CenterPoint® Accounting for Agriculture

- Leases

Related Help

_24.jpg) Crop Lease Agreements Video - Duration: 9 min 19 sec

Crop Lease Agreements Video - Duration: 9 min 19 sec

_24.jpg) Livestock Lease Agreements Video - Duration: 5 min 41 sec

Livestock Lease Agreements Video - Duration: 5 min 41 sec

| Document #: | 3435 | Product: | CenterPoint® Accounting for Agriculture |

|---|

A lease establishes the relationship between one or more owners and one or more operators. A lease can describe three different types of relationships:

Create or Change an Owned Lease

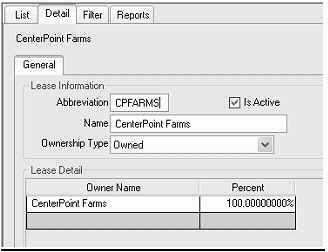

After you install the Crop/Livestock module, one Owned Lease is automatically created with 100% ownership for each company in your database.

Create or Change an Owned Lease

- Select Setup > Profit/Production Centers > Crop or Livestock Leases.

- To edit a lease, select the lease and then click Edit.

- To create a new lease, click New.

- Under Lease Information, in the Abbreviation box, enter an optional abbreviation for the lease. In the Name box, enter the name for the lease.

- In the OwnershipType box, select Owned.

- Under Lease Detail, in the Owner Name column, select the owner for this lease (usually this owner will be associated with a company and, therefore, it is possible that inventory may be maintained for this owner). If more than one owner will split the production for this lease, select the owner names and then enter the ownership percentage for each owner name.

- In the Percent column, enter the ownership percentage.

- Click Save.

In the example above, CenterPoint Farms is the owner of the land. CenterPoint Farms is an owner that is associated with a company, so CenterPoint Farms will receive 100% of the production when a transaction is entered and an inventory will be maintained for the production center details in the transaction.

In the example below, CenterPoint Farms is the owner of the livestock. CenterPoint Farms is an owner that is associated with a company, so CenterPoint Farms will receive 100% of the production when a transaction is entered and an inventory will be maintained for the production center details in the transaction.

Create or Change a Cash Rented Lease

- Select Setup > Profit/Production Centers > Crop or Livestock Leases. Select the lease and then click Edit.

- To create a new lease, click New.

- Under Lease Information, in the Abbreviation box, enter an optional abbreviation for the lease. In the Name box, enter the name for the lease.

- In the Ownership Type box, select Cash Rent.

- Under Lease Detail, in the Operator Name column, select the operator(s) for this lease (usually, the operator(s) of a cash rented lease will be associated with a company in the database, and, therefore, inventory may be maintained). If you want to track the owner of the land that you are renting from, in the Owner Name column, select the owner (usually, the owner in a cash rent lease does not get a share of the production, but instead is paid rent. The cash rent owner percentage should be set to 100%).

- In the Percent column, enter the operator percentage.

- Click Save.

In the example below, Bob Jones is renting land from Tim King. Bob Jones is an operator that is associated with a company, so Bob Jones will receive 100% of the production. If inventory is maintained, then production transactions will increase the value of that inventory for 100% of the production.

In the example below, Bob Jones feeds livestock for Tim King. Bob Jones is an operator that is associated with a company, so Bob Jones will receive 100% of the production. If inventory is maintained, then production transactions will increase the value of that inventory for 100% of the production.

Create or Change a Crop Share Lease

- Select Setup > Profit/Production Centers > Crop or Livestock Leases.

- To edit a lease, select the lease and then click Edit.

- To create a new lease, click New.

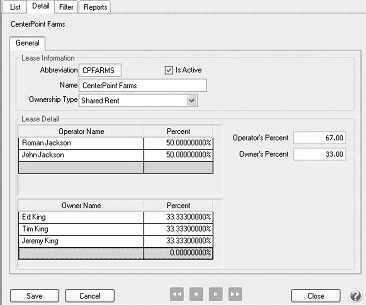

- Under Lease Information, in the Abbreviation box, enter an optional abbreviation for the lease.

- In the Name box, enter the name for the lease.

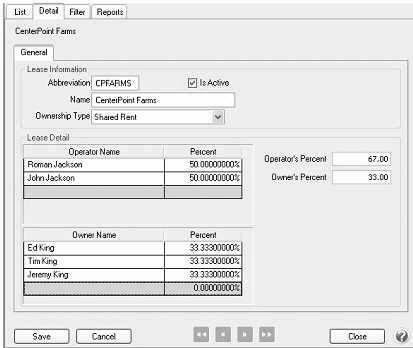

- In the Ownership Type box, select Shared Rent.

- Under Lease Detail, in the Operator Name column, select the operator(s) for this lease. In the Owner Name column, select the owner(s) for this lease.

A shared rent agreement can be set up with various combinations. The operator and/or the owner might be companies in the database. For example, CenterPoint Farms is a company and rents some ground from Ed, Jeremy, and Tim King who are associated with another company, then both the operator and owner’s share of production are recorded as transactions in CenterPoint Production Center Details. If this is stored production, inventory balances would be created for both the operator and owner’s share of production. If the owners are not a company in the database, only the operator’s share is recorded in CenterPoint as a transaction. The owner’s share is a calculated production in the Production Center Details

There can always be more than one operator and more than one owner. The total operator percentages must total 100. The total owner percentages must total 100. The operator’s percentage and owner’s percentage must total 100. An example split of production follows:

- In the Percent column, enter the operator percentage.

- Click Save.

In the example below, Roman and John Jackson are brothers that are operating the land for the owner’s Ed, Jeremy, and Tim King. Roman and John Jackson are operators that are not associated with a company, so when a transaction is entered they will receive 67% of the production split by 50% for each of them and an inventory will not be maintained.

Ed, Jeremy, and Tim King are owners that are associated with a company, so when a transaction is entered they will receive 33% of the production split by 33.333% for Ed and Tim King and 33.334% for Jeremy King. If an inventory is maintained, each of the three companies will increase an inventory balance for their portion of the production.

In the example below, Roman and John Jackson are brothers that are feeding hogs for the owners Ed, Jeremy, and Tim King. Roman and John Jackson are operators that are not associated with a company, so when a transaction is entered they will receive 67% of the production split by 50% for each of them and an inventory will not be maintained.

Ed, Jeremy, and Tim King are owners that are associated with a company, so when a transaction is entered they will receive 33% of the production split by 33.333% for Ed and Tim King and 33.334% for Jeremy King. If an inventory is maintained, each of the three companies will increase an inventory balance for their portion of the production.

|

Document: 3435 |

|---|