CenterPoint® Payroll

- Vermont Child Care Contribution

Related Help

Beginning July 1, 2024, Vermont employers will begin making contributions composed of a 0.44% payroll tax on wages to the Vermont Department of Taxes for deposit into the Child Care Contribution Special Fund. Employers must pay 0.44% of their employees’ wages paid on or after July 1, 2024, but employers may choose to deduct and withhold up to one-quarter of the contribution (not more than 0.11%) from employee wages. The employer may choose to withhold a smaller portion of the employees' wages or choose not to withhold any amount from employees. For more information on the Vermont Child Care Contribution, please visit https://tax.vermont.gov/business/child-care-contribution.

Because employers can choose how much tax to withhold from employees, Red Wing Software cannot maintain the tax rate as part of the CenterPoint Tax Table Updates and recommends creating a Local Tax for the Vermont Child Care Contribution.

Step A - Create a Local Tax for Vermont Child Care Contribution

Step A - Create a Local Tax for Vermont Child Care Contribution:

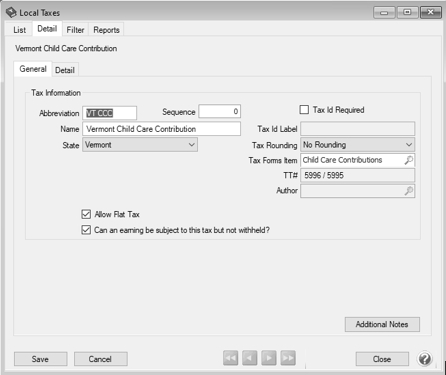

- Select Setup > Payroll Details > Local Taxes. Click New.

- Enter an Abbreviation and Name for this tax.

- In the State box, select Vermont.

- In the Tax Forms Items box, select Child Care Contributions.

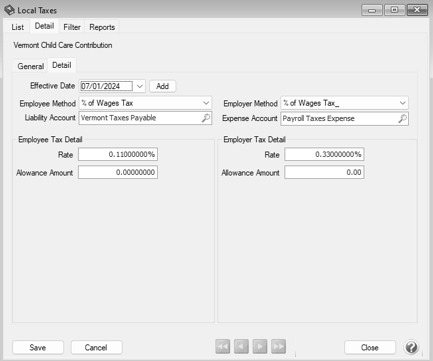

- Select the Detail tab.

- In the Employee Method box, select % of Wages Tax.

- In the Employer Method box, select % of Wages Tax_.

- Select a Liability Account.

- Select an Expense Account.

- Click Save.

- Edit the tax you just created and select the Detail tab.

- Click Add. In the Effective Date box, enter 7/1/24.

- In the Employee Tax Detail section, enter the Rate you wish to withhold from your employees’ checks. This can be anything between 0 and 0.11%. Leave the Allowance Amount at 0.00.

- In the Employer Tax Detail section, enter the Rate for the employer contribution. This should be between 0.33 and 0.44%. The total Employee Tax Detail Rate plus the Employer Tax Detail Rate must equal 0.44%. The Allowance Amount should remain at 0.00.

- Click Save.

Step B - Add the Vermont Local Tax to an Employee Record:

Follow the instructions below to add the Vermont Child Care Contribution local tax to individual employee records. If you have multiple employees to add the local tax to, use the Employee Mass Update (Setup > Payroll Details > Employee Mass Update) option instead. Refer to the Employee Mass Update topic for more information.

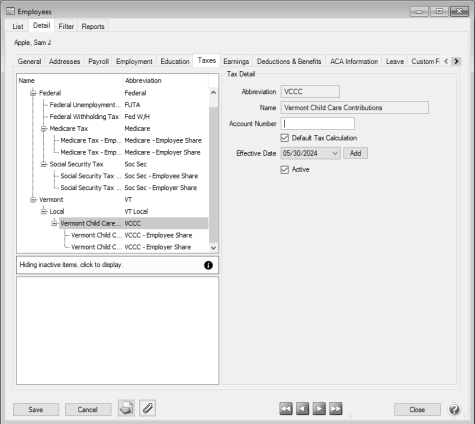

- Select Setup > Employees.

- Select the employee to add the local tax to, and then click Edit.

- Select the Taxes tab.

- Under the employer in the box on the left, select Vermont.

- Under Vermont, select Local. Select the Vermont Child Care Contribution tax in the box in the lower left side of the screen.

- From the upper left side of the screen, select Vermont Child Care Contribution.

- In the Tax Detail area on the right, select the Default Tax Calculation box and complete any other information such as Account Number, etc.

- Click Save.

|

Document: 3465 |

|---|