CenterPoint® Accounting for Agriculture

-

Commodity Credit Corporation Transactions

Related Help

This topic explains how to record Commodity Credit Corporation (CCC) transactions. Tax law allows for the treatment of CCC loans either as a loan, or as income. Once an election is made and reported, all CCC loans must be reported using the same method until a change in accounting method is properly filed with the IRS. This topic provides step-by-step instructions for each method.

Method 1: CCC Loan Treated as Income

Step A - Enter a Cash Receipt for the Loan Amount

Method 2: CCC Loan Treated as a Loan

Step A - Enter a Cash Receipt for the Loan Amount

Method 3: CCC Loan Treated as Income with Elevator Repaying Loan

Step A - Enter a Cash Receipt for the Loan Amount

Method 1: CCC Loan Treated as Income

Prerequisites

The following accounts (Setup > Accounts > Accounts) specific to CCC will be required to process the transactions:

- CCC Loan Income (Type = Revenue, Category = CCC Loan Income)

- CCC Corn Inventory (Type: Asset, Category = Purchased Crop Inventory)

- CCC Grain Redemption (Type = Cost of Goods Sold, Category = Cost of Goods Sold)

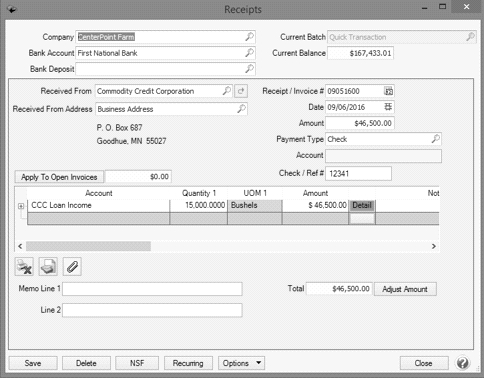

Step A - Enter a Cash Receipt for the Loan Amount

This transaction will deposit the loan amount in the bank account and decrease the bushels from inventory.

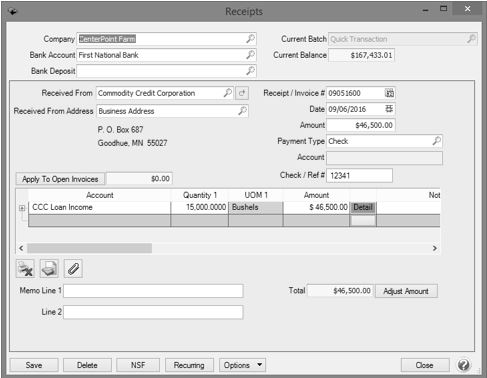

- Select Processes > Sales > Receipts.

- Specify Commodity Credit Corporation in Received From. Specify the Date and Amount received from the loan.

- In the grid, select the CCC Loan Income for the Account.

Note: If you cannot select the CCC Loan Income account, see the Frequently Asked Questions section of this document.

Schedule F.

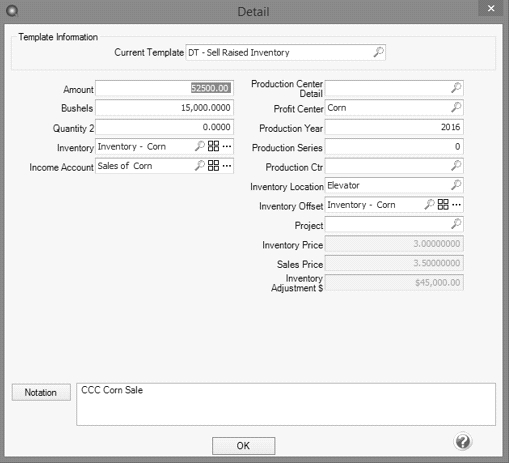

- Select the Detail button in the grid.

- In the Current Template, select DT - Sell Raised Inventory.

- Specify the amount received in the Amount field, enter the quantity pledged in the Quantity 1. Select the Inventory .

- Enter production details as needed. Click OK.

- Click Save.

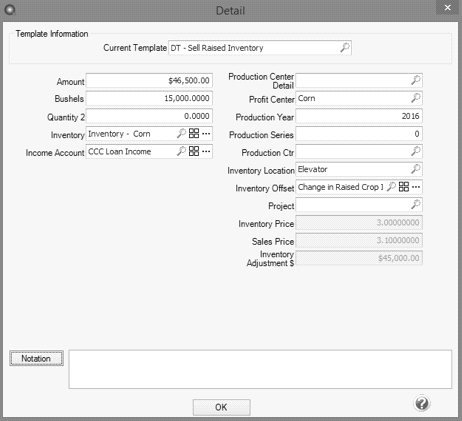

Step B - Loan Repayment

When the loan is repaid and the crop is redeemed, enter a cash payment to purchase the grain back.

- Select Processes > Purchases > Payments.

- Specify Commodity Credit Corporation in thePay to the Order of field. Specify the Date and actual Amount repaid on the loan.

- In the grid; specify CCC Corn Inventory in the Account field and the Template should automatically default to DT - Increase Asset.

- Enter the Quantity originally pledged (same quantity that was used in Step A).

- Click Save.

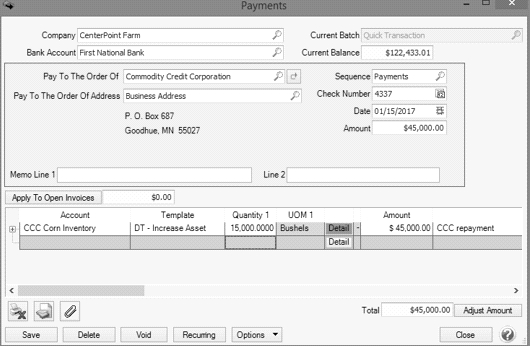

Step C - Sale of the Crop Inventory

When the CCC corn is taken to the elevator and sold, a transaction will record the total sale of the corn in the Crop Sale revenue account. In the same transaction, the inventory is reduced and the redemption value recorded to the CCC Grain Redemption cost account. The cost account should be specifically for cost of CCC grain redemption. The cost will be assigned to the Schedule F expense line.

- Select Processes > Sales > Receipts.

- Specify the appropriate Received From, Date and Amount.

- In the grid, select CCC Inventory in the Account field. Then click on the Detail button.

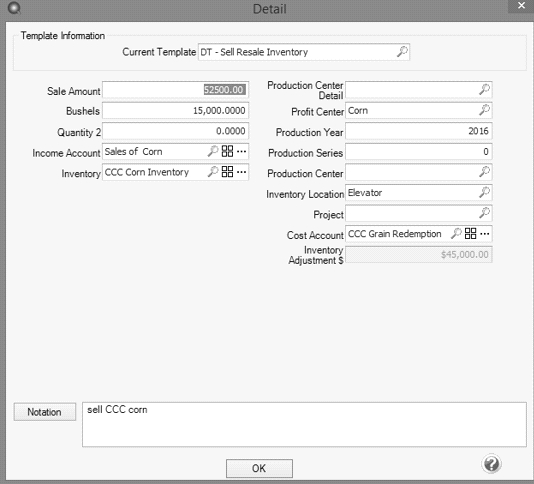

- Select DT - Sell Resale Inventory as the Current Template.

- Specify the Sale Amount and Quantity 1.

- Select the appropriate Income Account and then specify the CCC Grain Redemption account in the Cost Account field.

- Click OK.

How Transactions Affect the Schedule F

- CCC Loan Income revenue account ($46,500 from Step A) is assigned to Schedule F line 5a.

- The Crop Sale revenue account ($52,500 in Step C) is assigned to Schedule F line 2.

- The CCC Grain Redemption cost ($45,000 in Step C) is assigned to Schedule F line 32d.

The total taxable gain of the CCC transactions is $46,500 + $52,500 - $45,000 = $54,000.

$46,500 is reported the year of the CCC loan receipt. The $52,500 sale to elevator minus the $45,000 grain redemption cost is reported the year of grain sale to elevator.

On an accrual income statement, the new crop production valuing the corn at $3 per bushel displays in the month of new crop production in 2016. $3 x 15,000 bushels equals $45,000 recorded to the revenue account Change in Raised Crop. The CCC Loan Income of $46,500 displays in September 2016 minus the $45,000 Change in Raised Crop. The grain is purchased back in January 2017 which has no effect to the accrual income statement. When the grain is sold in March 2017, the accrual income statement reports the revenue to Sales of Corn of $52,500 minus the CCC Grain Redemption cost of $45,000 for a difference of $7,500. The total accrual income for the 2016 production of the 15,000 bushels is $45,000 + $46,500 - $45,000 + $52,500 - $45,000 = $54,000.

Method 2: CCC Loan is Treated as a Loan

Prerequisites

The following accounts (Setup > Accounts > Accounts) specific to CCC will be required to process these transactions:

- CCC Loan (Type = Liability, Category = Short Term Mortgages)

- Market Gain Income (Type: Revenue, Category = Agricultural Program Payments)

Step A - Enter a Cash Receipt for the Loan Amount

This transaction will deposit the loan amount in the bank account and increase the loan liability account.

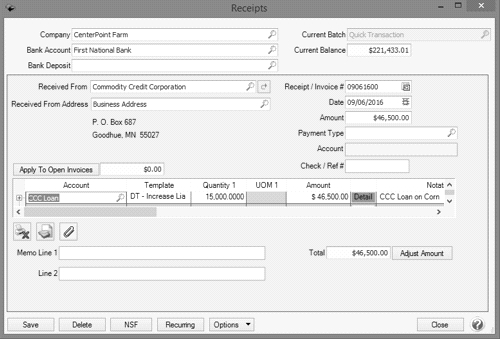

- Select Processes > Sales > Receipts.

- Specify Commodity Credit Corporation in the Received From field. Specify the Date and Amount received from the loan.

- In the grid, specify CCC Loan in the Account field. The Template should be DT - Increase Liability. Note: If the Template field is not displayed in the grid, right-click in the grid and use the Add/Remove Columns option to add Template to the main screen. Or simply click the Detail button to select the template at the top of the Detail screen.

- Enter the Quantity pledged for your records.

- Click Save.

Step B - Loan Repayment

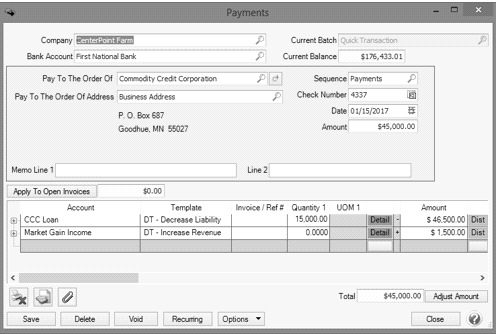

- Select Processes > Purchases > Payments.

- Specify Commodity Credit Corporation in the Pay to the Order of field. Specify the Date and actual Amount repaid on the loan.

- In the first line of the grid, select the CCC Loan in the Account field and in the Amount, specify the original loan amount (not the amount being repaid). The Template should be DT - Decrease Liability.

- If the amount repaid on the loan is lower than the original loan amount, then a second line will be needed in the grid. In this second line, select Market Gain Income in the Account field.

- The Template should be DT - Increase Revenue and the Amount will fill in automatically with the difference between the original loan and the amount repaid. The Market Gain is reported as taxable income the year the CCC loan is repaid.

- Click the Detail button to select the production details such as the profit center and production year.

- Click Save.

Step C - Sale of the Crop Inventory

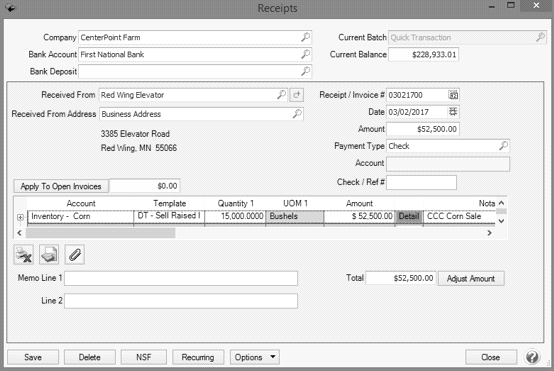

- Select Processes > Sales > Receipts.

- Specify the appropriate Received From, Date and Amount.

- In the grid, select the appropriate Raised Crop Inventory in the Account field. Then click on the Detail button.

- Specify DT - Sell Raised Inventory in the Template field.

- Specify the Quantity sold and select the appropriate Income Account such as Sales of Corn.

- Click OK and then Save.

How Transactions Affect the Schedule F

- The Market Gain income account ($1,500 in Step B) is assigned to Schedule F line 4a.

- The Crop Sale income account ($52,500 in Step C) is assigned to Schedule F line 2.

The total taxable gain of the CCC transactions is $1,500 + $52,500 = $54,000.

All taxable gain is reported in 2017 in this example. The $1,500 gain and the $52,500 sales of corn were recorded in 2017.

On an accrual income statement, the new crop production valuing the corn at $3 per bushel displays in the month of new crop production in 2016. $3 x 15,000 bushels equals $45,000 recorded to the revenue account Change in Raised Crop. The $1,500 Market Gain reports in January 2017. When the grain is sold in March 2017, the accrual income statement reports the revenue to Sales of Corn of $52,500 minus the Change in Raised Crop of $45,000 for a difference of $7,500. The total accrual income for the 2016 production of the 15,000 bushels is $45,000 + $1,500 + $52,500 - $45,000 = $54,000.

Method 3: CCC Loan Treated as Income with Elevator Repaying Loan

Prerequisite

The following accounts (Setup > Accounts > Accounts) specific to CCC will be required to process the transactions:

- CCC Loan Income (Type = Revenue, Category = CCC Loan Income)

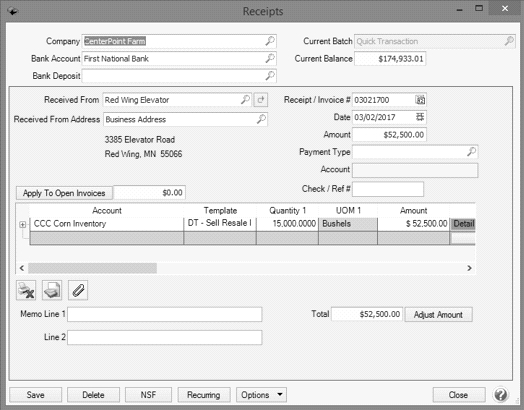

Step A - Enter a Cash Receipt for the Loan Amount

This transaction will deposit the loan amount in the bank account and decrease the bushels from inventory.

- Select Processes > Sales > Receipts.

- Specify Commodity Credit Corporation in Received From. Specify the Date and Amount received from the loan.

- In the grid, select the CCC Loan Income for the Account. Note: The income account should be specifically for CCC Loan Income and not mixed with the regular Crop Sales income account as the CCC grain sale is recorded on a different line on the Schedule F.

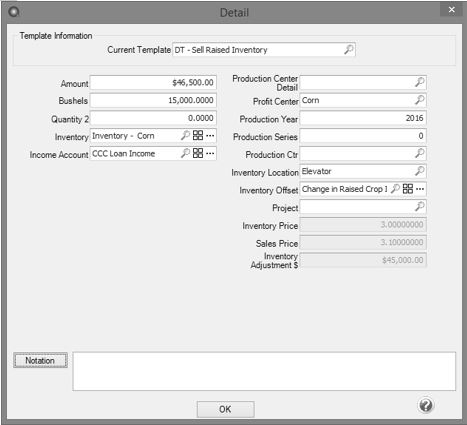

- Select the Detail button in the grid.

- In the Current Template, select DT - Sell Raised Inventory.

- Specify the amount received in the Amount field. Enter the quantity pledged in Quantity 1. Select the Inventory.

- Enter production details as needed. Click OK.

- Click Save.

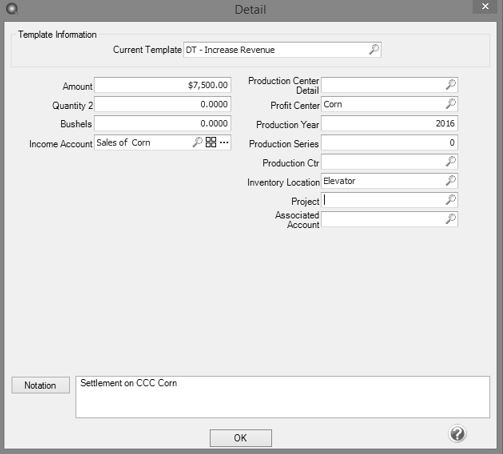

Step B – Record Sale Settlement following Loan Repayment

When the CCC corn is taken to the elevator and sold, the elevator repays the CCC Loan. When the initial loan amount is taken as income and the loan is repaid by the elevator, there is no need to record the loan repayment. The elevator sends you a settlement check. The check is entered as a receipt for additional revenue to the Crop Sales revenue account with no additional inventory adjustments.

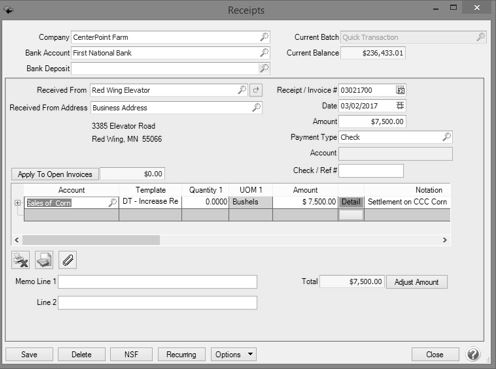

- Select Processes > Sales > Receipts.

- Specify the appropriate Received From, Date and Amount.

- In the grid, select the crop sales revenue account in the Account field. Then click on the Detail button.

- Select DT – Increase Revenue as the Current Template.

- Specify the Sale Amount. No additional quantity is recorded. Enter any production details as needed.

- Click OK.

How Transactions Affect the Schedule F

- CCC Loan Income revenue account ($46,500 from Step A) is assigned to Schedule F line 5a.

- Sales of Corn revenue account ($7,500 from Step B) is assigned to Schedule F line 2.

- The total taxable gain of the CCC transactions is $46,500 + $7,500 = $54,000.

On an accrual income statement, the new crop production valuing the corn at $3 per bushel displays in the month of new crop production in 2016. $3 x 15,000 bushels equals $45,000 recorded to the revenue account Change in Raised Crop. The CCC Loan Income of $46,500 displays in September 2016 minus the $45,000 Change in Raised Crop. When the grain is sold in March 2017, the accrual income statement reports the revenue to Sales of Corn of $7,500. The total accrual income for the 2016 production of the 15,000 bushels is $45,000 + $46,500 - $45,000 + $7,500 = $54,000.

Frequently Asked Questions

Q: Why can't the CCC Loan Income Account be selected from Processes > Sales > Receipts when following Method 1: CCC Loan Treated as Income section of this document?

A: If you can’t select your CCC Loan Income Account, the DT - Sell Raised Inventory data entry template needs to be changed. Follow the steps below to change the template:

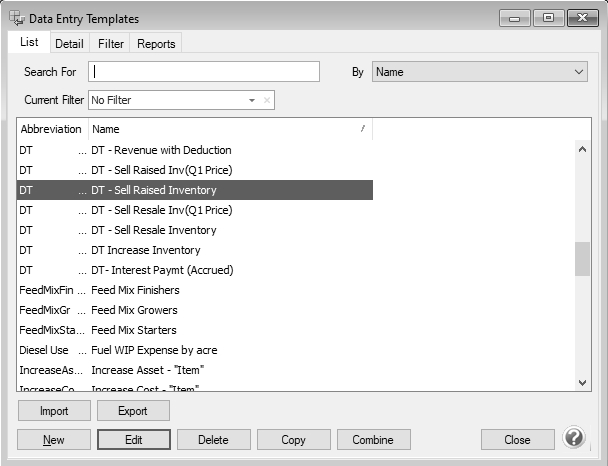

- Select Setup > General > Data Entry Templates.

- From the List tab, select DT - Sell Raised Inventory and then click Edit.

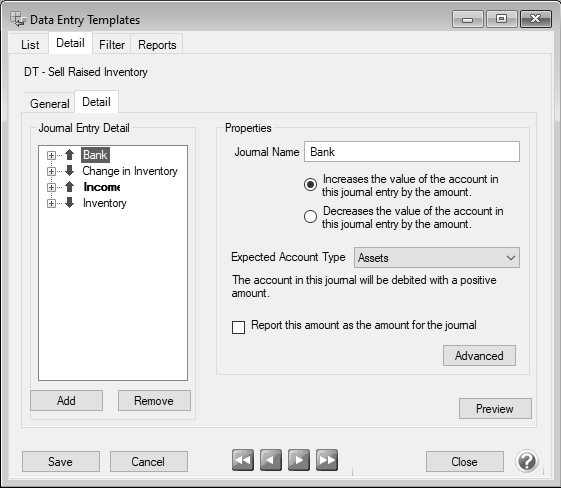

- From the Data Entry templates screen, from the Detail tab, select the Detail tab.

- From the left side of the screen, expand the Income section by clicking the +.

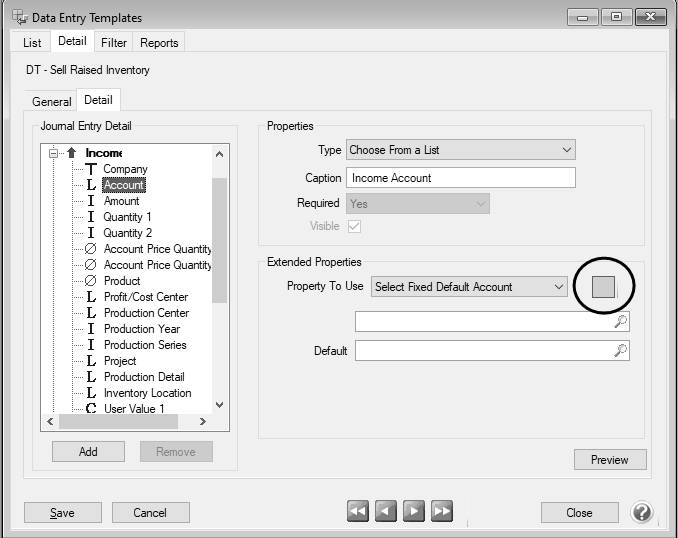

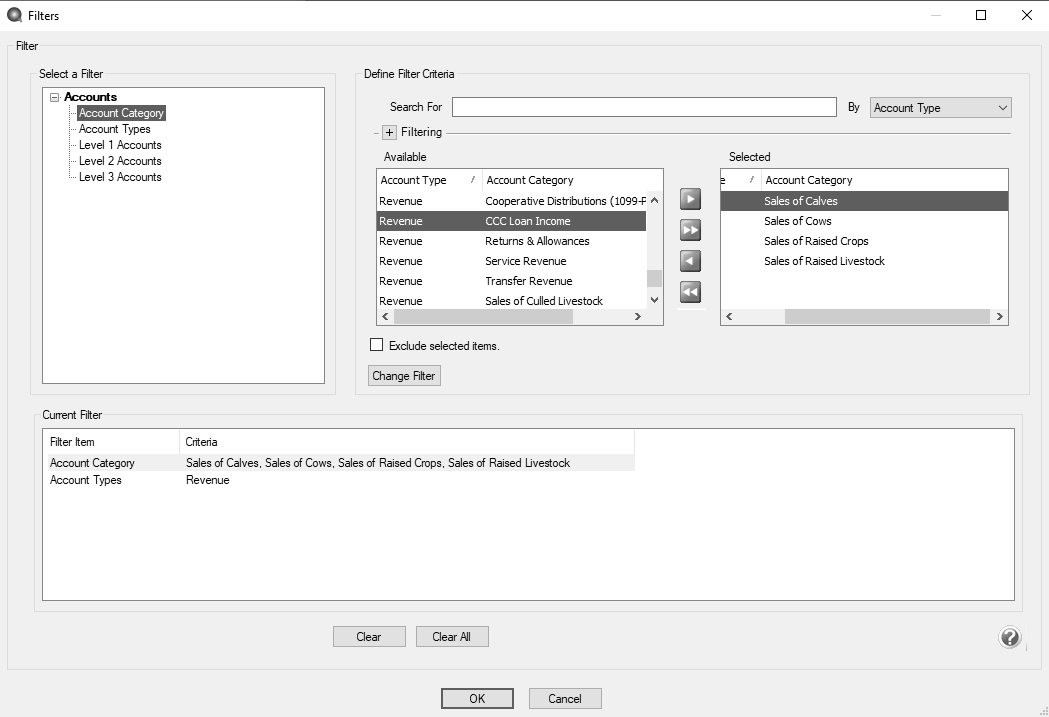

-

Select Account and then click the Filter button.

Note: The filter button will display when your mouse is positioned over the section circled in the screenshot below.

- In the Filters screen, select Account Category. Under Available, select CCC Loan Income.

-

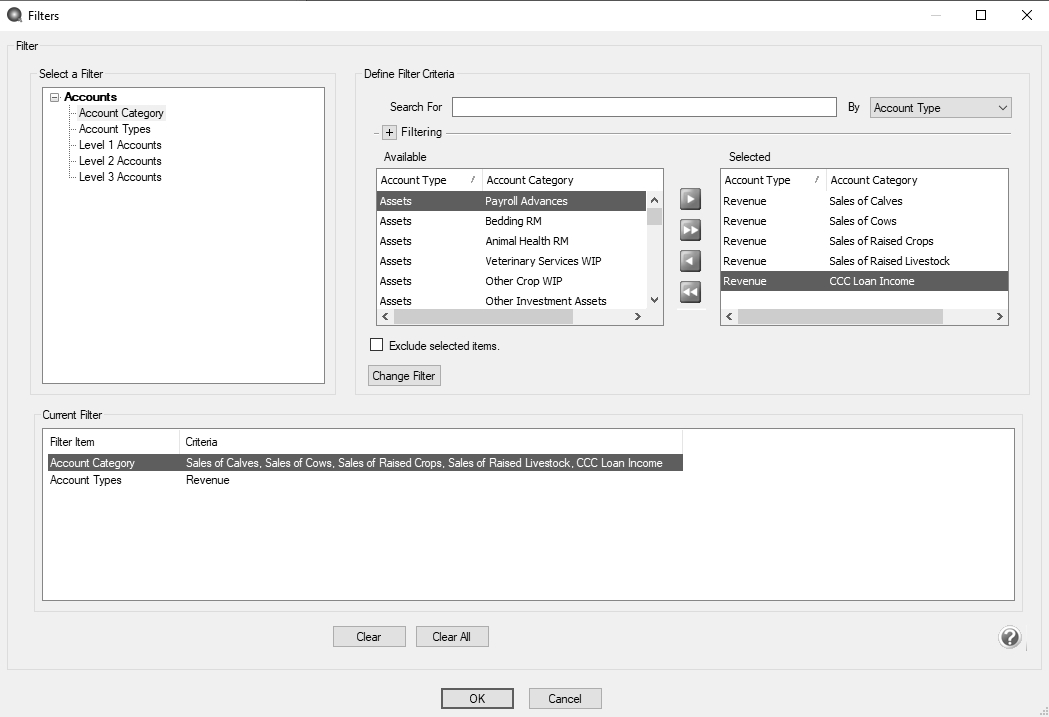

Click the Green right arrow

to move CCC Loan Income account category to the Selected column.

to move CCC Loan Income account category to the Selected column.

-

Click Change Filter.

- Click OK and then click Save.

|

Document: 3162 |

|---|

View or Print as PDF

View or Print as PDF