CenterPoint Fund Accounting

- Reporting Payroll Expenses by Department using Profit Centers

| Document #: | 3002 | Product: | CenterPoint Payroll |

|---|

This topic provides instruction on reporting payroll expenses by department using Profit Centers instead of Payroll Departments. Profit centers are similar to departments, but they allow you post all payroll expenses (earnings, taxes, benefits) to a profit center. This allows you to get detailed reports of your expenses for each profit center.

Step 1: Set Up Profit Centers for each Department (One-time Setup)

Step 2: Assign Profit Centers to Employees Earnings

Step 1 - Set Up Profit Centers for Each Department (One-time Setup):

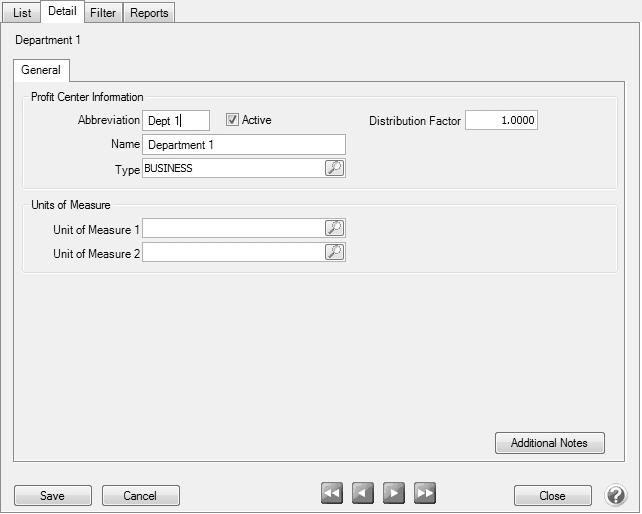

- Select Setup > Profit Centers/Locations > Profit Centers.

- Click New.

- Enter an Abbreviation and Name for the profit center. Select Business as the Type.

- Click Save.

- Repeat Steps 2 - 4 until you have a profit center for each of your departments.

Step 2 - Assign Profit Centers to Employee Earnings (One-time Setup):

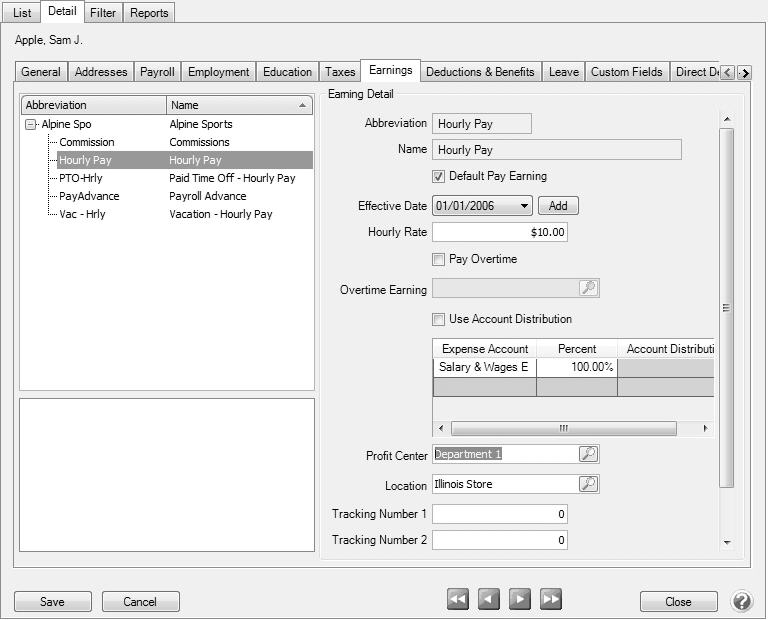

- Select Setup > Employees.

- Highlight an employee and click Edit. Select the Earnings tab.

- In the box on the upper-left, select an earning. Assign the appropriate department in the Profit Center field on the right. Repeat this for each earning.

- Click Save.

- Repeat Steps 2 - 4 for each employee.

Step 3 - Using Profit Centers when Processing Payroll:

When entering time for your employees, the profit centers assigned to the earnings in Step 2 will be used for the earning expense and any tax or benefit expenses associated with that earning. If necessary, you can change the profit center from the default to a different profit center on a per line basis in either Time Sheets or Pay Employees.

- If you use time sheets, you can change the profit center on the Time Entry screen. For more information see the topic Process a Payroll Using Time SheetsProcess a Payroll Using Time Sheets.

- To add the Profit Center column to the Time Entry screen, right-click on the time entry grid and select Add/Remove Columns. Check the box for Profit Center and click OK.

- The profit center from the employee's setup will display in this column. You can change it here if these hours are for a different profit center.

- Continue entering time sheets and process the pay run as usual.

- If you do not use time sheets, the profit center can be changed in Pay Employees when you enter the employees hours. For more information see the topic Process a Payroll (Pay Run)Process a Payroll (Pay Run).

- To add the Profit Center column to the 2. Enter Pay tab, right click in the time entry grid and select Add/Remove Columns. Check the box for Profit Center and click OK.

- The profit center from the employee's setup for this earning will display. You can change it if these hours are for a different profit center.

- Continue processing the pay run as usual.

Step 4 - Generating Reports for Expenses by Profit Center:

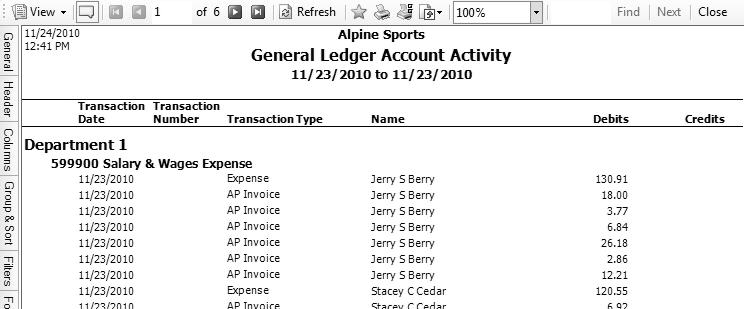

The majority of the general ledger reports can be filtered to show expenses for a particular profit center. You can also group the reports by profit center to see all profit centers on the same report. The examples below are using the General Ledger Account Activity report.

Option 1 - Filter Report by Profit Center

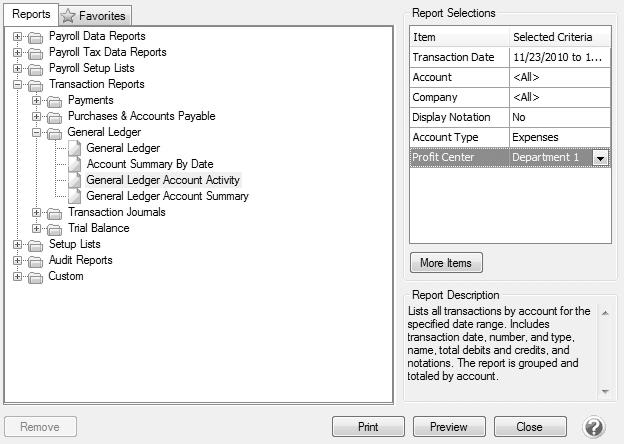

- Select Reports > Reports > Transaction Reports > General Ledger > General Ledger Account Activity.

- Click on the More Items button. Check the boxes for Account Type and Profit Center. Click OK.

- Enter the Transaction Date range to run this report for. In the Account Type filter, select Expenses and select a profit center.

- Click Print to print the report or click Preview for a preview of the report or to make any additional modifications.

Option 2- Group Report by Profit Center

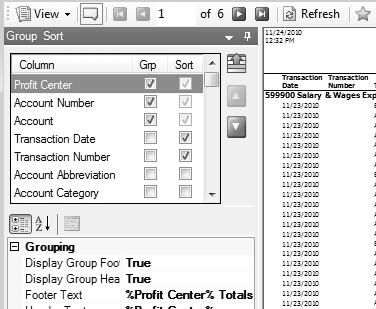

- Follow the steps above, only select All profit centers. Preview the report.

- On the Group/Sort fly-out tab, check the Grp box for Profit Center. Use the green arrow keys to move Profit Center to the top of the list. Click the Refresh button.

- Each profit center will show as its own header and all expenses to that profit center will display beneath it.

- For more information see the topic Customizing Reports.