CenterPoint Payroll

- Additional Payroll Accounts

Setup > Accounts > Accounts

The CenterPoint account structure and the way that it integrates with CenterPoint Payroll is flexible enough to allow the posting of payroll transactions so that they best fit the accounting methods used by your company. An example of this is if you are using accrual accounting, you may want to post your payroll to a Labor Work in Process account rather than a Labor Expense account. Or, you might want to post your payroll to Labor Cost of Goods rather than Labor Expense. This is completely within your control.

There are some account categories that are most commonly used in payroll and this section will address setting up accounts in those categories, but keep in mind that additional accounts can be added as needed.

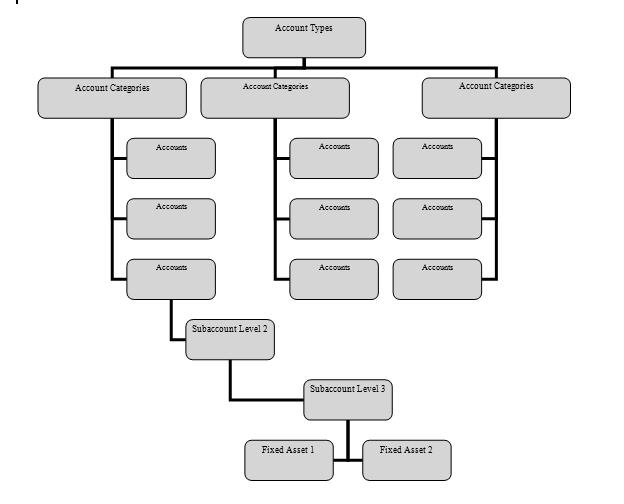

CenterPoint defines an account hierarchy to help organize your financial structure:

Account Types are predefined in CenterPoint as:

- Assets

- Liabilities

- Equity

- Revenue

- Cost of Goods

- Expenses

- Other Revenue

- Other Expenses

Account Categories

Account categories are predefined in CenterPoint for each account type. The account category names cannot be changed and you cannot create new account categories. The account category is currently fixed in CenterPoint because the category defines the behavior of the accounts in that category. For example, accounts created in the category of Payroll Taxes Expense can be used by the system to post payroll transactions to.

Accounts

There is further breakdown when we get to the actual accounts. You can define up to three levels of accounts. An example might be the following:

Account Type: Liability

Account Category: Tax Liabilities

Main Account: Federal Liabilities

Level 2 Account: 943 Liabilities

Level 3 Accounts: Federal Income Tax Liability, Social Security Liability, Medicare Liability

The payroll transactions would be posted to the Federal Income Tax Liability, Social Security Liability, and Medicare Liability accounts, but the information can be summarized on reports to the Level 2 account and even further to the Main Account. Transactions may only be posted to the lowest level of the account structure; however data can be summarized on reports at the above levels. For the above example, data may be summarized or totaled so that Federal Income Tax Liability, Social Security Liability, and Medicare Liability accounts are found under 943 Liabilities and totaled there.

If you are using CenterPoint Payroll with another CenterPoint product (integrated), the CenterPoint Payroll program needs additional general ledger accounts in specific account categories entered into the chart of accounts. The additional accounts and the account category they must be in are listed in Table 1 below.

The account names listed below are suggestions. Account numbers and abbreviations are optional. Select Setup > Accounts > Accounts to create new general ledger accounts.

TABLE 1. Additional Payroll Accounts

|

Account Number |

Account Name |

Abbreviation |

Account Category |

|

100000 |

Checking |

checking |

Cash |

|

130000 |

Payroll Advance |

payadvnce |

Payroll Advances |

|

200000 |

Payroll Liabilities |

pr liabil |

Payroll Liabilities |

|

307000 |

Retained Earnings |

retained |

Retained Earnings |

The Payroll Liabilities account listed in Table 1 (under Account Name) can be used to post all payroll liabilities. We recommend expanding the chart of accounts to include a separate payroll liability account for each vendor because CenterPoint Payroll automatically creates open invoices for payroll liabilities by vendor (this is not required). You can assign a vendor to a payroll liability account in Setup > Accounts > Accounts > Detail tab> Detail tab. In the Vendor Liability is Paid To box, select a vendor. To create a new vendor, in the Vendor Liability is Paid To box, right-click, select New, enter the vendor information, and then click Save (For the system-supplied accounts, vendors are already assigned to the account, but can be changed. For example, the Federal Taxes Payable account is assigned the Internal Revenue Service vendor and the State Unemployment account is assigned the State Department of Revenue vendor.).

*If you want to accumulate a liability to post to your general ledger but do not want to create a payment in CenterPoint Payroll, use the Other Current Liabilities account category instead of the Payroll Liabilities account category.

Table 2 lists an example of additional payroll liability accounts.

TABLE 2. Additional Payroll Liability Accounts

|

Account Number |

Account Name |

Abbreviation |

Account Category |

|

210000 |

Federal Taxes Payable |

fed tax py |

Payroll Liabilities* |

|

211000 |

FUTA Payable |

futa pybl |

Payroll Liabilities* |

|

220000 |

State Taxes Payable |

st tax py |

Payroll Liabilities* |

|

221000 |

SUTA Payable |

suta pybl |

Payroll Liabilities* |

|

222000 |

Work Comp Payable |

wcompybl |

Payroll Liabilities* |

|

230000 |

Local Taxes Payable |

local tax |

Payroll Liabilities* |

|

240000 |

Child Support |

cs |

Payroll Liabilities* |

|

241000 |

Garnishment |

garn |

Payroll Liabilities* |

|

242000 |

401K |

401 |

Payroll Liabilities* |

|

243000 |

Health Insurance |

hth |

Payroll Liabilities* |

|

244000 |

Dental Insruance |

dntl |

Payroll Liabilities* |

You may also want to include additional expense accounts in your chart of accounts. Some examples of expense accounts you may need in your chart of accounts for CenterPoint Payroll are listed in Table 3.

*If you want to accumulate a liability to post to your general ledger but do not want to create a payment in CenterPoint Payroll, use the Other Current Liabilities account category instead of the Payroll Liabilities account category.

TABLE 3. Additional Expense Accounts

|

Account Number |

Account Name |

Abbreviation |

Account Category |

|

600000 |

Salary & Wages Expense |

labhrlyexp |

Payroll Expense* |

|

601000 |

Payroll Taxes Expense |

prtaxes |

Payroll Taxes Expense |

|

603000 |

Benefits Expense |

benexp |

Benefits Expense |

|

677000 |

Other Expense |

otherexp |

Other Expense |

*If you want to post your labor expense directly to a cost of goods sold account instead of a labor expense account, use the Cost of Goods Sold account category instead of the Payroll Expense account category.

Adding/Editing Account Information

To add or edit an account in CenterPoint, select Setup > Accounts > Accounts.

To add an account, click New. To edit an account, highlight the account and then click Edit.

Whether adding or editing the account. You will be taken to the Detail tab. The Detail tab has several tabbed screens within it. The only three tabs that we are concerned with for payroll are the General, Detail and Distributions tab.

Fill in any details on each of these tabs and then click Save to save the new account. Each tab’s details are described below:

General tab:

The General tab is identical for each account (use the tab key to navigate between fields):

Abbreviation – Is an additional means of identifying an account. This abbreviation can be displayed on reports as well as any account number used.

A right-click on the Abbreviation field allows you to set the Abbreviation field to:

- Allow duplicates

- No duplicate allowed – must be unique

- Warn if duplicated

Number – The format of the account number is set in File > Preferences. See the Preferences section of this guide for defining a format for account numbers.

A right-click on the Number field allows the user to set the behavior of this field as:

- Allow duplicates

- No duplicate allowed – must be unique

- Warn if duplicated

Name – Every account must have a name. CenterPoint will default with the name of ‘New’ on all accounts. The default name of New may be overridden and a more descriptive name can be entered.

Type – An account type for each account must be selected. Options are: Assets, Cost of Goods Sold, Equity, Expenses, Liabilities, Other Expenses, Other Revenues, and Revenues.

Category – If an account type is selected first, the categories available are only those categories created for that account type. If a category is selected first, the account type will be filled in automatically.

Subaccount of – If data posted to this account is to be summarized at a higher level on reports, the account that it is to be summarized at should be identified in this field.

Quantity 1 and 2 – If the account that you are creating can be identified with a quantity value, a Unit of Measure for that account can be selected from a list of default units of measurement provided in CenterPoint or a new unit of measure may be created. A typical unit of measurement for payroll might be Hours for a labor account or it might be something like bushels for a labor account used to capture piece work.

Detail tab:

The Detail tab can be different for different account categories. Some accounts such as Revenue Expense and Cost of Goods do not have any additional detail. Some of the account types that have additional detail that you should be aware of will be defined here:

Bank Accounts – Setup each bank account used for payroll in the account type of Assets and the Cash category. Accounts in this category have the following details you may want to enter:

This is an Undeposited funds account – If selected, this check box tells CenterPoint which receipt transactions have been entered but not yet deposited. When a deposit is made, a journal entry is posted to credit an Undeposited Funds account and debit the Bank account it was deposited into. You most likely won’t be using accounts marked as undeposited funds account for payroll.

Under Company Specific Detail Information, bank routing number information and account number information can be maintained for each company for each bank account. This information is currently available for the Additional Direct Deposit option in payroll.

Payroll Advances - Payroll advances are posted as an Asset type of Receivable. There is an Asset category for payroll advances. It is important to make sure that all of your employee payroll advances are setup in this category. Accounts in this category do not require any additional detail, but it is important to know how information is tracked. If you create an account in this category perhaps called ‘Payroll Advances’, link this account to the payroll earning for advances. Each employee that is paid an advance using that earning will have a separate balance maintained for them. As the advance is re-paid, that employee’s balance will decrease.

Labor Costs as Work in Process – If you are using an accrual accounting method or a management accounting method, you may want to record your labor costs (including benefits) to a Work in Process account that will be expensed at the time of production. There are several Work in Process categories under the account type of Assets. The two Work in Process categories that you would likely setup accounts in to track labor costs are Benefits WIP and Labor WIP.

When setting up WIP accounts, you will need to enter in an Offset Account for the Work in Process account. When your production is finalized, the amounts accumulated in the Work in Process accounts need to be moved to an Expense or Cost of Goods account. That is what your offset account will be. See Labor as Expense or Costs of Goods.

Labor Costs as Expense or Cost of Goods- Expense and\or Cost of Goods accounts do not require any additional detail on this tab. Everything necessary to get the account set up can be found on the General tab unless an account distribution needs to be set up. There are two categories under both account types (Expenses and Cost of Goods) that you will likely use for your labor costs, these are: Labor Expense or Labor Cost and Benefits Expense or Benefits Cost.

Payroll Liabilities – Generating payroll creates liabilities for taxes that are deducted from the employee paychecks and the employer’s portion of those taxes, but may also create additional liabilities for benefits that are calculated during that payroll. ALL payroll liabilities need to be created under the account type of Liabilities and the account category of Payroll Liabilities (whether they are taxes or not). The Detail tab for accounts in this category contains information specific to a payroll vendor:

- Vendor Liability is Paid To - Corresponds to a vendor on your list of vendors.

- The lookup control will show a list of vendors that you have already added. If the vendor for this account isn’t on the list, right-click on this field, and then select New to add a new vendor.

- You can have more than one account going to the same vendor. In the example above, the federal deposit is made by electronic payment to the IRS, so the IRS was setup as a vendor.

Direct Deposit tab:

The Direct Deposit tab will display for accounts in the Cash account category. This tab will display if you've purchased the Direct Deposit additional option. Please see the Direct Deposit: Setup & Processing procedure for more information.