CenterPoint® Payroll

- Account Setup for Payroll

Related Help

_24.jpg) Account Setup for Payroll Video - Duration: 13 min 07 sec

Account Setup for Payroll Video - Duration: 13 min 07 sec

_24.jpg) Payroll Vendors - Duration: 12 min 14 sec

Payroll Vendors - Duration: 12 min 14 sec

In CenterPoint Payroll, each checking account, earning, deduction and benefit is assigned to an account so that when a payroll transaction is posted, the accounts describe what is happening in the movement of that payroll activity and the result updates the company's account balances.

The CenterPoint Payroll account structure and the way that it integrates with CenterPoint Payroll is flexible enough to allow the posting of payroll transactions so that they best fit the accounting methods used by your company. An example of this is if you are using accrual accounting, you may want to post your payroll to a Labor Work in Process account rather than a Labor Expense account. Or, you might want to post your payroll to Labor Cost of Goods rather than Labor Expense. This is completely within your control.

There are some account categories that are most commonly used in CenterPoint Payroll, but keep in mind that additional accounts can be added as needed.

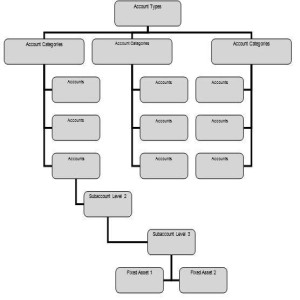

Under each account type are account categories that describe the account type and maintains the properties of the account type. In the Asset account type the Cash account category represents the different accounts used for paying payroll and they maintain the details that allow you to perform direct deposit with your bank. In the Liabilities account type the Payroll Liabilities account category assigned to your taxes and deductions create an accounts payable when a pay run is posted and Other Current Liabilities would not create a payable but would still update the liability balance.

When the account category is expanded, the accounts that are part of that category display. When a pay run is posted, the accounts will be updated with the activity.

There is further breakdown for the actual accounts. You can define up to three levels of accounts.

An example might be the following:

Account Type: Liability

Account Category: Payroll Liabilities

Main Account: Federal Liabilities

Level 2 Account: 943 Liabilities

Level 3 Accounts: Federal Income Tax Liability

Social Security Liability

Medicare Liability

The payroll transactions would be posted to the Federal Income Tax Liability, Social Security Liability, and Medicare Liability accounts, but the information can be summarized on reports to the Level 2 account and even further to the Main Account. Transactions may only be posted to the lowest level of the account structure; however data can be summarized on reports at the above levels. For the above example, data may be summarized or totaled so that Federal Income Tax Liability, Social Security Liability, and Medicare Liability accounts are found under 943 Liabilities and totaled there.

If you are using CenterPoint Payroll with another CenterPoint product (integrated), the CenterPoint Payroll program needs additional general ledger accounts (select Setup > Accounts > Accounts to create new general ledger accounts) in specific account categories entered into the chart of accounts. The additional accounts and the account category they must be in are listed in Table 1 below. The account names listed below are suggestions. Account numbers and abbreviations are optional. The account categories are specific.

Note: If you want your Cash Income Statement to include any payments of taxes, the account category that should be assigned to those payroll liabilities is Payroll Liabilities. The Payroll Liabilities account category generates an invoice to pay the payable from Processes > Pay Invoices Due. If you want your Cash Income Statement to include any payments of deductions or benefits, assign the deduction/benefit to an account in the Payroll Liabilities account category.

The Payroll Liabilities account listed in Table 1 (under Account Name) can be used to post all payroll liabilities. Payroll vendors are used while setting up payroll liabilities to identify the vendor to which the liability is paid. Checks can be written to payroll vendors or a payroll vendor can be used to record payments made electronically. We recommend expanding the chart of accounts to include a separate payroll liability account for each vendor because CenterPoint Payroll automatically creates open invoices for payroll liabilities by vendor (this is not required).

You can assign a vendor to a payroll liability account in Setup > Accounts > Accounts > Detail tab> Detail tab. In the Vendor Liability is Paid To box, select a vendor. To create a new vendor, in the Vendor Liability is Paid To box, right-click, select New, enter the vendor information, and then click Save. See the Payroll Vendors video for additional information. Table 2 lists an example of additional payroll liability accounts.

Generating payroll creates liabilities for taxes that are deducted from the employee paychecks and the employer's portion of those taxes, but may also create additional liabilities for benefits that are calculated during that payroll. ALL payroll liabilities need to be created under the account type of Liabilities and the account category of Payroll Liabilities (whether they are taxes or not).

Table 1 – Additional Payroll Accounts

| Account Number | Account Name | Account Category |

|---|---|---|

|

100000 |

Checking |

Cash |

| 130000 | Payroll Advance | Payroll Advances |

| 200000 | Payroll Liabilities | Payroll Liabilities |

| 307000 | Retained Earnings | Retained Earnings |

You may also want to include additional expense accounts in your chart of accounts. Some examples of expense accounts you may need in your chart of accounts for CenterPoint Payroll are listed in Table 3.

Table 2 – Example Additional Payroll Liability Accounts

| Account Number | Account Name | Account Category |

|---|---|---|

|

210000 |

Federal Taxes Payable |

Payroll Liabilities |

| 220000 | State Taxes Payable | Payroll Liabilities |

| 222000 | Work Comp Payable | Payroll Liabilities |

| 240000 | Child Support | Payroll Liabilities |

Table 3 – Example Payroll Expense Accounts

| Account Number | Account Name | Account Category |

|---|---|---|

|

600000 |

Salary & Wages Expense |

Payroll Expense |

| 601000 | Payroll Taxes Expense | Payroll Taxes Expense |

| 603000 | Benefits Expense | Benefits Expense |

| 677000 | Other Expense | Other Expense |

Note: For information on creating, editing, or deleting accounts, see the Understanding & Using Accounts topic.

|

Document: 3358 |

|---|