CenterPoint® Accounting for Agriculture

- 1099 Forms - Correcting Completed 1099s

Related Help

View or Print as PDF for CenterPoint Accounting for Agriculture

View or Print as PDF for CenterPoint Accounting for Agriculture

View or Print as PDF for CenterPoint Accounting

View or Print as PDF for CenterPoint Accounting

View or Print as PDF for CenterPoint Fund Accounting

View or Print as PDF for CenterPoint Fund Accounting

| Document #: | 3257 | Product: |

|

|---|

This document describes how to make corrections to processed 1099 forms.

The 1099 correction printing/efiling process includes multiple steps which are detailed below.

Exporting Data from CenterPoint Accounting

for Agriculture

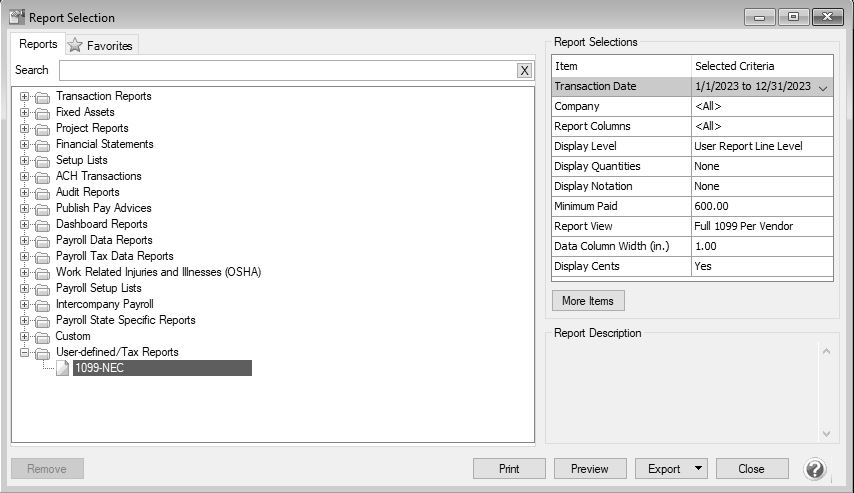

- Select Reports > Reports > Reports tab > User-defined/Tax Reports.

- Select the appropriate 1099 Form.

- Fill in the Report Selections with the appropriate Transaction Date. To correct 1099s for the current tax year, enter the current tax year date range. To correct 1099s from a previous tax year, enter the date range for the previous tax year.

- Fill in the Report Selections with the appropriate Company.

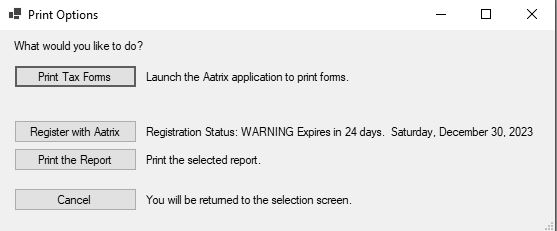

- Click Print.

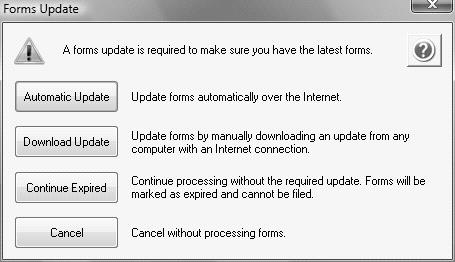

Forms Update

If you have internet access and the latest version of Federal/State Tax Forms (Aatrix) is not installed, the following Forms Update screen will automatically be displayed when you select the menu selection above. Simply click on Automatic Update and follow the on screen instructions.

If a Forms Update was required, from the Report Preview screen, click the Print or Print To icons again or from the Report Selections screen, click the Print button again. If an update was not required, the 1099 History Options screen will display.

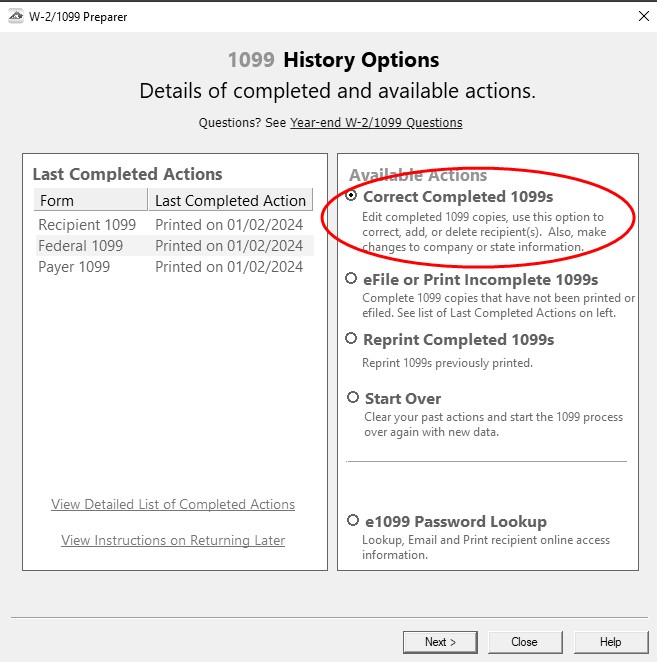

1099 History File Options

The following 1099 History Options screen will be displayed. Choose Correct Completed 1099s on the right and click Next.

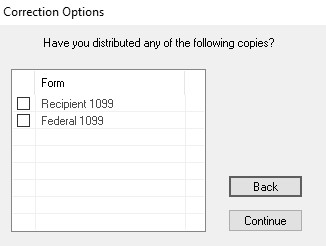

The Correction Options screen will display and ask you questions based on the status of your original 1099 process. The following screen shot is an example screen that will display. Answer the questions that display and then click Continue.

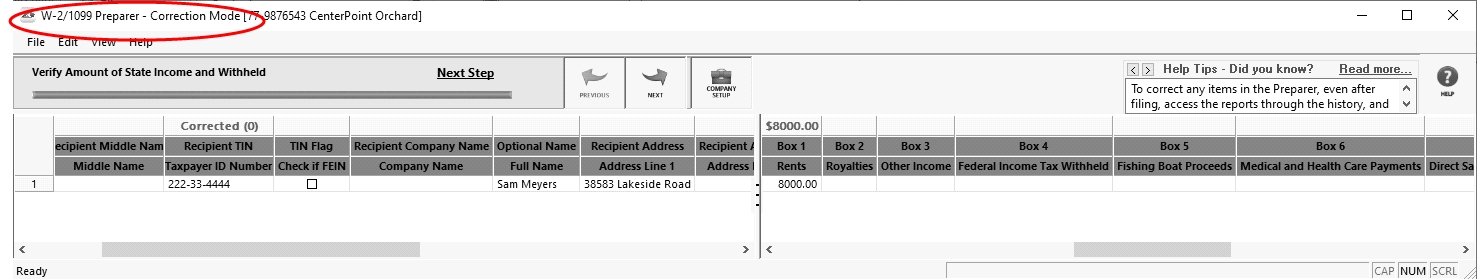

The W-2/1099 Preparer will display. Here you can change any of the recipient information.

- To correct any box values including names, addresses, and tax payer id numbers, simply select the box in the recipient row and just type in the new value.

- To add a 1099 recipient to the W2/1099 Preparer grid, select Edit > Row > Insert and enter the new name, address, taxpayer id, box values, etc.

- Do not remove recipients that are not being corrected; they need to remain in your filing. Only remove recipients if they in fact did not need a 1099 form from your company.

- For any data you change, the cell values will turn blue and the far left column in the row of the recipients 's name will turn green. Keep in mind that all the same error checking done in the Preparer applies again just as the first time you went through.

- The Preparer will walk you through your particular correction depending on whether your initial 1099 process was printed, efiled, or you used the complete filing option.

-

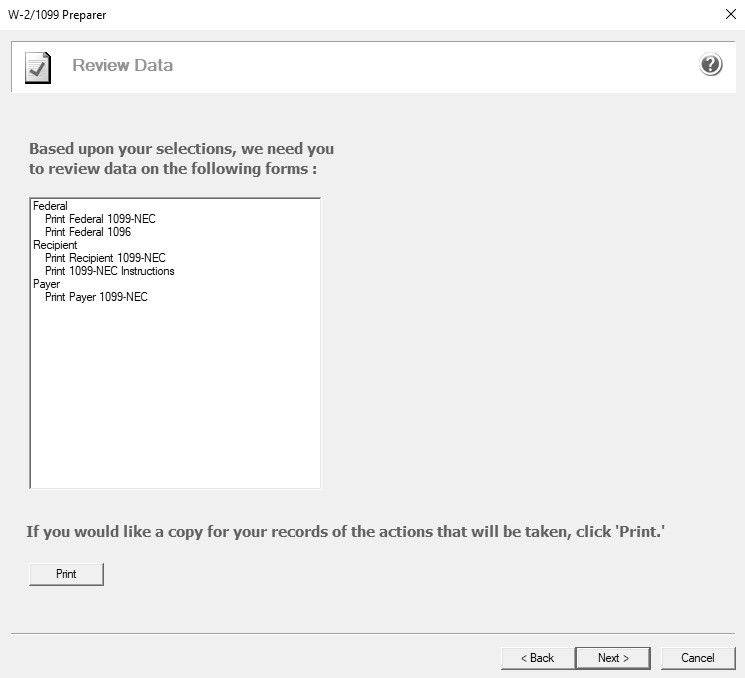

When you have completed all changes, click Next Step, the Divider Sheet screen will display and then the Review Data action list will appear. The action list is created based upon the type of 1099 copies previously completed, what was changed in the 1099 Preparer, and the current status of the eFiling. All this information is compiled through the software to determine what needs to be completed for the corrections made.

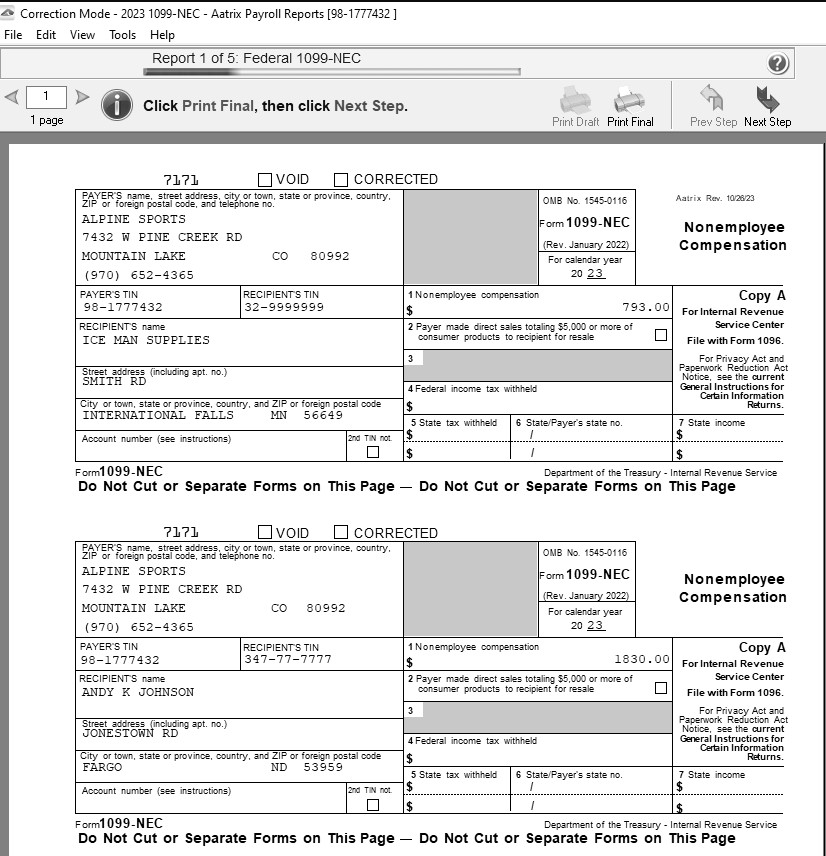

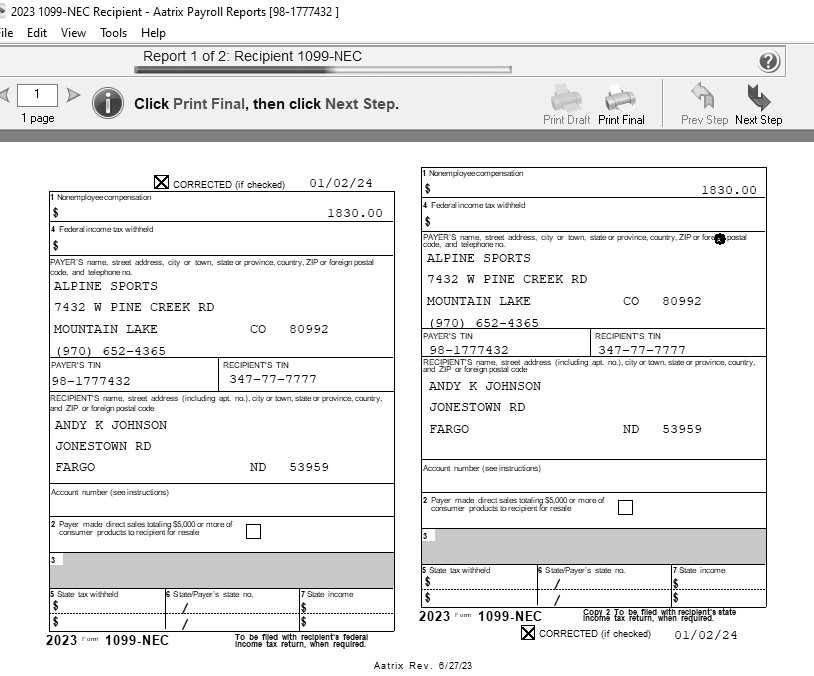

- Click Next, the Forms Viewer will display. The forms will begin to display in the same order as displayed on the action list.

Note: The forms displayed are determined based on what has already been processed.

-

When you are done in the Forms Viewer, and if the original submission was eFiled, the eFile Wizard will appear. Enter the username and password to eFile and submit the corrections.

After submitting, you will receive a new Aatrix Filing Identification Number (AFID).

Changes made to a recipient's 1099 filing after they have been delivered to the recipient will be marked Corrected.

If the federal portion has not been filed yet, and you are eFiling, the corrected filing will replace the previous one. If the federal copies are filed, Corrected 1099s will be sent out.

Note: If the eFile Center has not submitted the filing to the agency, there is no charge to send a replacement filing. If the filing has been submitted, there is a charge per corrected recipient only. Once your Federal Filing is processed a minimum charge will be implemented for all corrections. Please log on to your eFile account at efile.aatrix.com and select the Pricing tab to view your pricing.

- If a State correction is required, and your state filing has already been submitted to the State agency, the corrections will need to be printed and mailed to the agency.

Frequently Asked Questions

Q: When corrections are made to 1099s at what point does Aatrix need to be notified about changing the eFile?

A: Aatrix is notified automatically through the eFile process. When the corrected eFile is received a new AFID is received. The status of the eFile can be viewed on the efile.aatrix.com website.

Below are few different scenarios regarding correcting 1099s. These scenarios will help you determine the differences that will occur during the 1099 correction process.

Example Scenario 1

A customer submitted the Complete Filing Option 1099s to Aatrix for e-filing and mailing out. A future date was selected for the e-file so Aatrix still has the filing. Corrections are made with the processes outlined above, do they need to notify Aatrix that there is new information to be mailed and efiled and is there a charge associated?

No, Aatrix does not need to be notified. When the customer selects to Correct 1099s and opens their history, Aatrix checks the status of their filing to determine what forms are needed based on the state of their filing. During the corrections process Aatrix tracks the changes, and when they eFile again they get a new AFID. Anything that hasn’t already been processed will move forward to the new filing and use the new information. There is no charge to replace the filing, but if something has already been processed, then the customer is charged just for the additions, corrections, and deletions. This is all based on the status of the filing when the corrections are submitted. If nothing has been processed yet, then the replacement filing is free.

Pricing schemes change once Federal or State 1099s have been corrected. A $14.95 minimum applies to all correction filings submitted after the Federal or State 1099s have been processed.

Example Scenario 2

A customer submitted the Complete Filing Option 1099s and Aatrix has processed the eFile and mailed out the copies. Corrections are made with the processes outlined above do they need to notify Aatrix that there is new information to be mailed and efiled and is there a charge associated?

No, Aatrix does not need to be notified. When the customer selects to correct 1099s and opens their history, Aatrix checks the status of their filing to determine what forms are needed based on the state of their filing. During the corrections process Aatrix tracks the changes, and when they eFile again they get a new AFID. Anything that hasn’t already been processed will move forward to the new filing and use the new information. There is no charge to replace the filing, but if something has already been processed, then the customer is charged just for the additions, corrections, and deletions. This is all based on the status of the filing when the corrections are submitted. If nothing has been processed yet, then the replacement filing is free.

Pricing schemes change once Federal or State 1099s have been corrected. A $14.95 minimum applies to all correction filings submitted after the Federal or State 1099s have been processed.

Example Scenario 3

A customer submitted printed copies of 1099s to their recipients. Corrections are made with the processes outlined above but not eFiled. Is there a charge for the corrected 1099s?

No, there is not a charge for reprinting corrected 1099s. If you process corrections after a filing has been sent to the agency, the software will produce corrected 1099s.

|

Document: 3257 |

|---|