CenterPoint® Fund Accounting

- Exchange Goods/Services for Payment

Related Help

_24.jpg) Exchange Goods or Services for Payment Video - Duration: 6 min 47 sec

Exchange Goods or Services for Payment Video - Duration: 6 min 47 sec

Occasionally you may provide goods and/or services to a vendor in exchange for items that you have purchased from them. When this type of situation transpires, three transactions are required. One that records the items that were purchased, a second for the items that were sold, and a third that clears the two amounts so those invoices are not awaiting payment.

Step 1: Enter A/P Invoice for Purchases

Step 2: Enter A/R Invoices for Sales

Step 4: Mark the A/P Invoice as Paid in Exchange for the Goods/Services

Step 5: Mark the A/R Invoices as Paid in Exchange for Goods/Services Received

Step 1: Enter A/P Invoice for Purchases

When items are purchased from the vendor, an invoice would be entered the same as any other purchase. Please refer to the Enter a Vendor Invoice topic for step-by-step instructions for entering A/P Invoices into the system.

Step 2: Enter A/R Invoices for Sales

When items are sold to this same company/fund, a customer invoice should be entered for the goods/services. This is entered as an unpaid invoice. Please refer to the Enter Unpaid Sales Invoice topic for step-by-step instructions for entering an A/R Customer Invoice.

Step 3: One-Time Setup

Step A: Create an Exchange Account

This account will not carry a balance and is used to simply clear amounts for invoices that were paid for by exchanging goods/services instead of cash.

- Select Setup > Accounts > Accounts. Click New.

- Specify an appropriate number for this new Account. This is optional if you do not use account numbers.

- Specify "Exchange Account" or something similar in the Name field.

- Select Assets in the Type field, and Cash in the Category field. Click Save.

Step B - Setup a Payment Type

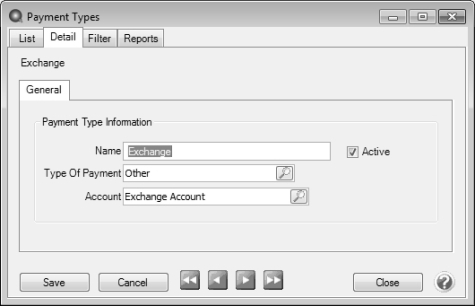

- Select Setup > General > Payment Types. Click New.

- Enter "Exchange" or something similar in the Name field.

- In the Type of Payment field, select Other as you will not be receiving cash or check payments for these A/R invoices.

- Specify your Exchange Account (setup in Step A) in the Account field.

Step 4: Mark the A/P Invoice as Paid in Exchange for the Goods/Services

In the example shown in Step 4 and 5, an electrician was hired to do $500 worth of wiring and the electrician purchased $450 in services from the Alpine Sports company. Both the A/R and A/P invoices have already been entered to record that purchase and sale. Below we'll mark the A/P invoice paid in exchange for what was sold.

- Select Processes > Purchases > Payments.

- Select the Exchange Account in the Bank Account field.

- Specify the appropriate Vendor in the Pay to the Order Of field.

- Select the Apply to Open Invoices button.

- In the Payment Amount field, specify the amount that is being "paid" by the exchange.

- Either click Apply (to have the system automatically select the invoices to be paid) or use the Pay boxes to select the invoices manually.

- Click OK to return to the main Payments screen.

- Select Save.

Step 5: Mark the A/R Invoices as Paid in Exchange for Goods/Services Received

- Select Processes > Sales > Receipts.

- Select the customer in the Received From field.

- In the Payment Type field, select the Exchange Type.

- Select the Apply to Open Invoices button.

- Specify the amount that is being exchanged for payment in the Receipt Amount field.

- Either click Apply (to have the system automatically select the invoices to be paid) or use the Pay boxes to select the invoices manually.

- Click OK to return to the main Receipts screen.

- Select Save.

|

Document: 3168 |

|---|