CenterPoint® Fund Accounting

- Customer Checks Returned from Bank for NSF (Non-Sufficient Funds)

Related Help

_24.jpg) Check Returned from Bank for NSF Video - Duration: 4 min 25 sec

Check Returned from Bank for NSF Video - Duration: 4 min 25 sec

If a bank refuses to honor a check because there is not enough money in the payer's checking account, the original receipt needs to be marked as such in CenterPoint. The NSF process in CenterPoint creates a reversing negative receipt and reverts the invoices originally paid back to a status of not paid. The process also allows the business to charge the customer a fee because of the returned check.

Mark a Customer Receipt as NSF

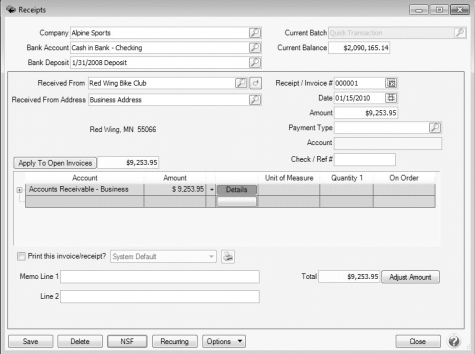

- Edit the original customer receipt transaction. This can be done through Transaction Search or by using the Report Drill Down capabilities within CenterPoint. See the Edit a Transaction topic for detailed instructions on how to find and edit an existing transaction.

- Once the original receipt is displayed in the Receipts screen (through the edit process), a NSF button will be displayed.

- Click the NSF button.

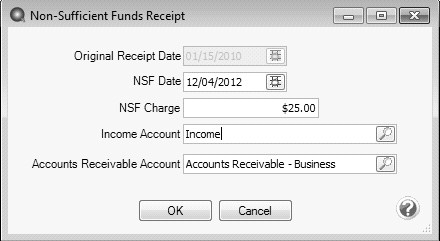

- In NSF Date field, specify the date the check came back from the bank.

- If the bank charged you a fee because of the NSF check AND you'd like this fee charged back to the customer, then specify the amount in the NSF Charge field.

- If an amount was entered in the NSF Charge field, then specify the account it should be charged to in the Income Account and Accounts Receivable Account fields.

- Click OK.

- At the Are you sure you want to post a NSF receipt? click Yes to complete the process.

- If an amount was entered in the NSF Charge field, then a new unpaid invoice for that amount will be in the customer's record.

- If the bank charged a fee for the NSF check, the fee should be entered as a payment transaction in CenterPoint.

|

Document: 3219 |

|---|