CenterPoint Fund Accounting

- Direct Deposit File Mapping

Direct Deposit Files and Viewer Video -Duration: 5 min 31 sec

_24.jpg)

| Document #: | 3161 | Product: | CenterPoint Payroll |

|---|

This document describes the information that is found in a Direct Deposit ACH file and where that information comes from in CenterPoint. The first part of the document has several screen shots which show where in CenterPoint data is entered for use in the Direct Deposit process. The second part shows each of the Direct Deposit record types and which screens in CenterPoint contain that data, on a field-by-field basis.

Screens where Direct Deposit data is entered

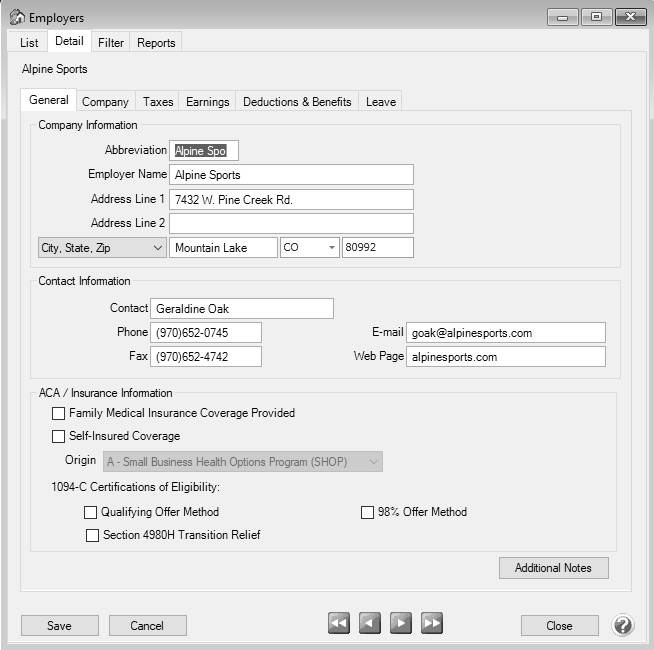

- Screen 1 - Setup > Payroll Details > Employers > General tab.

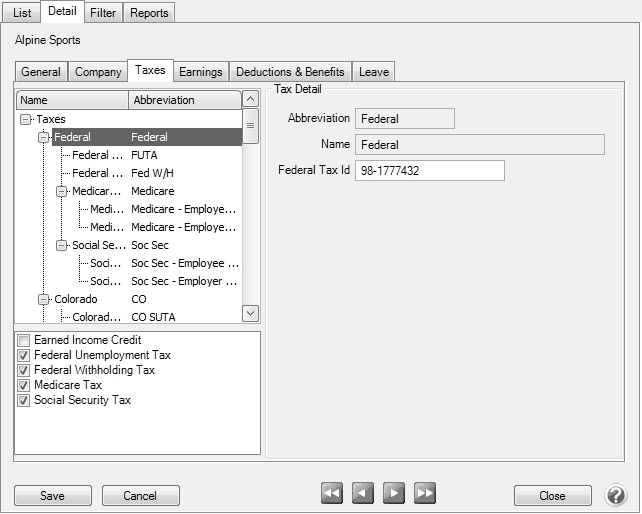

- Screen 2 - Setup > Payroll Details > Employers > Taxes tab.

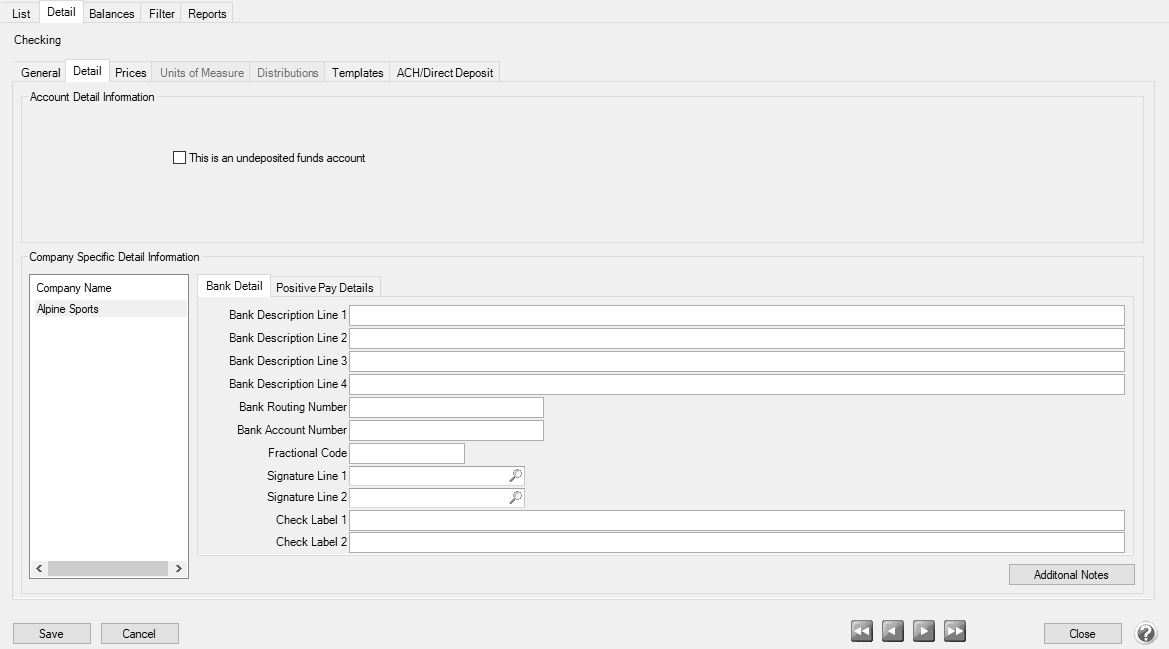

- Screen 3 - Setup > Accounts > Accounts > ACH/Direct Deposit tab (of the checking account used for Payroll).

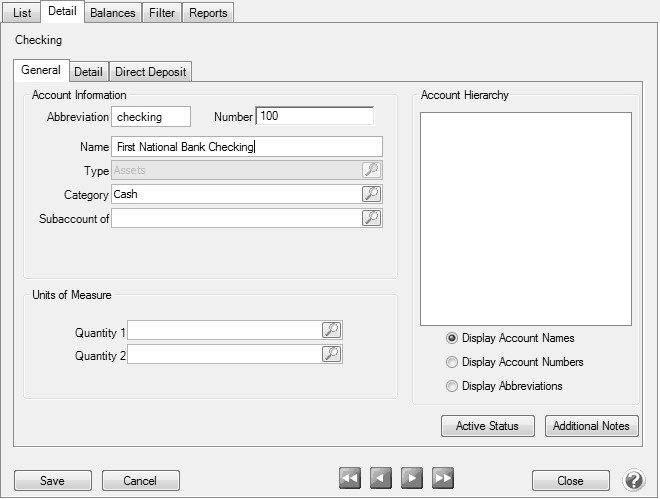

- Screen 4 - Setup > Accounts > Accounts > General tab (of the checking account used for Payroll).

- Screen 5 - Setup > Accounts > Accounts > Detail tab (of the checking account used for Payroll).

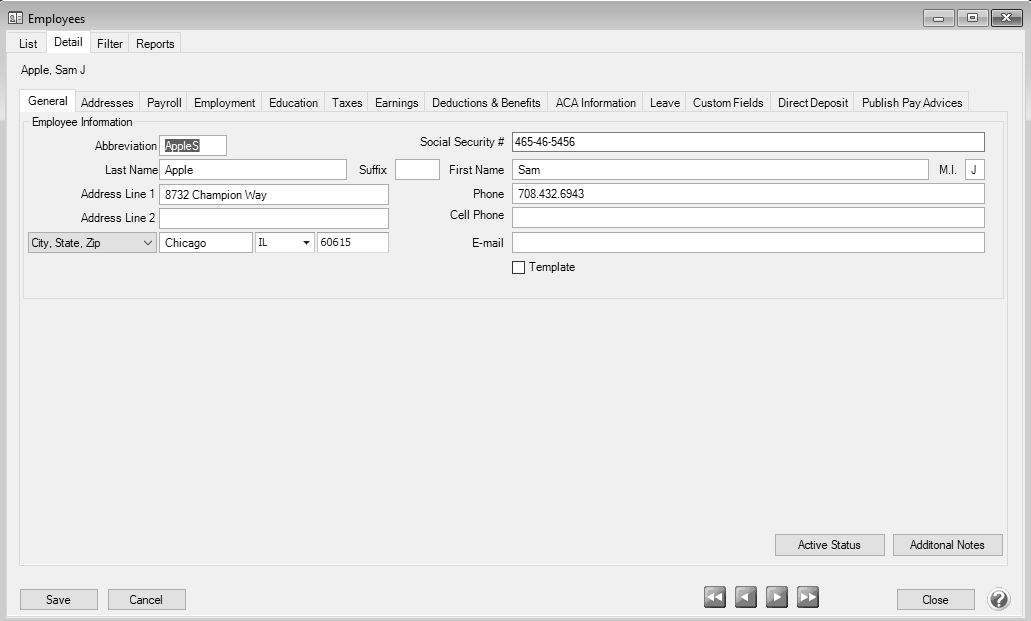

- Screen 6 - Setup > Employees > General tab.

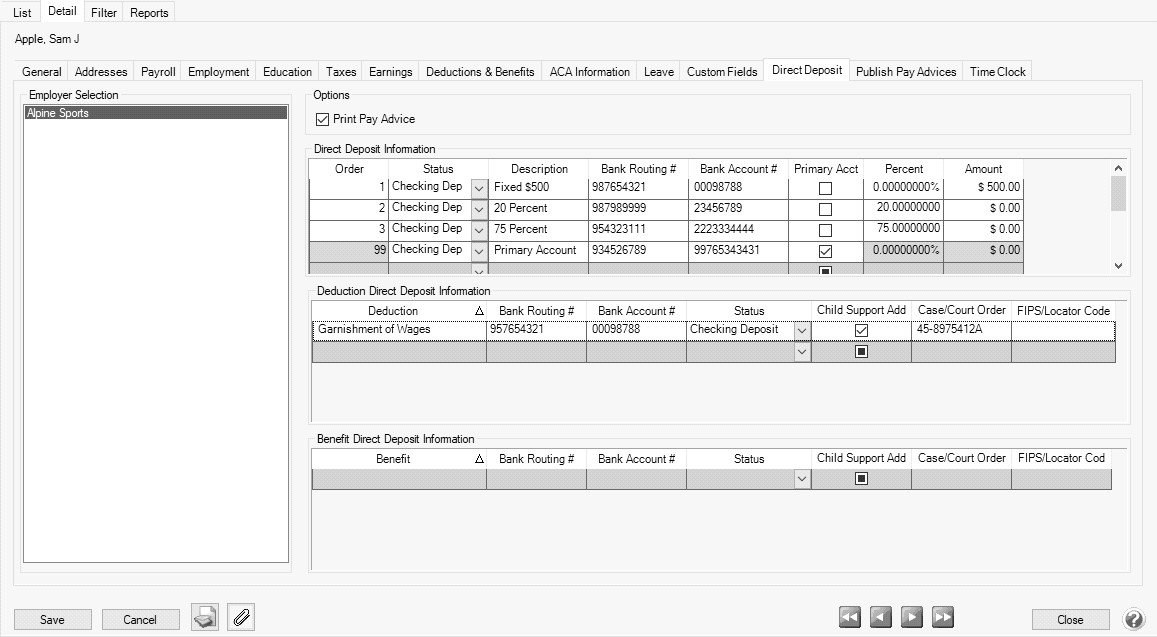

- Screen 7 - Setup > Employees > Direct Deposit tab.

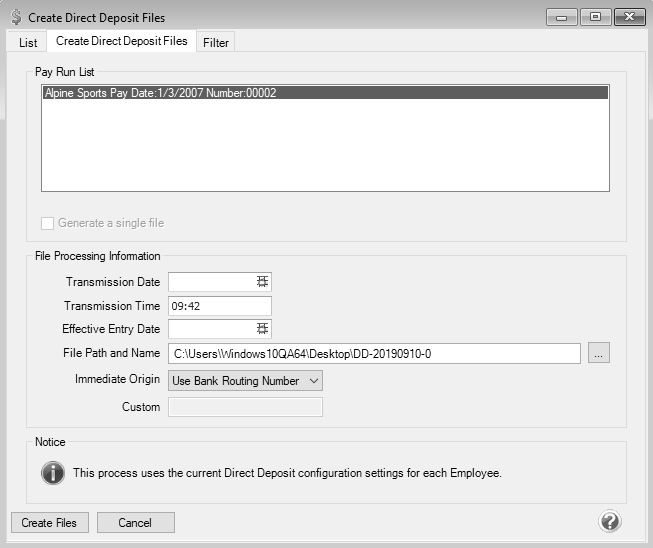

- Screen 8 - Processes > Create Direct Deposit Files or Processes > Payroll > Create Direct Deposit Files.

File Mapping

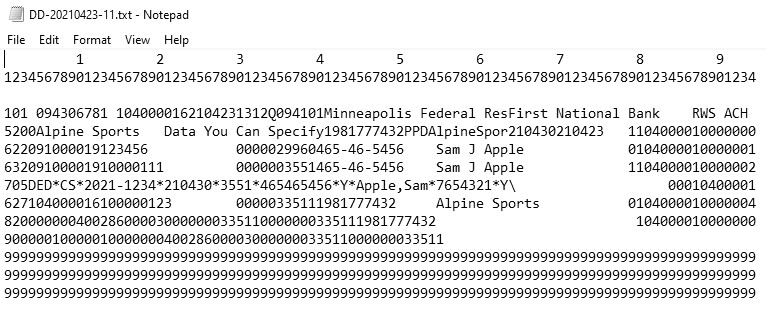

This is the actual format of the direct deposit file that is created. The first three lines have been inserted to make it easier to read the file data (they wouldn't be a real direct deposit file). Each record (row) is 94 characters long and for the ASCII and NACHA (modified) formats there is a CR/LF pair of characters at the end of each record. The standard NACHA format does NOT have the CR/LF pair of characters at the end of each record but does have a series of 999s at the end of the file. (The file must have a specified number of 94 character records, a number that is evenly divisible by 10, and there are always enough 999 records added to make the "blocking factor" correct.)

The information below explains each record/row found in a direct deposit file. By comparing the data in the "example" column to the image of a direct deposit file above, it will help you understand what each of the numbers communicates to the bank. For example, the row that starts with "101"; the 101 refers to the first three characters in the File Header Record (record type 1). Characters 5-13 are the routing number, etc.

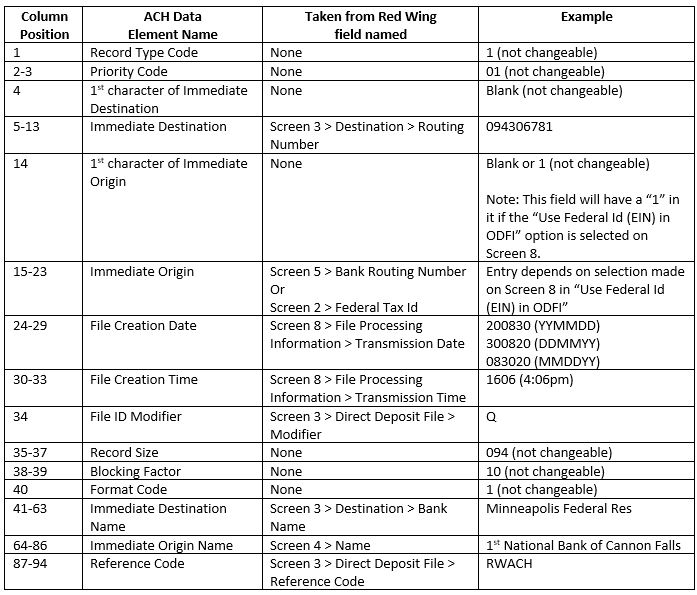

File Header Record (record type = 1)

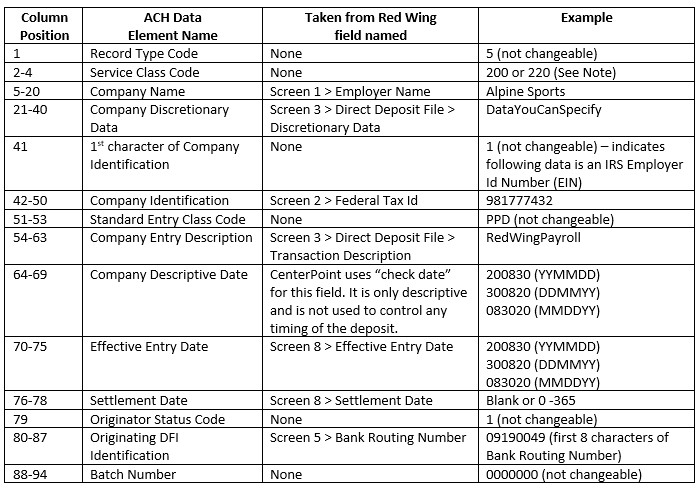

Company/Batch Header Record (record type = 5)

Note: If your lender instructs you that the Batch Header (5) and Batch Control (8) records must contain Service Code 200 (ACH Credits and Debits), the Create Offsetting Debits check box on the Setup > Accounts > Accounts > ACH/Direct Deposit tab should remain selected. If your lender instructs you that the Batch Header (5) and Batch Control (8) records must contain Service Code 220 (ACH Credits Only), the Create Offsetting Debits check box on the Setup > Accounts > Accounts > ACH/Direct Deposit tab should not be selected.

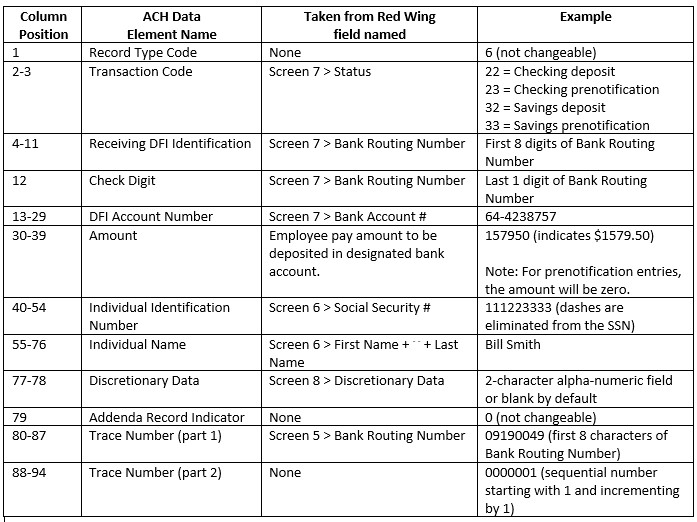

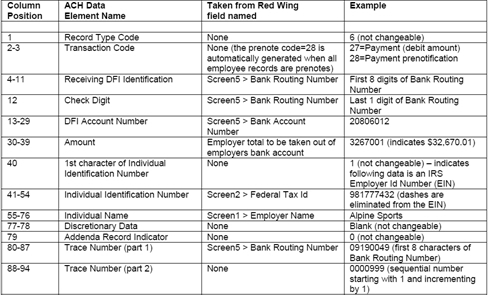

Note: If your lender instructs you that the Batch Header (5) and Batch Control (8) records must contain Service Code 200 (ACH Credits and Debits), the Create Offsetting Debits check box on the Setup > Accounts > Accounts > ACH/Direct Deposit tab should remain selected. If your lender instructs you that the Batch Header (5) and Batch Control (8) records must contain Service Code 220 (ACH Credits Only), the Create Offsetting Debits check box on the Setup > Accounts > Accounts > ACH/Direct Deposit tab should not be selected.Entry Detail Record - EMPLOYEE information (record type =6)

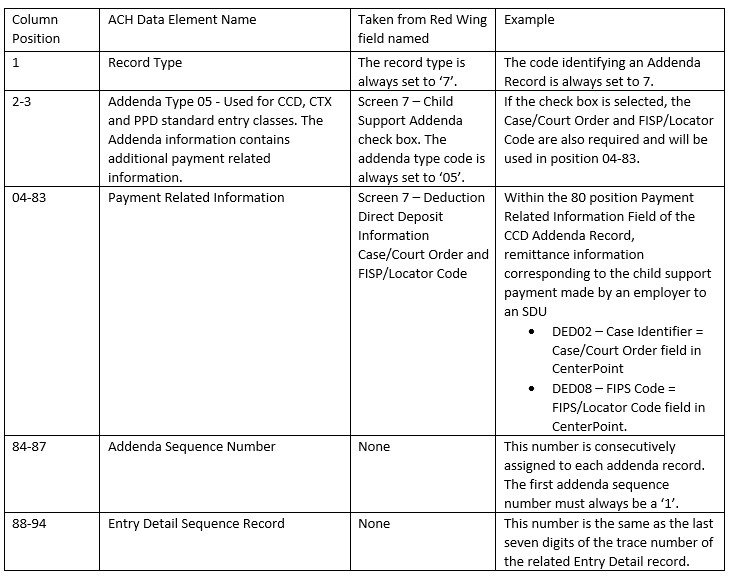

CCD Addenda Record (record type=7) Note: The Addenda record is created only if Screen 7 has the Child Support Addenda check box selected with Case/Court Order and FIPS/Locator information supplied.

Entry Detail Record -EMPLOYER information (record type =6). Note this employer record is created only if the Screen 3: Create Offsetting Debit option is selected.

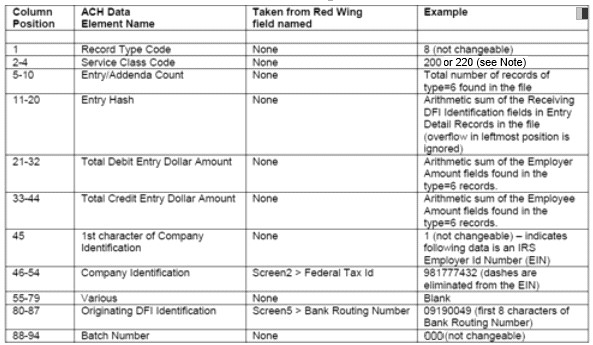

Company/Batch Control Record (record type =8)

Note: If your lender instructs you that the Batch Header (5) and Batch Control (8) records must contain Service Code 200 (ACH Credits and Debits), the Create Offsetting Debits check box on the Setup > Accounts > Accounts > ACH/Direct Deposit tab should remain selected. If your lender instructs you that the Batch Header (5) and Batch Control (8) records must contain Service Code 220 (ACH Credits Only), the Create Offsetting Debits check box on the Setup > Accounts > Accounts > ACH/Direct Deposit tab should not be selected.

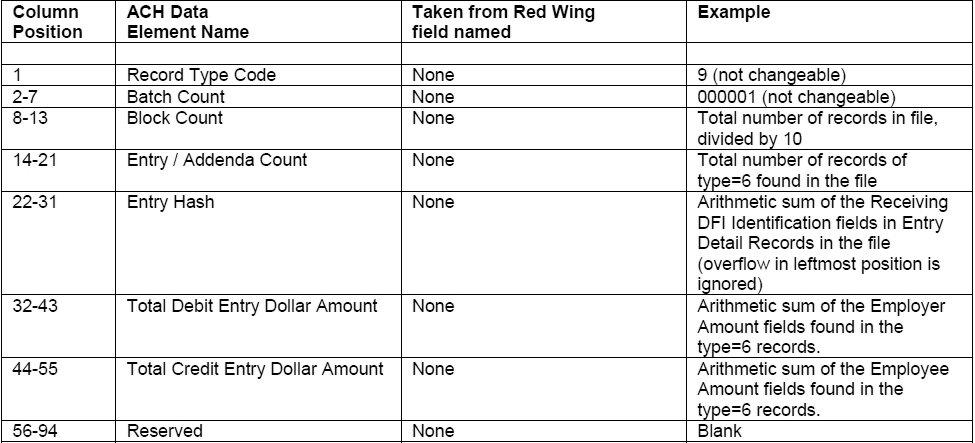

Note: If your lender instructs you that the Batch Header (5) and Batch Control (8) records must contain Service Code 200 (ACH Credits and Debits), the Create Offsetting Debits check box on the Setup > Accounts > Accounts > ACH/Direct Deposit tab should remain selected. If your lender instructs you that the Batch Header (5) and Batch Control (8) records must contain Service Code 220 (ACH Credits Only), the Create Offsetting Debits check box on the Setup > Accounts > Accounts > ACH/Direct Deposit tab should not be selected.File Control Record (record type =9)