CenterPoint® Payroll

- Interfund/Intercompany Payroll Distribution

Related Help

_24.jpg) InterFund/InterCompany Payroll Distribution - Duration: 15 min 20 sec

InterFund/InterCompany Payroll Distribution - Duration: 15 min 20 sec

Interfund/Intercompany Payroll Distributions allow a fund/company to process payroll in one fund/company and distribute the expenses to other funds/companies. Distribution journal entries are created that include liability account offsets to the responsible funds/companies expenses and reverses expenses out of the payroll fund/company that are not the responsibility of the payroll fund/company. The offset to the distribution journal entries is to Receivable accounts for the amounts due from the accounting funds/companies.

Step A: Create Interfund/Intercompany Account Categories

Step B: Create Due From/To Accounts

Step C: Setup Interfund/Intercompany Distribution

Step D: Process Payroll with Distribution

Create an Interfund/Intercompany Receivables Account Category

- Select Setup > Accounts > Account Categories.

- Click New.

- In the Name box, enter Interfund/Intercompany Receivables.

- In the Type box, select Assets.

- In the Class box, select Current Assets.

- In the Subclass box, select Other Current Assets.

- Determine if the account category should be Included in a Balance Sheet Group.

- Click the Balance Detail tab.

- Move Associated Fund/Company from the left list to the right list.

- Click Save.

Create an Interfund/Intercompany Payables Account Category

- Select Setup > Accounts > Account Categories.

- Click New.

- In the Name box, enter Interfund/Intercompany Payables.

- In the Type box, select Liabilities.

- In the Class box, select Current Liabilities.

- In the Subclass box, select Other Current Liabilities.

- Determine if the account category should be Included in a Balance Sheet Group.

- Click the Balance Detail tab.

- Move Associated Fund/Company from the left list to the right list.

- Click Save.

Step B: Create Due From/To Accounts

Create Due From Account

- Select Setup > Accounts > Accounts.

- Click New.

- In the Name box, enter Due From Fund/Company.

- In the Type box, select Assets.

- In the Category box, select Interfund/Intercompany Receivables.

- Click Save.

Create Due To Account

- Select Setup > Accounts > Accounts.

- Click New.

- In the Name box, enter Due To Fund/Company.

- In the Type box, select Liabilities.

- In the Category box, select Interfund/Intercompany Payables.

- Click Save.

Step C: Setup Interfund/Intercompany Distribution

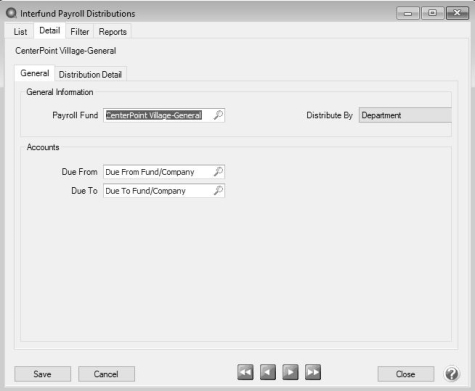

- Select Setup > Payroll Details > Interfund/Intercompany Payroll Distributions.

- Click New.

- In the Payroll Fund/Company box, select the fund/company that processes payroll for other funds/companies. You will be warned if a fund/company already has an assigned distribution.

- In the Distribute By box, select either Department/Profit Center or Location/Production Center.

- In the Due From box, select the account you created in the previous step (the account has to be an account that is not in the following account categories: Accounts Receivable, Payroll Advance, Cash, or Lotted Inventory.).

- In the Due To box, select the account you created in the previous step (the account has to be an account that is not in the following account categories: Accounts Payable or Line of Credit.).

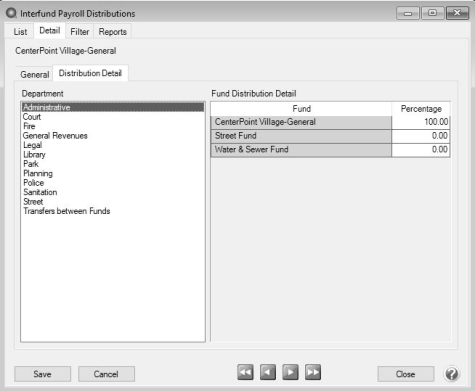

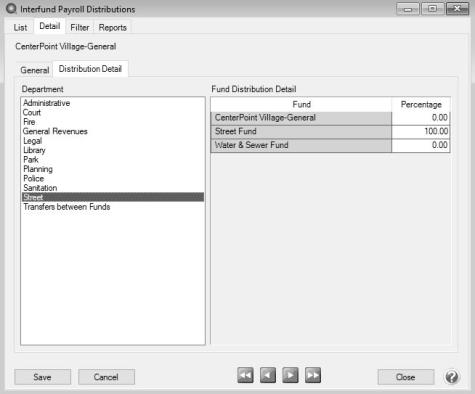

- Click the Distribution Detail tab.

- On the left side of the screen, select the Department/Profit Center or Location/Production Center (your list depends on your Distribute By selection on the General tab).

- The fund/company selected in the Payroll Fund/Company box on the General tab will display 100% in the right list.

- Select each Department/Profit Center or Location/Production Center (depending how you selected to distribute) from the left list and determine the percentages that should be distributed from the fund/company you process payroll in to your other funds/companies. In the example below, 25% will be distributed to each fund/company for the Department Fire from the fund/company processing payroll.

Note: If a fund/company is not listed and should be, select Setup > Payroll Details > Employer, select the Fund/Company tab, move the fund/company from the left side of the screen under Available Funds to the right side of the screen under Funds/Companies Processed By this Employer, and then click Save.

- Repeat Step 10 until all Department/Profit Center and Location/Production Center from the left list are distributed on the right list.

- Click Save.

- Click Close.

Step D: Process Payroll with Distribution

- Process payroll as you normally would using either the Processing a Pay Run/Pay Employees or Processing Payroll Using Time Sheets topics.

- When you have an Interfund/Intercompany Payroll Distribution set up, the only difference you will see in payroll processing is a notation on the 6.Print Checks tab that this fund/company will post Interfund/Intercompany Payroll distributions.

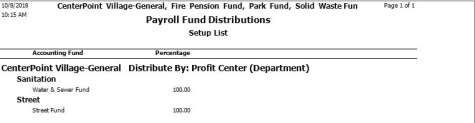

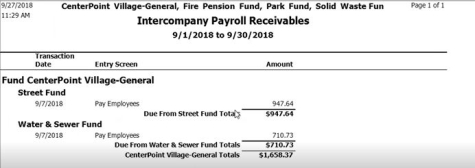

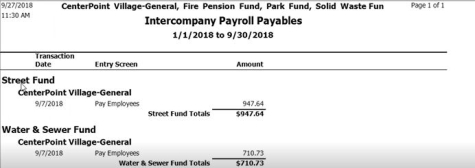

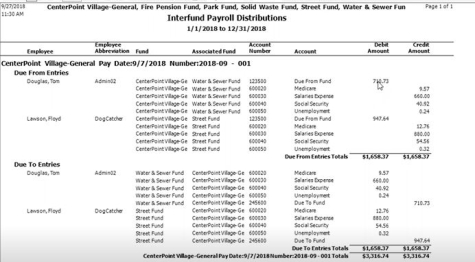

Step E: Report on Payroll Distributions

There are four reports specifically related to Interfund/Intercompany Payroll Distribution in Reports > Reports > Interfund/Intercompany Payroll.

- Payroll Fund/Company Distribution Setup List - Lists the funds that are paid by a payroll fund and the percentage of distributions for each.

- Interfund/Intercompany Payroll Receivables -Reports the amounts due from the funds/companies that are paid by a fund/company designated as the payroll fund/company.

- Interfund/Intercompany Payroll Payables - Reports the amounts due to a fund/company (Payroll Fund/Company) that processes payroll on behalf of other funds/companies (Accounting Fund/Company .

- Interfund/Intercompany Payroll Distributions - Lists the "Due From" and "Due To" journal entries distributed by the payroll fund/company to the fund/company it is paying the payroll for. No entries are made when the payroll fund and the accounting fund/company are the same.

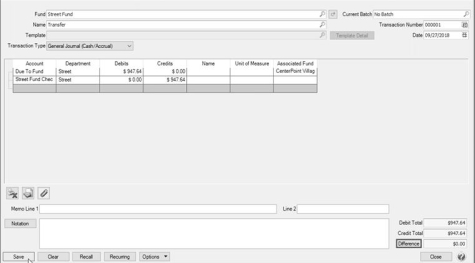

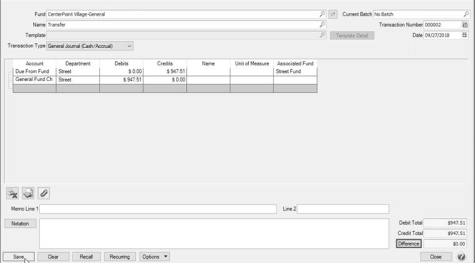

Step F: Record Payment of Transfer of Due From/Due To

- The Interfund/Intercompany Payroll Distribution process does not perform the accounting entries to move dollars between funds/companies automatically.

- Use Processes > General Journal Entries to record your entries to move dollars between funds/companies.

- The Associated Fund/Company can be added to the General Journal Entries grid by right-clicking on the grid and Add/Remove Columns > Associated Fund/Company.

|

Document: 3328 |

|---|