CenterPoint® Accounting for Agriculture

- Capital Asset Types

Related Help

| Document #: | 3348 | Product: | CenterPoint® |

|---|

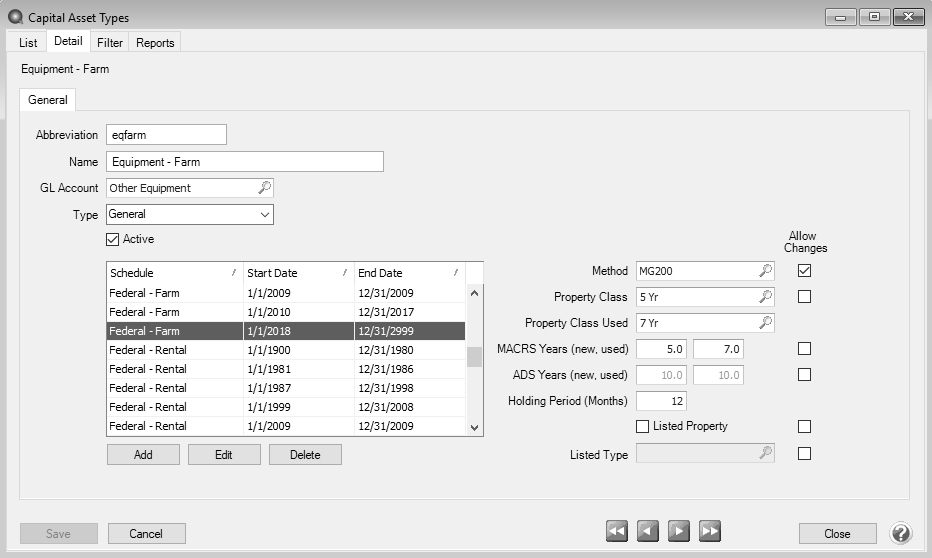

Capital Asset Types define the default values for a depreciation schedule(s) for an asset that will be used to calculate how that asset is to be depreciated. The capital asset type also determines whether or not the default value can be changed in other parts of the system . When a schedule is crated, it determines whether the property class is the same as that of the capital asset type. If it is, the years display from the asset type. If the property class is not the same as the capital asset type, the years would default to those of the property class.

This topic covers the following:

Create a Capital Asset Type

- On the Setup menu, point to Fixed Assets, and then click Capital Asset Types.

- Click New or if this new capital asset type is similar to an existing capital asset type, highlight the existing capital asset type and click Copy instead of New. A new capital asset type will be created using the same information as the highlighted capital asset type.

- In the Abbreviation box, enter up to ten characters of optional information that you can easily identify the capital asset type by.

- In the Name box, enter up to 30 characters of required information that describes the capital asset type.

- In the GL Account box, select a default Asset account to use on the Asset Entry screen for fixed assets with this capital asset type.

- Click Add and select a Schedule to use for this asset.

- Enter the Service Start and End Date range for the specified deduction schedule.

- Click OK.

- If the date range specified already exists or overlaps with an existing range for the depreciation schedule a message will display. To change the service date range, click Edit or click Delete to remove the schedule and service date range from the capital asset type.

- Select the depreciation Method to be used with the capital asset type. The list of available methods will display based on your service date range. For example, ACRS will not be available unless the service date range is after 1980 and before 1987. See Publication 946 - How to Depreciation Property on the IRS website or detailed explanations about depreciation definitions and requirements.The following are the options:

- ACRS - Accelerated Cost Recovery System was used for most tangible depreciable assets placed in service after 1980 and before 1987. You must continue to figure depreciation under ACRS for assets placed in service between 1981 and 1986.

- Declining Balance - This method multiplies a constant fraction by a declining depreciable balance. The fraction is determined by the years life and which declining balance method is used. For each of the methods, the fraction is multiplied by the cost basis less additional first year depreciation less all previously taken depreciation for a given year. That depreciation is subtracted from the remaining balance for depreciation, so that the balance "declines". Salvage value is not used to figure depreciation with this method, but he balance for depreciation cannot decline below the salvage value. However, a residual undepreciated amount will be left at the end of the item's life.

- 125% Declining Balance - For this method, the fraction is (1/yrs life* 1 1/4

- 150% Declining Balance - For this method, the fraction is (1/yrs life)*1 1/2

- Double Declining Balance - For this method, the fraction is (1/yrs life)*2

- MACRS - The modified accelerated cost recovery system (MACRS) applies to all tangible property placed in service after 1986. There are two systems of MACRS, regular MACRS and Alternative Depreciation System (ADS). MACRS is generally used to figure depreciation on post 1986 assets unless ADS is specifically required by law or you choose to elect it. There are five ways to depreciate property using MACRS. Under the declining balance methods, you will get larger deductions in the early years of the recovery period and your depreciation deduction will get smaller each year. The MACRS recovery periods are generally shorter than the ADS recovery periods.

- MACRS 150% Declining Balance - Formulas are used to calculate this based on a 150% declining balance method with an automatic shift to straight line.

- MACRS 200% Declining Balance - Formulas are used to calculate this based on a 200% declining balance method with an automatic shift to straight line.

- MACRS Straight Line - Under this method, you will deduct the depreciable basis of your property in equal amounts over its recovery period.

- ADS - Alternative Depreciation System (ADS). MACRS is generally used to figure depreciation on post 1986 assets unless ADS is specifically required by law or you choose to elect it. The two types of ADS depreciation are: ADS Straight Line and ADS 150% Declining Balance.

- You must use ADS for the following property.

- Listed property used 50% or less in a qualified business use.

- Any tangible property used predominantly outside the United States during the year.

- Any tax-exempt use property.

- Any tax-exempt bond-financed property.

- All property used predominantly in a farming business and placed in service in any tax year during which an election not to apply the uniform capitalization rules to certain farming costs is in effect.

- Any property imported from a foreign country for which an Executive Order is in effect because the country maintains trade restrictions or engages in other discriminatory acts.

- Straight Line - Under this method, the cost basis of the item less the salvage value less additional first year depreciation is divided evenly over the life of the item

- Sum of the Years Digits - Under this method, the cost basis less the salvage value less additional first year depreciation is multiplied by a fraction which changes each year. The denominator, or bottom of the fraction is the sum of the numbers between 1 and years life. For an item with a years life of four years the denominator would be 1 + 2 + 3 + 4 or 10. The numerator, or top, of the fraction is the number of years remaining in the estimated years life. Thus, the first year of depreciation for the example item with a four (4) year expected life would be calculated by multiplying the adjusted cost bases by 4/10; the second year 3/10, etc.

- Select the Property Class years applicable to the method you selected. For example, for the Federal - Farm Schedule, Equipment - Farm capital asset type, and the MG200 method, the property class is 5 years. . For more information about property classes, see Publication 946 on the IRS website.

- Select the Property Class Used years applicable to the method you selected. For example, for the Federal - Farm Schedule, Equipment - Farm capital asset type, and the MG200 method, the property class used is 7 years. For more information about property classes, see Publication 946 on the IRS website.

- Either the MACRS Years (new, used) or ADS Years (new, used) will display the recovery period in years for the new and used property class selected. This field displays the default values based on the property type, but the value can be changed.

- Enter the Holding Period (Months). The value can range from 0 to 999 and is used for the Reports > Reports > Fixed Assets > Sale of Business Property (For Form 4797) report.

- Select the Listed Property check box if this capital asset type includes listed property. For more information about listed property, visit Publication 946 - How to Depreciation Property on the IRS website.

- If you selected the Listed Property check box, select the Listed Type of listed property from the following options:

- Autos 6,000 to 14,000 pounds

- Autos under 6,000 pounds

- Computers and Peripheral Equipment

- Other Equipment

- Trucks, Vans, or SUVs 6,000 to 14,000 pounds

- Trucks, Vans, or SUVs under 6,000 pounds

- Click Save to save the capital asset type and return to the List tab, or click Close to save the capital asset type and close the Capital Asset Type screen.

Edit a Capital Asset Type

- On the Setup menu, point to Fixed Assets, and then click Capital Asset Types.

- Select the capital asset type you want to change, and then click Edit.

- The Capital Asset Type Information is displayed. Edit or view the capital asset type detail.

- Click Save to save the capital asset type and return to the List tab, or click Close to save the capital asset type and close the Capital Asset Type screen.

Change the Status of an Existing Capital Asset Type

Capital Asset Types that are no longer being used, but have history, can be deactivated.

- On the Setup menu, point to Fixed Assets, and then click Capital Asset Types.

- Select the capital asset type you want to change the status for, and then click Edit.

- Unselect the Active check box to deactivate the capital asset type or select the Active check box to activate the capital asset type.

- Click Save to save the capital asset type and return to the List tab, or click Close to save the capital asset type and close the Capital Asset Type screen.

Delete a Capital Asset Type

- On the Setup menu, point to Fixed Assets, and then click Capital Asset Type.

- Select the capital asset type(s) you want to delete, and then click Delete .

- At the "Are you sure you want the item deleted?" message, click Yes.

|

Document: 3348 |

|---|