CenterPoint Payroll

- Modify the Federal Unemployment Tax Act (FUTA) Rate

| Document #: | 3188 | Product: |

|

|---|

The effective tax rate for the Federal Unemployment Tax Act (FUTA) rate was reduced from .8% (.008) to .6% (.006) on July 1, 2011. Congress has announced that the FUTA .2% surcharge, first enacted in 1977, will not be extended after June 30, 2011. The IRS is currently revising Form 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return) to accommodate the two different FUTA rates for calendar year 2011.

This topic provides step-by-step instructions on how to manually update the tax rate in your payroll program. Please note that only the rate has changed. The $7000 Federal Unemployment Limit has not changed.

Setup > Payroll Details > Employer

CenterPoint Payroll

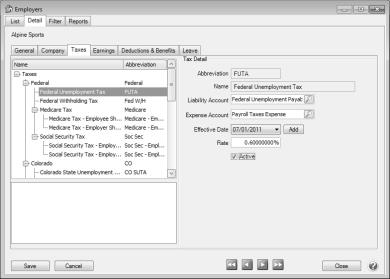

- Select Setup > Payroll Details > Employers. Select the appropriate Employer and click Edit.

- Select the Taxes tab. Select Federal > Federal Unemployment Tax.

- In the Tax Detail section on the right, click on Add to the right of Effective Date.

- Enter 07/01/2011 in the Date field and click OK.

- Change the Rate from 0.8% to 0.6.

- From the Effective Date drop down box, select 01/01/2006.

- Change the Rate from 0.00000% to .8%.

- Click Save. All payrolls processed after July 1, 2011 will use the new .6% rate.

The FUTA report in CenterPoint uses the FUTA rate in its calculations and does look at effective dates. For the report to be accurate, first print the report with a date range of 1/1/11 to 6/30/11 for the first half of the year (the .8% rate will be used) and then again for 7/1/11 to 12/31/11 (the .6% rate will be used).