CenterPoint Fund Accounting

- Adding Health Insurance Paid Through an S-Corp on Behalf of > 2% Shareholders

| Document #: | 3254 | Product: | CenterPoint® Payroll |

|---|

The steps below identify the process to use if your accountant specifies that an amount needs to be added to a shareholder's W-2 for health insurance paid through an S-Corp on behalf of > 2% shareholders, after all payrolls are complete for the year.

These steps will not add any liabilities to your payroll. It is simply a way to reflect the amount in the employee history and their tax forms. If you are paying social security and medicare you will have to pay the employee and employer share of tax. The benefit amount will display on the employee W-2 and any state forms. The employee W-2 will also display the appropriate withholding amount.

After using this process, you will need to pay any additional amount for the employee/employer share of social security and medicare on your 941 Form.

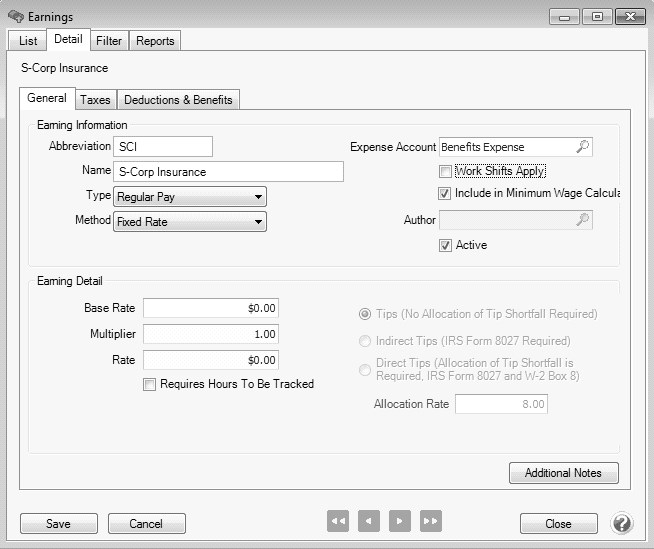

Step A - Create an Earning:

- Select Setup > Payroll Details > Earnings. Click New.

- Enter an appropriate Abbreviation and Name for this earning. In our example, we are using S-Corp Insurance. Specify the appropriate Expense Account for this earning.

- Select Regular Pay as the Type, and Fixed Rate as the Method. All other fields on the General tab can be ignored.

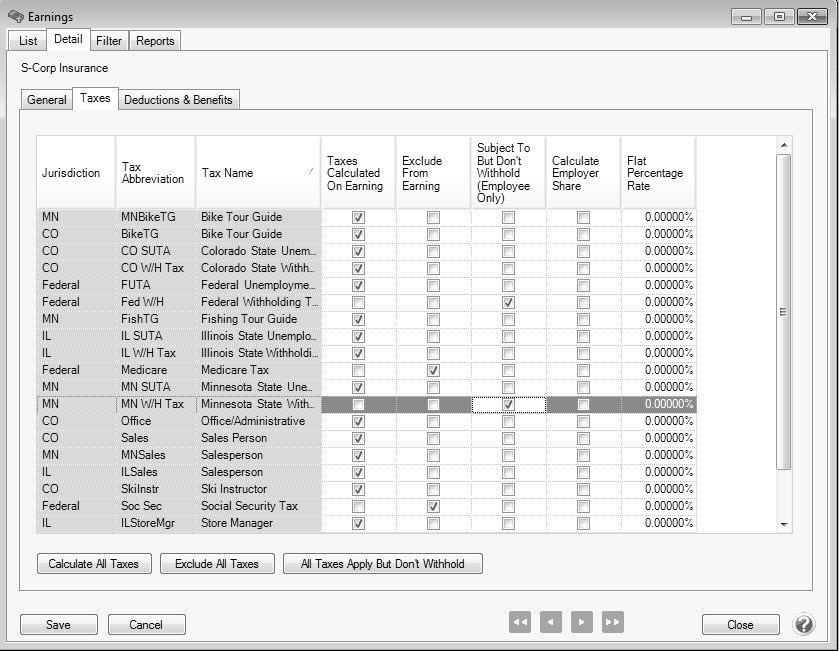

- Select the Taxes tab. For Federal Withholding and State Withholding, put a check mark in the Subject to But Don't Withhold column. The same thing should be done for any local (county, city, school district, etc.) taxes the employee would normally pay. Social Security and Medicare taxes are not taxable.

- Click Save.

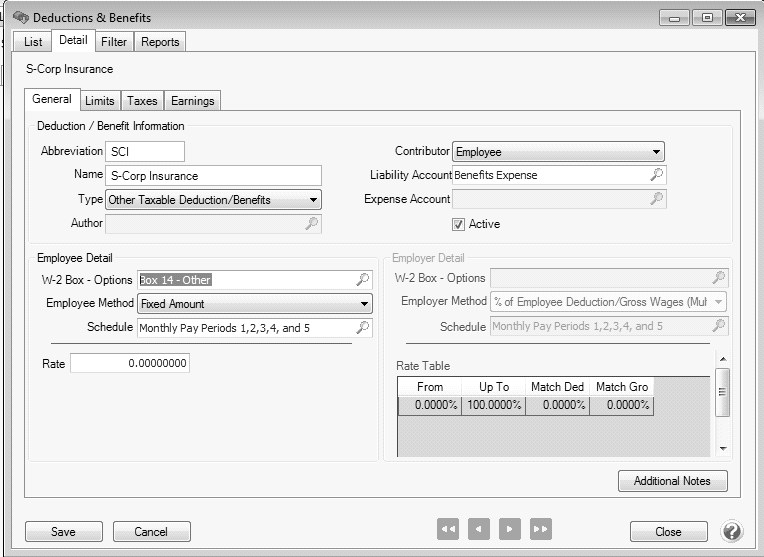

Step B - Create a Deduction

- Select Setup > Payroll Details > Deductions & Benefits. Click New.

- Enter an appropriate Abbreviation and Name for this deduction. In our example, we are again using S-Corp Insurance.

- The Type should be Other Taxable Deduction/Benefits. Select Employee in the Contributor field.

- In the Liability account field, use the same expense account that was used in the setup of the Earning.

- In the W-2 Box - Options field, select the Box specified by your accountant (For S-Corp Insurance, box 14 is normally used.).

- The Employee Method should be Fixed Amount. All other fields on the General tab can be ignored.

- Click Save.

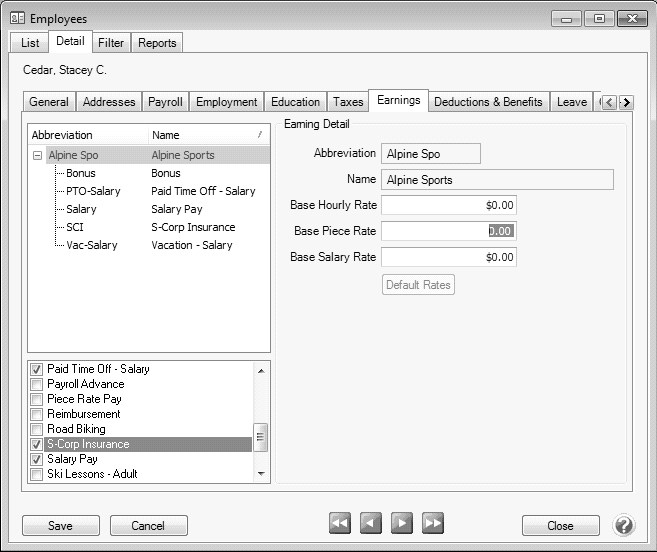

Step C - Add the Earning and Deduction to the Employee

- Select Setup > Payroll Details > Employees. Select an employee that needs the S-Corp Insurance added to their W-2 and click Edit.

- Select the Earnings tab.

- In the lower left corner of the Earnings tab, select the Earning that was created in Step A. Leave the Rate at 0.

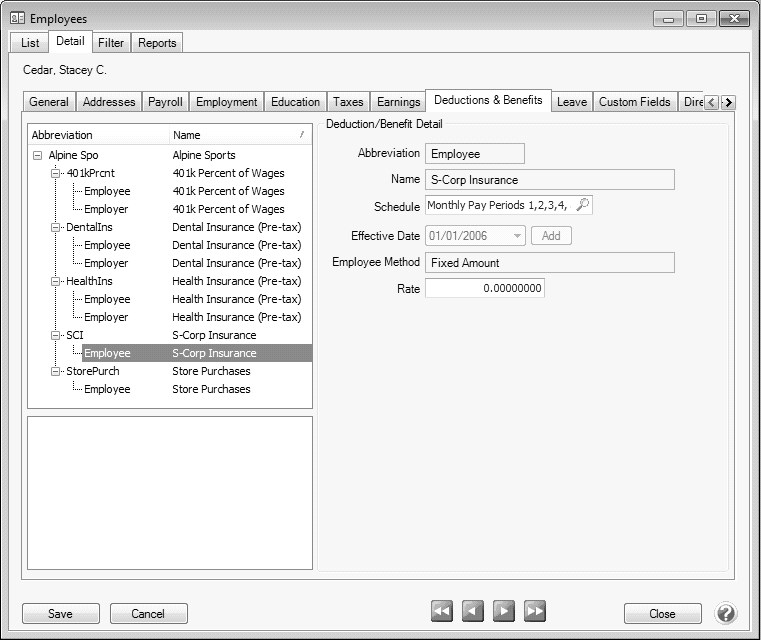

- Select the Deductions & Benefits tab.

- In the lower left corner of the Deductions & Benefits tab, select the Deduction that was created in Step B. Leave the Rate at 0.

- Repeat steps 1-5 for each shareholder that needs health insurance amounts added to their W-2.

Step D - Process a Pay Run:

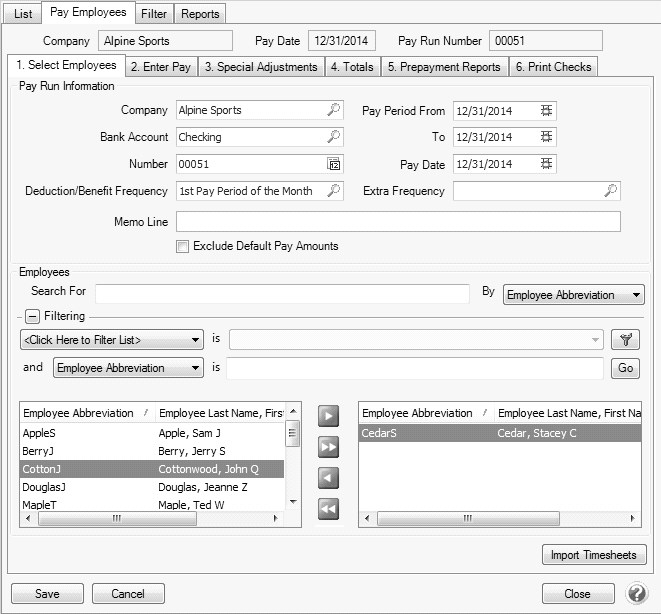

- Select Processes > Pay Employees or Processes > Payroll > Pay Employees. Click on New.

- Enter the appropriate Dates (Pay Period From, To, and Pay Date). These can all be set to 12/31/14 if you'd like.

- Select the shareholders you will be entering the health insurance information for. Shareholders can be selected by moving them to the right using the green right-arrow button.

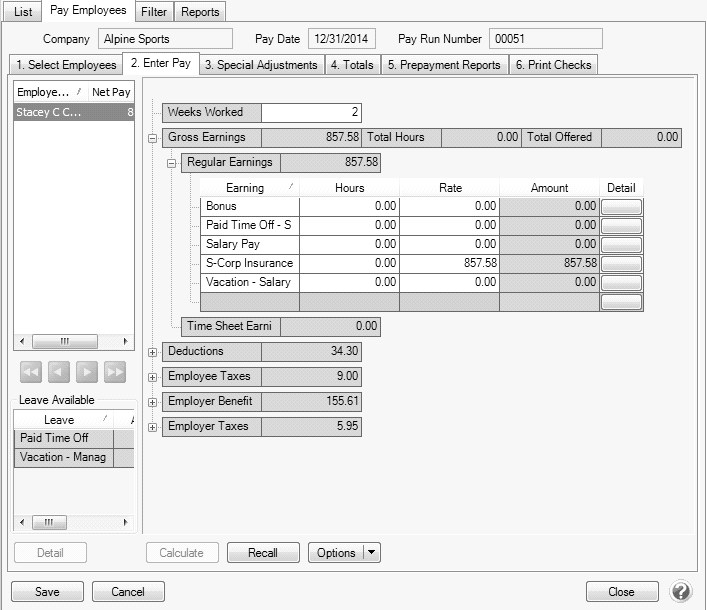

- Click on the Enter Pay tab.

- Zero out any Salary Pay or other earning amounts.

- Enter the Amount of the health insurance in the appropriate Earning.

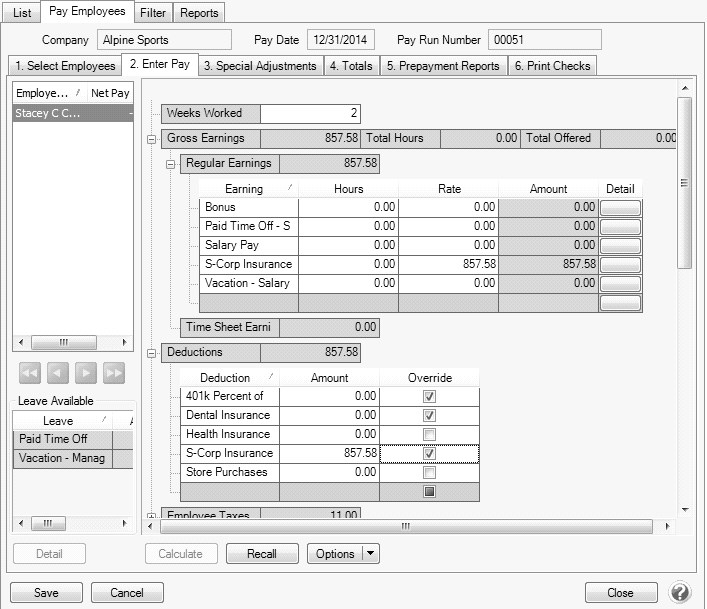

- Double-click on Deductions to see all deduction details.

- Zero out all deduction amounts displayed.

- For the S-Corp insurance Deduction, enter the same Amount that was entered for the Earning.

- Click Save.