By Stephanie Elsen

CenterPoint Accounting for Agriculture helps farms nationwide become more profitable with financial tools made specifically for farms and agricultural operations. Learn more about how CenterPoint can help your farm by watching this video!

By Stephanie Elsen

Red Wing Software customer Indy Family Farms has been honored twice in recent months: once with a Certification Award and another with a story in the popular Progressive Farmer Magazine.

In July 2012, Indy Family Farms, in Greenwood, Indiana was awarded Environmental Certification by Validus for their commitment to environmental cropland stewardship. The award recognizes a farmer's commitment to caring for the land and implementing exceptional conservation practices while applying strong security measures throughout the farm.

Indy Family Farms was also featured in the September 2012 issue of Progressive Farming Magazine! The story focused on the use of technology to help grow their family business.

Congratulations to Indy Family Farms!

Rob Richards and sons Eric and Aaron Dave Charrlin Photography

by Stephanie Elsen

CPA Practice Advisor has released its 2012 Review of Professional Payroll Systems. Only ten systems were reviewed this year, and Red Wing Software's CenterPoint Payroll was one of them! Read the complete review by clicking on the link below!

CPA Practice Advisor 2012 Review of Professional Payroll Systems

by Stephanie Elsen

You may have seen my name before on Red Wing Software’s company blog, Facebook page, or elsewhere. I handle the Web marketing at Red Wing Software; I also answer the phones on occasion. I have been at Red Wing Software for about 8 years. It is a wonderful place to work, and frankly I love it here. By day, you will find me writing articles, Web copy, blog posts, and talking to customers now and then too. But in my spare time, I have a passion for the wonderful sport of hockey. And my 13 year old son, Luke, is my favorite player.

I know it’s a little overdone to be a Minnesotan and love hockey. But every single hockey game is so full of action and excitement. I try not to miss any of my son’s games or tournaments, and they fill nearly every weekend (and some week nights) from October to March.

Since my son was little, I’ve tried my best to play hockey along with him, shooting on each other in the basement or driveway. One time I even planned a ‘parents vs. kids’ tournament. And I fell and broke my ankle before the game even started. (I never said I was a good player!) But I still love the game and even make it to as many Minnesota Wild games as I can each season.

Stephanie and Luke, Tubing in Hudson, Wisconsin

By Stephanie Elsen

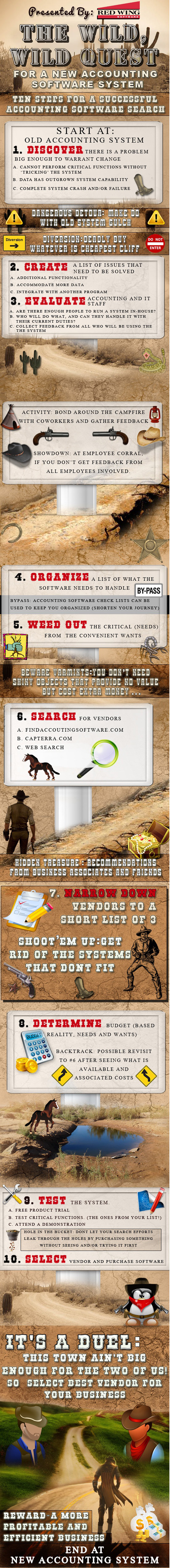

This infographic is a visual depiction of ten steps for a successful accounting software search. The search for accounting software can indeed be a wild, wild quest! Using these ten steps can help keep you on track in your search, and help you find the right product for your business. We encourage you to share this infographic.

To add this infographic to your blog or website, please use the following code listed below: