule and close the Depreciation Schedules screen.

Delete a Depreciation Schedule

- On the Setup menu, point to Fixed Assets, and then click Depreciation Schedules.

- Select the depreciation schedule(s) you want to delete, and then click Delete . Note: You cannot delete a record that is linked to other records in the system.

- At the "Are you sure you want the item deleted?" message, click Yes.

|

Document: 3432 |

|---|