CenterPoint® Accounting for Agriculture

- Selling Raised Livestock Inventory

Related Help

When raised livestock is sold it must be recorded in CenterPoint with either a Receipt (if money was already received) or a Customer Invoice (A/R) (if money has not yet been received for the sale). Prior to making the sale transaction, it's a good idea to verify that the Revenue accounts are setup properly (Step A below).

Step A: Verify the Revenue Account is Setup Properly (One-Time Setup)

Step A: Verify the Revenue Account is Setup Properly (One-Time Setup)

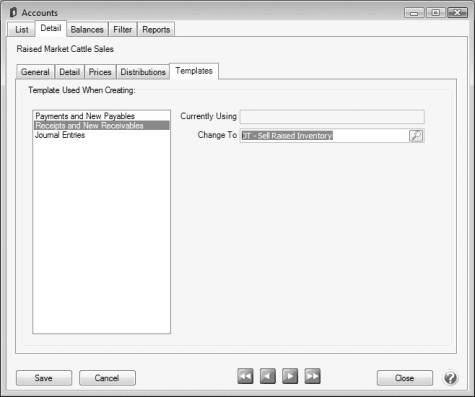

- Select Setup > Accounts > Accounts.

- Double click on the appropriate Revenue account (Raised Market Cattle Sales, for example).

- On the General tab, verify that the Account Category is assigned to Sales of Raised Livestock.

- On the Template tab, select Receipts and New Receivables on the left. On the right, set the Change To field to DT - Sell Raised Inventory.

- Click on Save.

Step B: Sell Raised Livestock Inventory

The sale of raised livestock inventory can be recorded using either a Receipt or a Customer Invoice (A/R). In our example, we'll be recording the sale with a Receipt transaction.

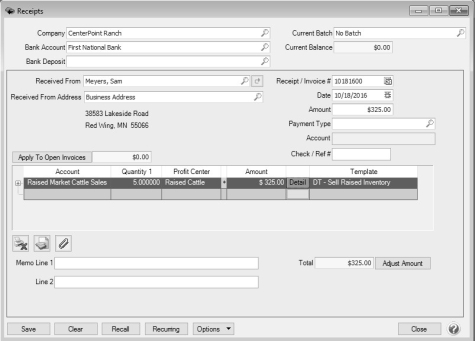

EXAMPLE: CenterPoint Ranch sold 5 of their 2010 calves to Louise Arnold at a price of 65.00 each.

- Select Processes > Sales > Receipts.

- Enter the appropriate information in the Company, Bank Account, Received From, Date, Amount and Check/Ref# fields.

- In the Account field, select the revenue account from Step A.

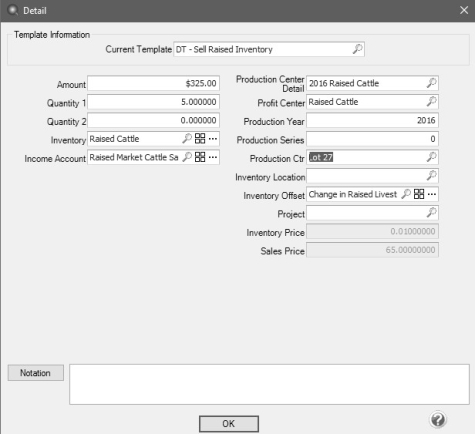

- Click on the Detail button.

- Enter the appropriate quantity sold in the Head field.

- In the Inventory field, select the appropriate Raised Livestock inventory account. Verify that the Inventory Offset account is correct. It should be a Change in Raised Livestock Inventory account.

- Specify all appropriate Production Center details. Click OK.

- Verify the information on the main receipt screen and click Save to complete the transaction.

|

Document: 3119 |

|---|