CenterPoint® Accounting

- Orchards and Vineyards - Taking SDA in the Planting Year with a Future Year Service Date for Regular Depreciation

Related Help

Note: For Orchards and Vineyards only, SDA (Special Depreciation Allowance) will be calculated in the year of the planting date and regular depreciation will start in the service date year.

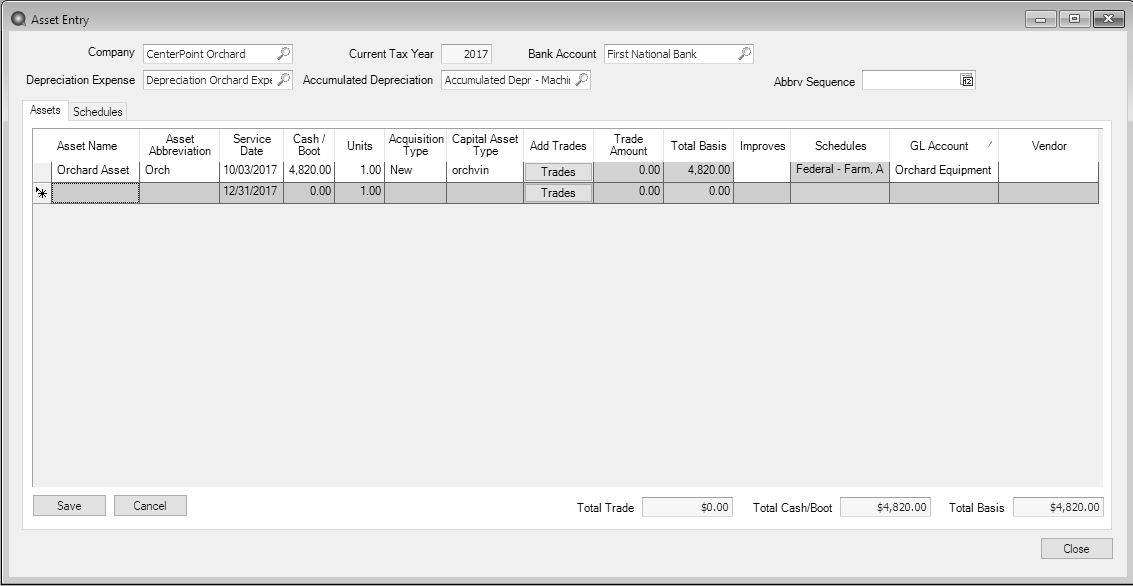

- Select Processes > Depreciation > Asset Entry. Assets acquired with a service date between the start and end date range of the current tax year in the database display.

- Select the Company that acquired the fixed asset.

- The Current Tax Year displays the current tax year set in File > Administration > Current Depreciation Tax Year. This field cannot be changed. The Current Tax Year will also display in the title bar when the Depreciation module is installed. For example, the title bar will display as "CenterPoint Accounting for Agriculture - [Database Name] - Current Tax Year: 2017".

- Select the Bank Account that will be changed by this transaction.

- Select the Depreciation Expense and Accumulated Depreciation accounts to use in the acquisition transaction.

- In the Abbrv Sequence box, select the sequence that should be used to automatically set the fixed asset's abbreviation. See the Numbering Sequences topic for more information.

- Enter the Asset Name.

- The Asset Abbreviation value will default to the next sequence from the Abbrv Sequence selection made at the top of this screen.

- In the Service Date box, enter today's date. (This date will be changed to a future year later in this document.)

- Enter the Cash/Boot amount. This is the additional value of the asset other than that coming from trades. This will be the amount where the bank account is offset by the fixed asset.

- The Total Basis will be calculated and will display the Trade Amount + the Cash/Boot Amount.

- Enter the original Units. The default units display as 1.00. This value will update the Original Units on the Fixed Asset Detail.

- In the Acquisition Type box, select New. To use SDA (Special Depreciation Allowance), the Acquisition Type must be New.

- In the Capital Asset Type box, select Orchards & Vineyards.

- Click Save.

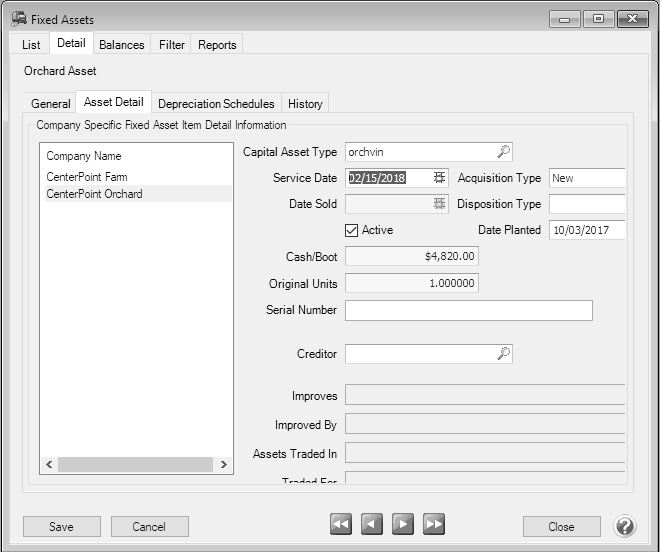

- Select Setup > Fixed Assets > Fixed Assets.

- Select the asset that was just created and then click Edit.

- Select the Asset Detail tab.

- In the Service Date box, enter the date you estimate the asset will be placed in service (the date on which regular depreciation will start).

- Click Save.

- Click Close.

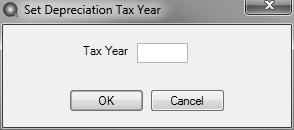

- Select File > Administration > Current Depreciation Tax Year.

- Change the TaxYear to the year you placed the asset in service.

- Click OK.

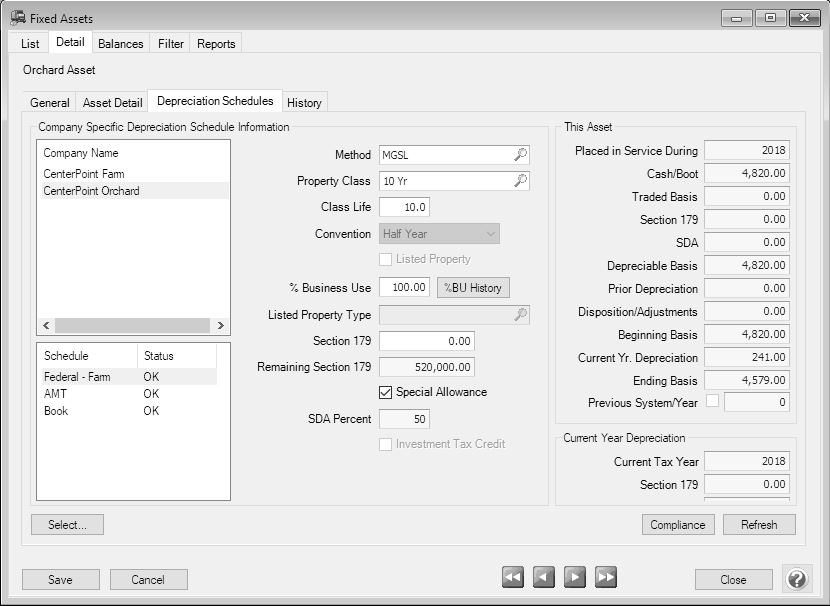

- Select Setup > Fixed Assets > Fixed Assets.

- Select the asset that was placed in service and then click Edit.

- Select the Depreciation Schedules tab.

- Select the Special Allowance check box.

- The SDA percentage will display. In 2017, the percentage allowed is 50%, in 2017 it is 40%, in 2019 it is 30% and all years after 2020 it is 0 (zero).

- Click Save.

- Click Close.

- Select File > Administration > Current Depreciation Tax Year.

- Change the Tax Year back to the current tax year.

- Click OK.

|

Document: 3317 |

|---|