CenterPoint® Accounting

- Enter a Credit Received from a Vendor

Related Help

_24.jpg) Enter a Refund from a Vendor Video - Duration: 2 min 30 sec

Enter a Refund from a Vendor Video - Duration: 2 min 30 sec

_24.jpg) Enter a Credit from a Vendor Video - Duration: 3 min 09 sec

Enter a Credit from a Vendor Video - Duration: 3 min 09 sec

This topic will explain how to enter a credit received from a vendor that corrects a previous invoice.

Enter a Credit Received from a Vendor

Apply a Credit Received from a Vendor to an Invoice

or

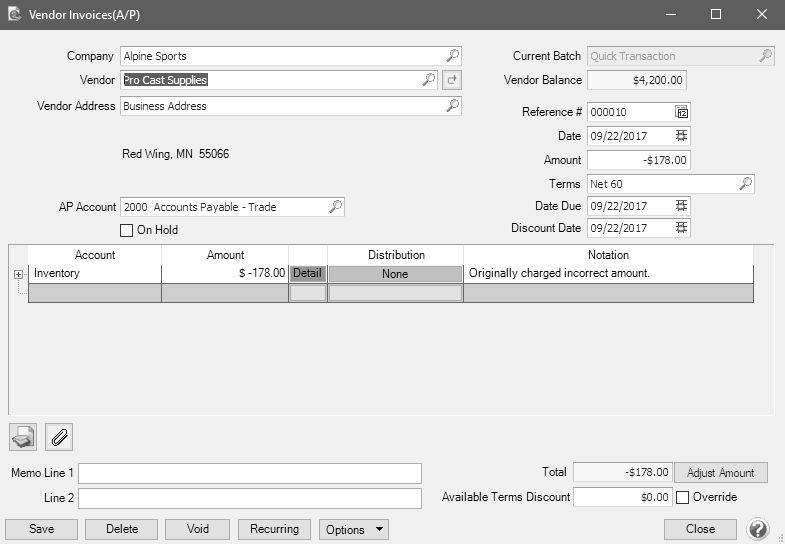

Enter a Credit Received from a Vendor

- Select Processes > Purchases > Vendor Invoices (A/P).

- In the Company/Fund box, select the company/fund name that the credit is being entered for.

- In the Vendor box, select the vendor that you are receiving the credit from.

- Verify/change the AP Account.

- Verify/change the Date Due (the date should be changed to a more current date if you want it to display on the Pay Invoices Due screen so it can be applied to an outstanding invoice if need be).

- Select the Account that should be credited by the amount of the credit.

- In the Amount box, enter the amount as a negative.

- If you need to adjust the quantity the credit applies to, enter the quantity as a negative.

- In the Notation box, optionally enter why the credit is being entered.

- Click Save.

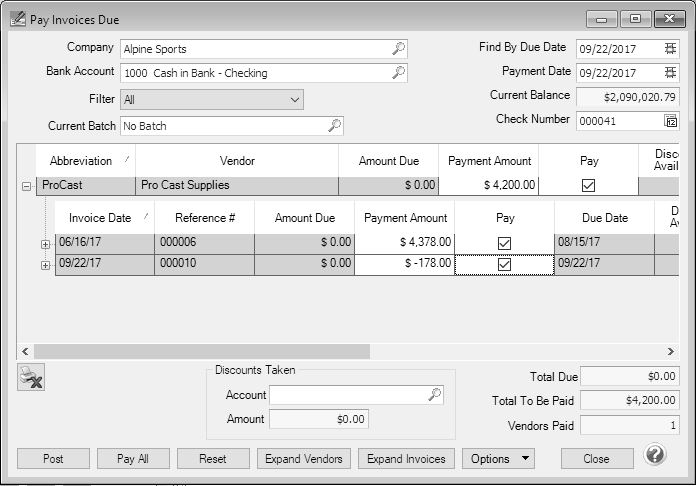

Apply a Credit Received from a Vendor to an Invoice

- Select Processes > Purchases > Pay Invoices Due.

- Select the Company/Fund.

- Click the Expand Invoices button.

- Select the Pay check box for the invoice(s) and the credit to be applied.

- Click Post.

or

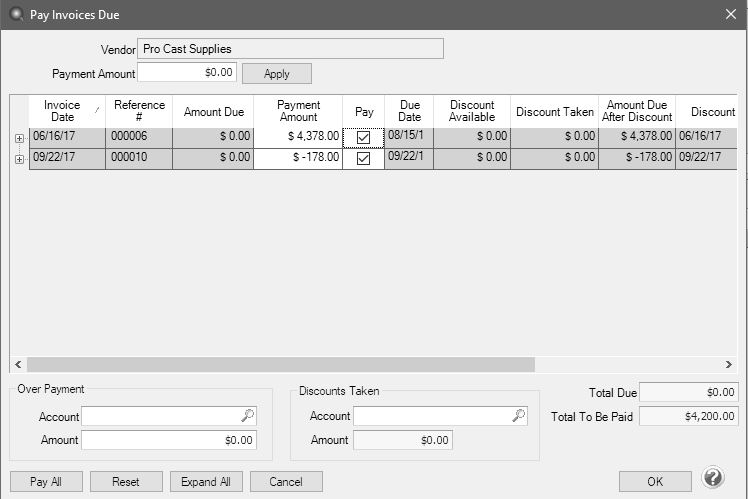

Apply a Credit Received from a Vendor on the Payment Screen

- Select Processes > Purchases > Payments.

- Select the Company/Fund and Bank Account.

- Select the Vendor the credit was entered for.

- Leave the Amount at 0.00.

- Click the yellow Apply to Open Invoices button.

- Select the invoice and the credit that should be applied to the invoice. Click OK.

- On the Payment Entry screen, click Save.

- At the displayed message, click Yes.

|

Document: 3315 |

|---|