Understanding & Using Management Accounting

| Document #: | 3132 | Product: | CenterPoint® Accounting for Agriculture |

|---|

This topic includes information that allows you to understand and setup the Management Accounting module:

Management Accounting Concepts

Terminology Used in Management Accounting

Accounts used in Management Accounting

Creating Responsibility Centers

Prerequisite

You must have the Management Accounting module purchased, installed and registered in the module configuration manager (File > Administration > Module Configuration Manager) prior to proceeding with the processes outlined below.

Management Accounting Concepts

Management Accounting is designed for the agricultural producer for consistent, reliable, and accurate management information systems to support day-to-day production decisions.

Agricultural producers have varying needs for management information depending on the variety and diversity of agricultural enterprises and asset ownership/control. While farming operations may be similar, it is unlikely that any two operations will be exactly the same. Each manager must make their own determination as to the management information needed and how best to develop that information.

The concepts of managerial accounting include the following:

- Management Accounting uses full accrual accounting and the capture and accumulation of inventory and capital asset information on an actual cost basis rather than accrual adjusted.

- To manage costs, cost information must be organized in a logical manner, for example associate them with appropriate “cost objects”. This organization requires that costs be correctly classified at the time they are entered into the accounting system. If the entry is done correctly, the rest of the process merely involves accumulation, allocation, and reporting.

- Managerial Accounting uses a responsibility center approach for information accumulation and reporting. Cost accumulation and reporting should be done at a level where costs are “controllable” and where management responsibility exists for those costs.

- Effective cost analysis and management requires the cost information to be organized in a manner that mirrors the key drivers of cost (for example, crop costs are driven primarily by acres, not bushels). This type of organization allows managers to identify and analyze how costs behave at different levels of production or activity.

- Management Accounting integrates production factors/measurements. It allows the user to evaluate costs, expenses, and revenues based on appropriate units of production (acres, bushels, pounds, animals or other units) and accommodates multiple period production cycles.

- Costs must be effectively matched with revenue in a manner that allows for consistent and accurate measurement of margins and profit. Certain “revenue” items are in fact “cost reducers” rather than core revenue of the operation. Therefore, they should be reflected as a reduction in production cost rather than implying they are part of the overall core sales mix of the entity. For example, the sales of breeding stock in a livestock operation (which more accurately reduce the cost of providing breeding livestock rather than increase the sales of the operation), or perhaps custom hire of machinery (which actually reduces the cost of machinery operations on the farm rather than increases overall sales). Unless the operation is actually in the “business” of producing breeding livestock or providing machinery for hire, including these items as revenue can make cost analysis quite difficult.

- In any business involving manufacture of a product, costs move through the operation in a “flow” – they start as raw materials (the seed and chemicals not yet applied), then move to “work in process” (the growing crop) and finally to “finished goods” (the harvested grain). Tracking these three categories of inventories is a major component of the overall managerial accounting process.

Terminology used in Management Accounting:

- Costs vs Expense - Cost is the dollar value of resource given up for some product, service or specific purpose. Expense is the dollar value of resource used during a specific accounting period. Costs are incurred to produce inventory (an asset), and the inventory cost is later expensed as it is sold.

- Production Costs and Period Expenses.- This distinction is important in understanding the overall flow of costs through the production process. Production costs are recorded as assets as products are made; they become expenses only when the product is sold. Period expenses are costs of goods and services that are recorded as expenses in the period in which they are consumed. Period expenses do not really “add value” to the product. They are merely associated with maintaining it in saleable form (storage and warehousing expenses), transporting it to the point of sale (marketing expenses), providing overall general administrative support to the business (general and administrative expenses), or providing capital to finance the production process (finance expenses).

- Direct Costs vs Indirect Costs - Direct costs are those that are directly traceable to a particular cost object. They are coded directly to a cost or profit center. Indirect costs are those costs that are accumulated in one cost pool and then “allocated” to another cost or profit center. For example, costs associated with machinery activity would be directly coded to a machinery cost center (depreciation, repairs, fuel, etc.). Then the entire balance in the machinery cost center would be allocated to production cost centers (corn and soybeans, for example). The allocation would show up as an indirect cost on the corn and soybean cost center report.

- Responsibility (Cost) Center - A cost center is a manageable segment that, while fulfilling its role in the organization, is principally responsible for the control of costs. Cost centers typically control inputs to the business’ production and service activities and generally have no control over sales or the generation of revenue. Cost centers are the most common type of responsibility center.

- Profit Center - A profit center is a segment of the business that embraces both costs and revenues. Profit centers typically encompass significant areas of activity within the business and are a major reflection of management’s strategy to achieve its overall profit goals. A profit center facilitates management’s need to measure the performance of these significant activities of the business.

Defining Production Flow

The cost and profit centers that are established for a business are typically configured in a manner consistent with the physical production processes and activities of the business. The management accounting system models and tracks the flow of resources used in the business from the very beginning of operations through the sale of the finished product and any post sale activity that may occur.

The creation of such a system requires a comprehensive understanding of the business, its processes and activities, and the manner in which management does (or wishes to) view the organization and make the decisions essential to fulfilling its responsibility. This section provides an overview of the issues that should be addressed and their role in creating an effective system.

- Identify Costs - What is to be costed must be clearly understood. While a single “thing” may sound as if it is costed and management wants to know the ultimate cost of a finished product, many processes, phases, production stages are measured along the way. The mix of the costs objects are the core component of the system. The system will accumulate costs for each of the objects. The configuration of cost accumulation determines the level of complexity and sets boundaries around the kinds of data that must be accumulated to allow the system to function effectively. Many configuration alternatives must be considered in specifying an appropriate management accounting system. Understanding how management intends to make decisions, what the underlying rationale is for each segment, and the organizations capacity to collect and communicate relevant data are important considers in this process.

- Types of Costs & Expenses

- Production Costs - All costs associated with the production process; directly and indirectly.

- Sales, Marketing and Transportation Expenses - Period expenses that are recognized in the period which they are incurred. These are expenses associated with transforming the products in inventory ready for sale to a completed sale.

- Sales, General and Administrative Expenses - Period expenses that are recognized in the period which they are incurred and are not included in inventory costs. These are expenses associated with transforming the products in inventory ready for sale to a completed sale for example,marketing expense, storage expenses, transportation expenses, professional fees, liability insurance, management salaries, and office and accounting expenses.

- Finance - Includes interest expense on operating and term loans, late payment charges, early pay discounts, and interest income.

- Types of Costs & Expenses

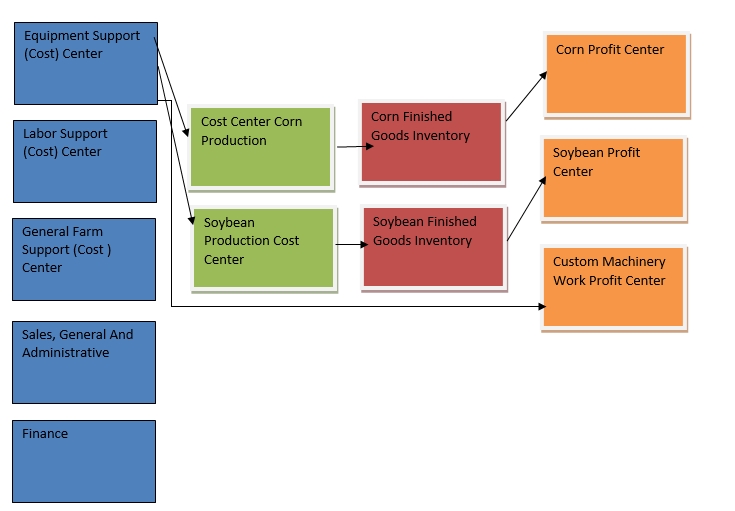

The following flow chart outlines a company that is involved in Corn and Soybean production as well as actively engaging in marketing Custom Work rather than solely using it as a cost reducer.

Support Cost Centers (Blue or First Column from the Left)

Costs accumulated here are generally put into WIP with the exception of support cost centers such as G&A, Sales and Finance. Costs accumulated to G&A, Sales and Finance are generally recorded directly to an expense account since they will not make-up the value of the Finished Goods Inventory.

Mostly costs from these support centers will eventually be allocated as indirect costs to a production cost center. However, costs from a Support Cost Center can sometimes move from the support center directly to a profit center. In the case outlined below, some of the equipment costs are being allocated to a Custom Harvesting operation that this company runs. There is no finished goods inventory in this case.

In other special cases such as labor, some of the labor can be allocated as an indirect cost to the Crop Production cost centers, such as field labor. While other labor, such as management labor, might first move to the General Farm Overhead support center and will be recorded as period expenses rather than Work In Process. This overhead labor is considered a period expense.

Sales Costs, G&A and Finance usually get allocated directly to the profit centers and do not make-up the value of the finished goods inventory.

Production Cost Centers (Green or Second Column from the Left)

Costs accumulated here would be direct costs into the production. These might be costs such as fertilizer, seed, chemicals and rent. All the costs that are accumulated in the production costs centers should eventually become part of the value of the Finished Goods Inventory account. However, sometimes sales happen directly out of the field and those costs never become part of a finished goods inventory but instead get allocated (moved) out as cost of goods sold to a profit center at the time of the sale.

Finished Goods Inventory (Red or Third Column from the Left)

The finished goods inventory represents the cost of the production of those goods (the costs that have been allocated here).

Profit Centers (Orange or Fourth Column from the left)

Sales get posted directly to a profit center. At the time of the sale, the costs for the production sold (a portion of the value of the finished goods inventory) are moved to the Income Statement for that profit center as a cost of goods sold. The revenue from Sales – Cost of Goods Sold – G&A and Finance = Profit\Loss.

- Capturing Costs - Management must consider which detailed transaction information should be captured to have the most effective system. The transaction information will include both financial and production activity. Both types of information are necessary so the reporting of financial activity is relative to an appropriate measure of production. This requires extensive coordination of information capture strategies with production and financial entry staff. Organizational disciple and understanding the value and importance of accurate timely data are crucial in cost capture. The specification of the Chart of Accounts is a significant part of the cost capture strategy. The Chart of Accounts will largely control the level of line item detail available on your reports. One of the challenges in the cost capture process is to balance the coding effort (breaking a single invoice into many separate entries associated with several different segments) with processing efficiency and accurate data entry into the accounting system.

- Specifying Production Units of Measure - Each cost and profit center should be considered for the most appropriate per unit of measure to assess performance and drives revenue. For one production center it may be per acre or per breeding female for another, it may be based on output; per bushel, per calf, etc.

- Allocation to Cost Centers - Once the direct costs have been properly captured in the appropriate cost centers, the system can begin to produce management information. At a minimum the system can provide direct production cost information by cost center via Cost Center reports. However, having only the direct costs leaves a number of information gaps that can leave out potentially significant indirect costs associated with machinery and equipment, labor and other overhead items. These indirect production costs may very well be directly accumulated in another cost center. To include them in a more complete determination of costs, they are allocated from one cost center to another in a logical fashion to provide a more complete cost picture and set of management information. The purpose of the allocation will determine how the costs will be designated and the level of precision needed in the allocation process. To have the greatest value, considerations of these issues should be applied while designing the management accounting system. The flow of costs through the business is facilitated by defining the allocation method by specifying a criteria based on the most objective and measurable way a particular cost center provides support to either another cost center or profit center.

Accounts used in Management Accounting

One of the important components of creating a managerial accounting system is to review and finalize the Chart of Accounts that management will utilize as transactions are posted and stored in the system.

Income Statement Accounts

- Revenue - These accounts represent revenues from the profit centers within the accounting system. They are the revenues from the profit-focused activities of the business.

- Production Expenses (Cost of Gods Sold) - These accounts represent the production costs related to the revenue accounts. Usually a one-to -one correspondence exists between revenue accounts and production expense accounts. (An example would be Cost of Corn Sold).

- Operating Expenses - These accounts represent the expenses associated with producing revenues that are not production related. They are identified in four major categories:

- Sales Expenses - Expenses that are related to a specific sales transaction.

- Marketing Expenses - Expenses that are not related to a specific sales transaction.

- Freight Expenses - Related to the transportation of finished goods.

- General and Administrative Expenses-Expenses associated with transforming the products in inventory ready for sale to a completed sale (For example, marketing expenses, storage expenses, transportation expenses, professional fees, liability insurance, management salaries, and office and accounting expenses.)

- Income Tax Expense - These accounts represent the actual and deferred income tax expense.

- Other Revenue - These accounts represent revenues and expenses not related to operating activity but are those items related to financing or investing activities.

Balance Sheet Accounts

- Inventory - Three types of inventory accounts are:

- Raw Materials - These accounts represent materials to be used in the production process that have been purchased but not utilized.

- Work in Process (WIP):

- WIP Transfer - These accounts are used when you want to maintain the cost of production at the end of a stage rather than accumulate the entire cost in one production cost center. For example, for livestock you may transfer the costs from the Weaned Calves cost center to the Calves cost center and from the Calves cost center to the Backgrounding cost center. When looking at the Backgrounding Cost Center report you probably do not need to see the detail of all of the costs accumulated during the weaning stage because you could look at a Weaning Cost Center report for that information. Instead you might see those costs represented as a single line item such as an indirect cost called "Transferred from Weaning".

- WIP Revenue - These accounts include production related revenue that supplements the core business and whose primary purpose is to reduce overall production costs rather than creating profit. For example, in the example flow chart above, the sample company has set up a Custom Work profit center because they actively engage in marketing their custom work, however for some companies, doing a little custom work is actually viewed as a reduction in their overall equipment costs and therefore should be posted as a WIP Revenue to the Equipment cost center.

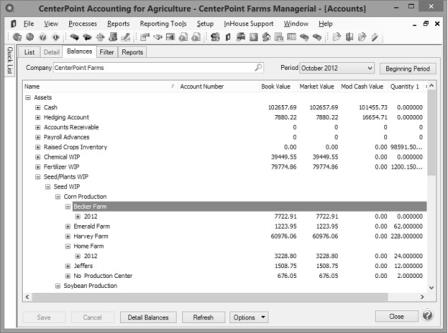

- WIP Costs - These accounts are the accumulators for all production-related costs You do not need a separate Work in Process account for each cost center. The Balance Detail tab used in the Change Account Categories section below is used to "assign" cost centers to a single account. For example, you may have one Crop Insurance account that is used to insure multiple cost Centers.

- Finished Goods - These accounts represent products where the production process is complete and items are available for sale.

Changing Account Categories

The account category further defines each account in your Chart of Accounts. Account categories define the behavior of the accounts in that category. With the Management Accounting module, account categories also determine what level of detail you want to maintain inventory (different account categories can maintain different levels of detail). Balances can be maintained by Associated Account, Name, Inventory Location or Lot, Production Center, Production Center Detail, Production Series or Year, Project, or Responsibility Center. For Work In Process account categories, they also determine the type of costs and the valuation for the account category. This is the feature that allows you to have only one account for each cost center instead of separate accounts for each cost center.

Most of the account categories necessary to use the Management Accounting module already exist in CenterPoint, if you find it necessary to create a new account category, please see the About Account Categories topic for information about creating a new account category.

- On the Setup menu, point to Accounts, and then click Account Categories.

- Click Edit

- If this account category is an Inventory category (purchased, finished goods, work in process, or lotted), click the Balance Detail tab. This is only needed if you want to track the balance of these account categories by something other than account, company and date. On the Balance Detail tab, select the sub-ledger details you want to maintain by selecting the detail and then clicking to move the detail to the Selected Balance Detail Options list or drag-and-drop the detail to the Selected Balance Detail Options list. For example if you'd like to track inventory by Responsibility Center, then move Responsibility Center to the right side of the screen.

- If this account category is a Work In Process account category, determine the Work In Process Type:

- Direct Costs - Those costs that are directly traceable to a particular cost object. They are coded directly to a cost or profit center. For example, chemicals, fertilizer or seed labor.

Indirect Costs - Those costs that are accumulated in one cost pool and then allocated to another cost or profit center. For example, costs associated with machinery activity would be directly coded to a machinery cost center (depreciation, repairs, fuel, etc.). Then the entire balance in the machinery cost center would be allocated to production cost centers (for example, corn or wheat). The allocation would show up as an indirect cost on the corn or wheat cost center report.

- Revenue - The primary goal of the account category is the creation of revenue.

- If this account category is a Work In Process account category, determine the Valuation Method of the inventory in the category, Use Company (uses the valuation method from Setup > Companies), FIFO, LIFO, or Average. Each account category can have a different valuation method.

- Default templates will automatically be assigned on the Templates tab and we do not recommend they be changed. Templates control how all the pieces of a transaction are entered. Usually no change is needed to the Templates tab.

- Click Save to save the account category and return to the List tab, or click Close to save the account category and close the Account Categories screen. To return to the List tab without saving the account category, click Cancel. To close the Account Categories screen without saving the account category, click in the upper-right corner.

In the following example, the WIP Category called Seed WIP was set to have balances maintained by Responsibility Center, Production Center, and Production Year:

Creating Responsibility Centers (Profit/Cost Centers)

Responsibility centers allow you to obtain knowledge about those segments of your business on which management wishes to focus its attention. Responsibility centers are created according to who management sees as responsible for a particular part of the business.

These responsibility centers must be structured to provide management with information appropriate to the decisions that must be made. The information that is accumulated through these responsibility centers must be reported to management in a manner consistent with the intended use of the resulting information.

Responsibility centers are typically classified in a variety of ways. The objectives of management and the nature of each particular segment determine the type of responsibility center appropriate for measuring the performance of various parts of the business.

For example, a producer may have a shop with the objective of providing efficient and effective repair and maintenance services to other segments of the business; particularly to equipment, transportation, or storage segments. The shop is limited to a responsibility to control costs while providing the requisite level of service.

The shop responsibility center is not intended to produce revenue or generate a profit. In contrast to this focus, the producer may have a feedlot to finish cattle for market. This center has responsibility to create revenue through the sale of its output, to control the costs incurred in creating the output, and to generate a profit by maximizing the excess of revenue over the costs incurred.

- On the Setup menu, point to Responsibility/Production Centers, and then click Responsibility Centers.

- Click New to start with a blank responsibility center or select an existing responsibility center that is similar to the one to be added and click Copy. The Responsibility Center General tab appears.

- Specify up to 10 characters in the Abbreviation field for this new responsibility center.

- Specify up to 30 characters in the Name field for this new responsibility center.

- In the Type field, select the type of responsibility center appropriate for measuring the performance of various parts of the business. For example:

- Crop, Livestock, Support or Other Cost Center - A cost center is a manageable segment that, while fulfilling its role in the organization, is principally responsible for the control of costs. Cost centers typically control inputs to the business' production and service activities and generally have no control over sales or the generation of revenue.

- Revenue Center - A revenue center is a responsibility center that has as its primary goal the creation of revenue. Revenue centers would typically have little control over the cost of the goods sold and would have significant influence over sales and marketing strategies and related pricing decisions.

- Investment Center - An investment center is a segment in which the overall focus of performance measurement is the profitability or return on capital invested.

Sales - A Sales profit center is a segment of the business that embraces both costs and revenues. Profit centers typically encompass significant areas of activity within the business and are a major reflection of management’s strategy to achieve its overall profit goals.

- Distribution Factor - If this responsibility center uses more resources, you can weight the center at a higher percentage, for example, for every dollar you give other centers you may give this center 1.5 dollars. The distribution factor is used in combination with a CenterPoint feature called Account Distributions.

- If the responsibility center type is either a Crop or Livestock Cost Center, select the Extend Cost Center definition to Production Center Details check box if you want to include the responsibility center in the production center detail definition.

- Unit of Measure 1 and Unit of Measure 2 - For Work In Process accounts, enter the label that you want printed on the Cost and Profit Center reports.

Creating Responsibility Center Groups - Optional

Responsibility center groups provide an easy way to combine similar responsibility centers for reporting and analysis. At the same time, the responsibility centers maintain individual detail.

- On the Setup menu, point to Responsibility/Production Centers, and then click Responsibility Center Groups..

- Click New to start with a blank responsibility center group or select an existing responsibility center group that is similar to the one to be added and click Copy. The Responsibility Center Group General tab appears.

- Specify up to 10 characters in the Abbreviation field for this new responsibility center group.

- Specify up to 30 characters in the Name field for this new responsibility center group.

- In the Type box, click and select the type of responsibility center group.

- Under Available Responsibility Centers, select the responsibility centers that are assigned to this responsibility center group. The Available Responsibility Centers list will display only responsibility centers that have the same responsibility center type as the responsibility center group. To create a new responsibility center, right-click and select New Item.

- To move one responsibility center from the Available Responsibility Centers list to the Selected Responsibility Centers list, select the responsibility center and click or drag-and-drop the responsibility center to the Selected Responsibility Centers List. To move more than one responsibility center from the Available Responsibility Centers list to the Selected Responsibility Centers list, select the responsibility centers and click or drag-and-drop the responsibility centers to the Selected Responsibility Centers list.

- To identify notes specific to this group, select the Additional Notes button. Click OK after entering the notes. Additional Notes are optional.

- Click Save to save the responsibility center group and return to the List tab, or click Close to save the responsibility center group and close the Responsibility Center Groups screen. To return to the List tab without saving the responsibility center group, click Cancel. To close the Responsibility Center Groups screen without saving the responsibility center group, click X in the upper-right corner.

Creating Allocation Definitions

Allocation Definitions

In Managerial Accounting, costs and sometimes revenue are accumulated at different cost centers so that those costs can be managed by those who are responsible for them. The cost centers are often referred to as Responsibility Centers in CenterPoint. Often, one responsibility center supports the actions of another responsibility center. This type of center would be called a Support Center. Usually the Support Center would support a Production Cost Center or centers of some sort so eventually all or some of the costs accumulated by the Support Center would need to get allocated to the Production Cost Center(s). An Allocation Definition is the process that allows a user to do this in CenterPoint. The following example describes a possible use of an Equipment Support Center in Agriculture Production:

CenterPoint Farms raises corn and soybeans. They have a corn production cost center setup to track all of the costs associated with corn production and a Soybean Production Cost Center setup for tracking costs of producing soybean. Their equipment is used for both corn and soybean production therefore they have also setup an Equipment Support Cost Center to capture all of their equipment costs. These equipment costs need to eventually be allocated to the corn and soybean cost centers as an indirect cost of production. CenterPoint Farms Management has decided that they will allocate the Equipment costs to the corn and soybean productions centers using a percent of acres planted method on a monthly basis.

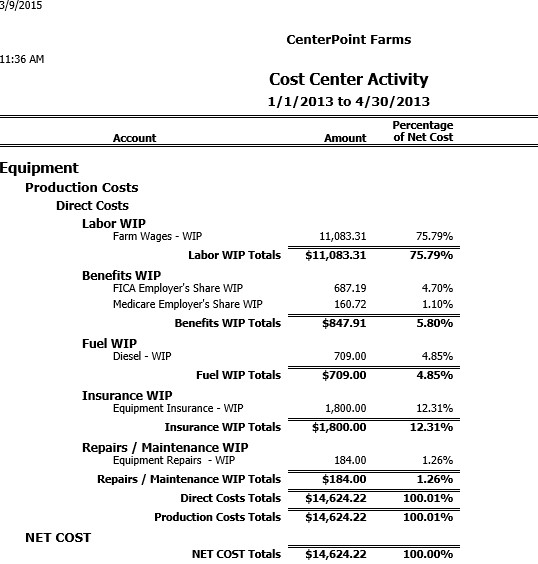

Currently Equipment costs are being captured to Work in Process and allocated only to a production year. The Cost Center Activity Report looks like the following:

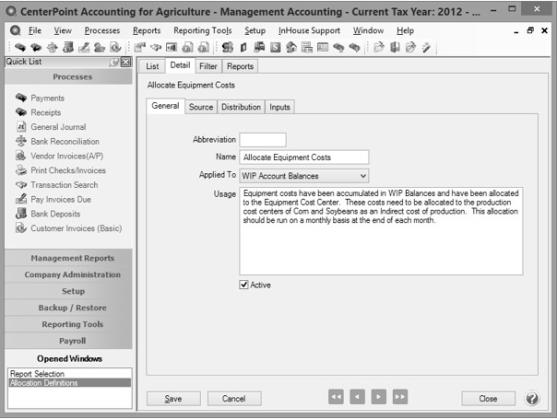

To develop an allocation definition to move these costs to the crop production cost centers CenterPoint Farms will take the following steps:

- Select Setup > Responsibility/Production Centers > Allocation Definitions.

- Select the New button.

- On the General tab:

- The Abbreviation is optional.

- Fill in the Name to describe the purpose of the allocation definition.

- There are three types of allocations: WIP Account Balances, Other Account Balances and Transaction Activity. Since the equipment costs have been accumulated in the Equipment cost center and to WIP accounts, for this allocation we will be allocating WIP Account Balances.

- In the Description box, you will want to type in a description for the purpose of this allocation. It is advised to do this since some allocations are only run on a periodic basis. It will help to understand the purpose of the allocation later.

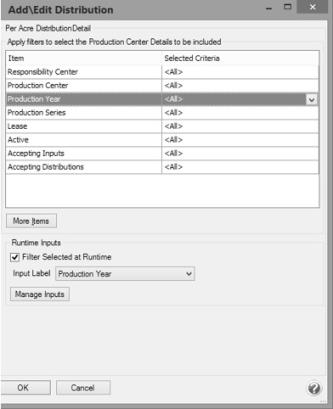

Select the Source Tab – The purpose of the Source tab is to query for the data that the allocation is intended for. In this case, we need to query for all WIP Account Balances that have been allocated to Equipment for each period. Some of the criteria for the query will be items that are known factors, such as the cost center that we are querying for is the Equipment Cost Center, however some of the information may change and would be better as an input item that we select each time the query is run. For example, if you want to reuse the allocation definition each year, you may want the query to include a production year that is input each time the query is run.

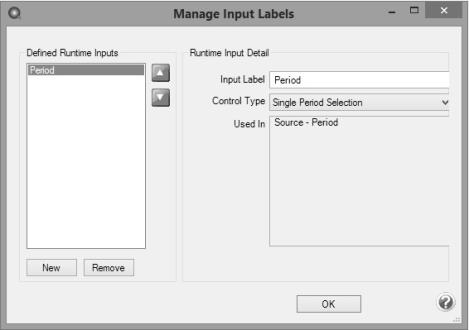

The input item of Period is something that we are going to query for each time so that we can reuse the allocation definition every month. When we select Period in the Select Source Accounts box on the left, at the bottom of the screen we will need to check the box labeled Filter Selected At Runtime.

To create a new input item called Period click on the Manage Inputs button.

You can also input a specific period into the period box such has been done in this example to make sure that the query till produce the correct results. In this case we have input the period 4/30/2013 to match the same period from the Cost Center Balances report.

Highlight Responsibility Center and select the Equipment Support cost center.

Click the Refresh button. This will display the results of your query on the right.

As we can see from our example, that the query has come up with the same values from our Cost Center Balances report for the same time period.

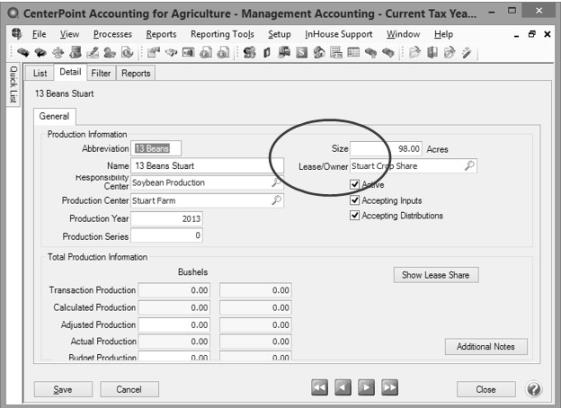

Now that the query has been defined we need to describe how the results will be allocated to the Corn and Soybean Production Cost Centers. The method that management has selected is Percent of Acres, so first we need to know where the system is going to get the acres from. Annually CenterPoint Farms is going to describe to the system how it has planted its fields. So the plantings are described by selecting Setup > Responsibility Centers \ Production Centers > Crop Production Center Details. On the detail of each of these we will tell the system how many acres of each crop we have planted on each field. If not capturing field data, then the system will need to at least know how many acres of each crop:

-

Back on the Allocation Definition, select the Distribution tab to describe the allocation. The allocation can take part of the results and allocate them one way and part of the results and allocate them a different way or all of the results can be allocated the same way which is what will be done for this example. So for each portion to be allocated you will select the Add button to describe that allocation.

-

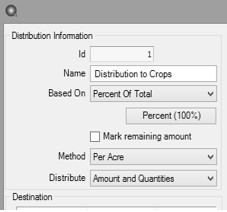

For each allocation, you will give it a Name. We will call our allocation Distribution to Crops.

-

You then need to tell CenterPoint what portion of the queried results from the Source tab will be allocated this way. We are going to use Percent of Total for our definition and the percentage amount will be 100%. The options are:

-

Percent of Total – This would be a percentage of the total amount of the queried results. This is the method we will use and our percentage will be 100%.

-

Percent of the Remainder- The allocations will be done in the order they appear on the Distribution tab, so after the first one is done, there may be a remaining amount to be allocated, the next allocation can be a percentage of the original query results or a percentage of the remaining value after the initial distribution is completed. We will not use this method in our distribution.

-

Formula – Sometimes a formula is needed to define the amount that is to be allocated a certain way. In those cases, the formula may use items that are already part of the allocation definition or may involve other input items.

-

-

The Mark as Remaining Amount check box will allow you to mark a distribution as the distribution that would result in a remainder that would be used for calculating the Percent of Remainder from. Since we are allocating 100% of the costs, we should not have a remainder for our example so we will leave this unchecked.

-

In the Method box, we will use Per Acre for our distribution. The options to allocate costs by are:

-

Per Acre – Uses the acres setup in the Crop Production Details to calculate the percentage to be distributed to each crop and field where field data is being captured.

-

Per Head – this is used to allocate costs to different groups of livestock on a per head basis of those in inventory.

-

Operations Per Acre – Sometimes allocating just on a per acre basis isn’t enough. Sometimes an allocation needs to include other factors. An example might be that costs to a particular piece of equipment are to be allocated to fields based off the number of trips across a field that equipment was used. The user would need to capture that information in an allocation factor and then an allocation percentage for each field would be calculated based on a combination of percent of acres and percent of trips across the field.

Formula – The last method is a Formula. When none of the other methods works, a formula can be setup that includes items that are already part of the distribution, fixed values or input items.

-

-

-

The last field Distribute informs CenterPoint about what is being distributed. Is it the Amount of the balance? Is it the Amount and Quantities? Or is it just quantity values? Our method will be to distribute just the Amount.

-

-

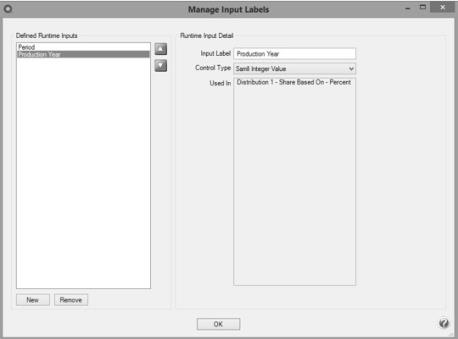

The box on the right will vary depending on the distribution method selected, since we selected Per Acres the box will be labeled ‘Per Acres Distribution’. In the ‘Per Acre Distribution’ detail on the right, we need to tell the system which field data to use. We don’t want it to calculate the percentage of acres on 2012 fields and 2013 fields so we need to query for just the 2013 fields.

- Highlight Production Year and just below all of the query items check the box to Filter Selected at Runtime.

- Click on the Manage Inputs button.

- Click new to create a new input called Production Year. You will be asked for the production year every time you run this allocation definition. The production year should be described as follows:

- The right hand side will now look like the following:

- The final step on this distribution will be to describe what will happen to the results. Do we want to keep it in the same WIP account or do we want to move it to another account? We are going to move all of these costs to a single WIP Account called Transferred from Equipment. We also need to tell the system how to handle responsibility center details and other production details. This will be done on the box at the bottom left labeled ‘Destination’.

For each item you have the following choices:

- Select a Particular Item to Use – An example would be in our case we are going to select a particular Account to use called Transferred from Equipment WIP.

- Use the Item from the Source – If we choose that item then we would be using the same item from the original query so for something like the Account the Original item might have been Fuel WIP or Repairs WIP.

- Use Item from Distribution Method – An example of this would be that the amounts coming from Equipment previously had the cost center of Equipment on them but now we are distributing it to the Production cost centers or Corn a Soybeans so the resulting transaction would distribution amounts to each of those profit centers from the distribution method of per acres.

- Do Not Use – the last option is that it might be a detail that we aren’t using. An example might be Project. If these costs aren’t being distributed to a particular project then there is no need to use the project field.

For our distribution the result might look like the following:

- Click OK and the distribution can now be Saved.

To run the distribution:

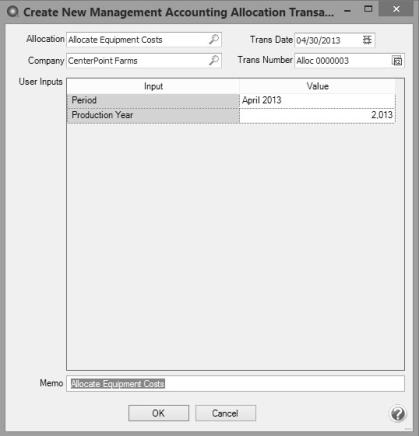

- Select Processes > Periodic > Management Accounting Allocation Transactions.

- Select Create New.

- Select the Allocation you wish to Run and the period that you are running it for (remember period was an input item in the query).

- It is advised to put a Memo on the Allocation which might just be the name of the allocation.

- Enter in any input items that were part of the allocation definition.

- Select Ok.

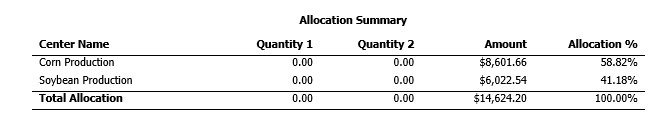

The result will be a series of journal entries that will be created to allocate the Equipment costs to each field after calculated the percentage of acres planted from each field.

- Select Post to post the allocation.

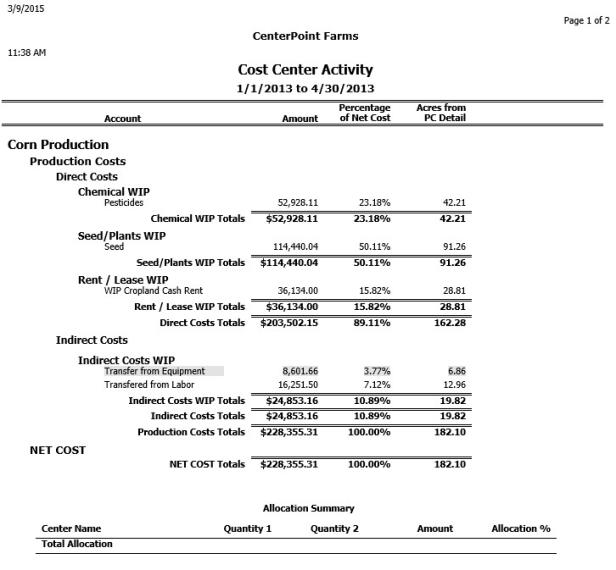

The resulting Cost Center Activity Reports for Equipment and then Corn and Soybean would be as follows:

Notice the detail at the bottom showing how much has been allocated and where.

For the Corn Production Cost Center the amount coming into the cost center from the Equipment Cost Center will show as an Indirect Cost. There are also indirect costs from a previous distribution of Labor Costs.