CenterPoint® Payroll

- Bi-weekly Salaried Employees and Years with 27 Pay Periods

Related Help

_24.jpg) How to Use Preferences - Duration: 6 min 05 sec

How to Use Preferences - Duration: 6 min 05 sec

_24.jpg) General Preferences - Duration: 9 min 55 sec

General Preferences - Duration: 9 min 55 sec

_24.jpg) Payroll Preferences Video - Duration: 16 min 25 sec

Payroll Preferences Video - Duration: 16 min 25 sec

If you have salaried employees that are paid on a bi-weekly schedule, every few years there will be 27 pay periods in a year, rather than the usual 26. Without changes to your payroll setup, this will result in an extra pay check for salaried employees (so they are paid more than their salary for the year), or skipping a check which can cause hardship for employees.

In CenterPoint, you can set a preference for the number of bi-weekly pay periods in a year. For years with 27 pay periods, this will calculate the employee’s per pay check salary based on 27 instead of 26 pay periods. Employees will still receive a pay check every pay period but each check will be for slightly less so they do not get paid more than their yearly salary.

For example: An employee earning $30,000 annual salary paid bi-weekly would usually earn $1,153.85 gross pay per check ($30,000 ÷ 26 pay periods = $1,153.85). In a year with 27 pay periods, the same employee would earn $1,111.11 per check ($30,000 ÷ 27 pay periods = $1,111.11).

To Set the Preference:

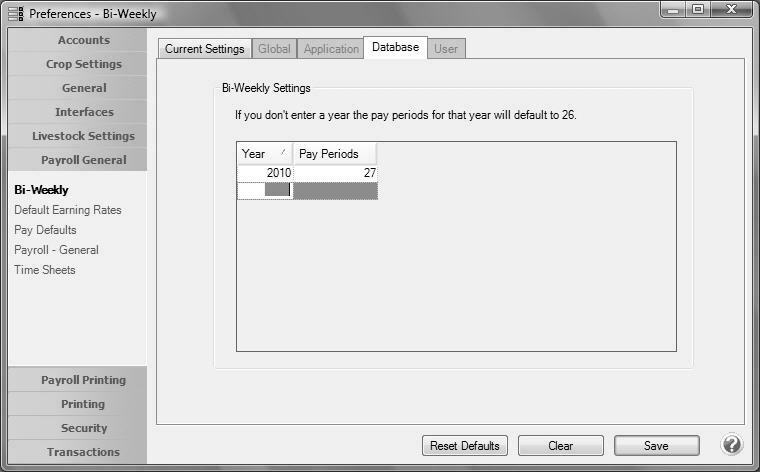

- Select File > Preferences > Payroll > Bi-Weekly Pay Periods > Database tab.

- Enter the Year that has 27 pay periods and then enter the number of Pay Periods. Ex: 2010 and 27. CenterPoint will assume any year not listed has 26 pay periods, so it is not necessary to enter every year.

- Click Save.

- When bi-weekly salaried employees payroll is processed, the system will automatically divide their annual salary by 26, unless it falls within a year that is specified in Preferences with 27 pay periods.

|

Document: 3039 |

|---|

View or Print as PDF

View or Print as PDF