CenterPoint® Payroll

- Modify State Unemployment Tax (SUTA) Rate or other Employer Rates for Additional Taxes (TDI, Job Development, Paid Family Leave)

Related Help

All of the State and Federal taxes are updated when you install the 2024 tax table update, except for your State Unemployment rate. This rate needs to be entered before the first payroll in 2024 or as soon as you receive it from your State Unemployment Agency.

Also, it is important to check the employer rates for additional taxes (TDI, Job Development, Paid Family Leave, etc.) other than Federal Withholding, State Withholding, or the wage base for State Unemployment tax because the tax rate may differ by employer and the rate may need to be updated manually.

Follow the topics below to verify/change employer tax rates:

Modify State Unemployment Tax (SUTA) Rate

Modify Employer Rates for Additional Taxes (TDI, Job Development, Paid Family Leave, etc.)

Modify State Unemployment Tax (SUTA) Rate:

Each year, your state will notify you of the rate you must use in the new year to calculate your unemployment tax liability. Because this rate differs by employer, it is not updated by installing tax table updates and must be updated manually. Follow the instructions below to manually update your unemployment tax rate.

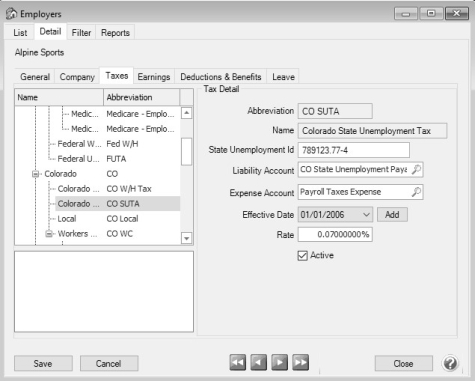

- Select Setup > Payroll Details > Employers.

- Select the appropriate employer and click Edit.

- Select the Taxes tab.

- On the left side of the screen, find the state that needs to be updated. Under the state, select the state unemployment tax.

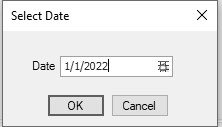

- In the Tax Detail section on the right side of the screen, click the Add button next to the Effective Date.

- In the Date field, enter the effective date for the rate change, for example 1/1/2023.

- Click OK.

- On the right side of the screen, enter the new Rate.

- Click Save.

- Click Close.

Modify Employer Rates for Additional Taxes (TDI, Job Development, Paid Family Leave, etc.)

To verify employer rates:

- Select Setup > Payroll Details > Employers.

- Select the appropriate employer and click Edit.

- Select the Taxes tab.

- On the left side of the screen, find the state that needs to be updated. Under the state, select the tax.

- In the Tax Detail section on the right side of the screen, verify the Rate. If no Rate box is available, this tax is updated by the tax table updates.

- If the rate is not correct, click the Add button next to the Effective Date. In the Date box, enter the effective date for the rate change, for example 1/1/2023.

- Click OK.

- On the right side of the screen, enter the new Rate.

- Click Save, and then click Close.

|

Document: 3201 |

|---|

View or Print as PDF

View or Print as PDF