CenterPoint® Accounting for Agriculture

- Sell Purchased Inventory (Livestock or Crop Inventory)

Related Help

_24.jpg) Sell Purchased Inventory for Resale Video - Duration: 8 min 45 sec

Sell Purchased Inventory for Resale Video - Duration: 8 min 45 sec

| Document #: | 3116 | Product: | CenterPoint® Accounting for Agriculture |

|---|

This topic describes how to sell purchased inventory. The same process is used for selling livestock or crop inventory. Changing to the DT - Sell Resale Inventory template on the sales account (or transaction) will cause the quantity sold to be deducted from the inventory account balance specified in the detail portion of the transaction. The amount deducted from inventory will then be charged to the cost of goods sold account assigned to the inventory account. It will be deducted from inventory at the value it was purchased into inventory. The total price of the items sold will be recorded to the revenue account, thus automatically calculating a net profit or loss (revenue - cost of goods sold = net profit/loss).

Prerequisite

Prior to processing the transactions, the database must have an inventory account (asset), a cost of goods sold account and a revenue account setup for the commodity being sold. The inventory account must have the appropriate cost of goods sold account assigned as the offset account on the detail tab.

Step A: Verify the Revenue Account is Setup Properly (One-Time Setup)

Step A: Verify the Revenue Account is Setup Properly (One-Time Setup)

- Select Setup > Accounts > Accounts.

- Double-click on the appropriate Revenue account (Sale of Purchased Cattle, for example).

- Click on the Templates tab. Select Receipts and New Receivables on the left. On the right, set the Change To field to DT - Sell Resale Inventory.

- Click Save.

Step B - Sell Purchase Inventory

Either a Customer Invoice (A/R) or Receipt transaction can be used to record the sale of inventory. In our example, we'll sell purchased cattle with a receipt transaction.

- Select Processes > Sales > Receipts or Processes > Sales > Customer Invoices (Basic).

Note: The DT - Sell Resale Inventory template is setup to deduct the quantity sold from the inventory account.

- Specify the appropriate Inventory account. Verify the Cost Account (this should be the cost of goods sold account assigned to the inventory account).

- Specify all applicable production details (profit center, production year, etc.). Click OK.

- Click Save to on the original receipt transaction screen to complete the transaction.

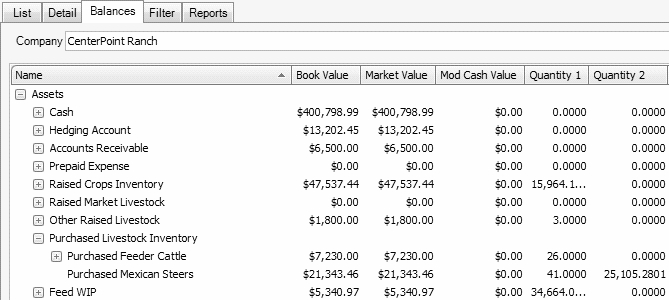

After the sale is entered, the quantity and amount sold will automatically be deducted from the Inventory account balance (Setup > Accounts > Accounts > Balances tab). The inventory value is offset with the cost of goods account assigned to the inventory account. The revenue account is increased by the sale amount and offset with cash.

|

Document: 3116 |

|---|